Welcome to a new edition of the most relevant news in the Cryptocurrency & Blockchain Space.

From Bitcoin and Ethereum most relevant news to the updates on the DeFi Space & Stablecoin market.

Bitcoin (BTC)

Bitcoin continues to consolidate around the $50k level this week, maintaining a strong composure despite volatility and weakness in traditional markets.

RECAP FROM THE LAST 2 WEEKS

Bitcoin has experienced its second market correction since breaking the USD 20K all-time- high.

On Sunday Feb 21 Bitcoin (BTC) reached a price of USD 58,330 USD and then going down and closing at a level of USD 45,837.

The loss between these two price ranges, saw almost 25% shaved off BTC`s market valuation.

The beginning of the week 9 of 2021 has been more volatile than usual, with both Monday and Tuesday seeing intraday moves of 18%. Bitcoin dropped from $57k to $46k before recovering to $54k. The volatility continued, as BTC dropped from the opening around $54k and all the way down to $45k. —A report from Luno and Arcade research.

Giving Bitcoin`s increasing adoption as an institutional grade macro asset, it is unsurprising that rapid changes in the time cost of money will influence Bitcoin pricing. So very likely that Bitcoin will continue playing a key role in these discussions amongst institutions and investors.

We see how the interest from institutions continue to rise. Specially with the CEO of MicroStrategy Michael Saylor stating that the company has purchased and additional 205 BTC at an average price of USD 48,888/BTC. In total , MicroStrategy has now completed 2 large initial treasury conversions to BTC, 2 large debt offerings where the proceeds were used to buy BTC. And 4 incremental of Bitcoin as part of MicroStrategy`s treasure reserve police.

On the other hand, the Investment Banking Goldman Sachs (NYSE:GS) will relaunch from next week its Bitcoins Futures Trading desk. (CRYPTO:BTC).

The bank is also showing interest in the official digital currencies under consideration by several countries, along with blockchain tech in general.

The move comes at a time when explosive growth in the value of Bitcoin and several other cryptocurrencies has led several big players in the financial sector to soften their previously hard-line attitude about digital currencies.

Mastercard (NYSE:MA) said in a blog post on Feb. 11 "this year Mastercard will start supporting select cryptocurrencies directly on our network," mentioning Bitcoin by name, while asserting it will "be very thoughtful about which assets we support based on our principles for digital currencies." According to Bloomberg, Visa (NYSE:V) has also said it will support cryptocurrencies if they become a "recognized means of exchange."

Despite the BTC correction,” Pankaj Balani CEO of Delta Exchange said in a note to investors. “The bull market and the case for a stronger rally in bitcoin remains intact. This is only the second correction in BTC prices since November, when bitcoin broke above its previous ATH and started a fresh rally.

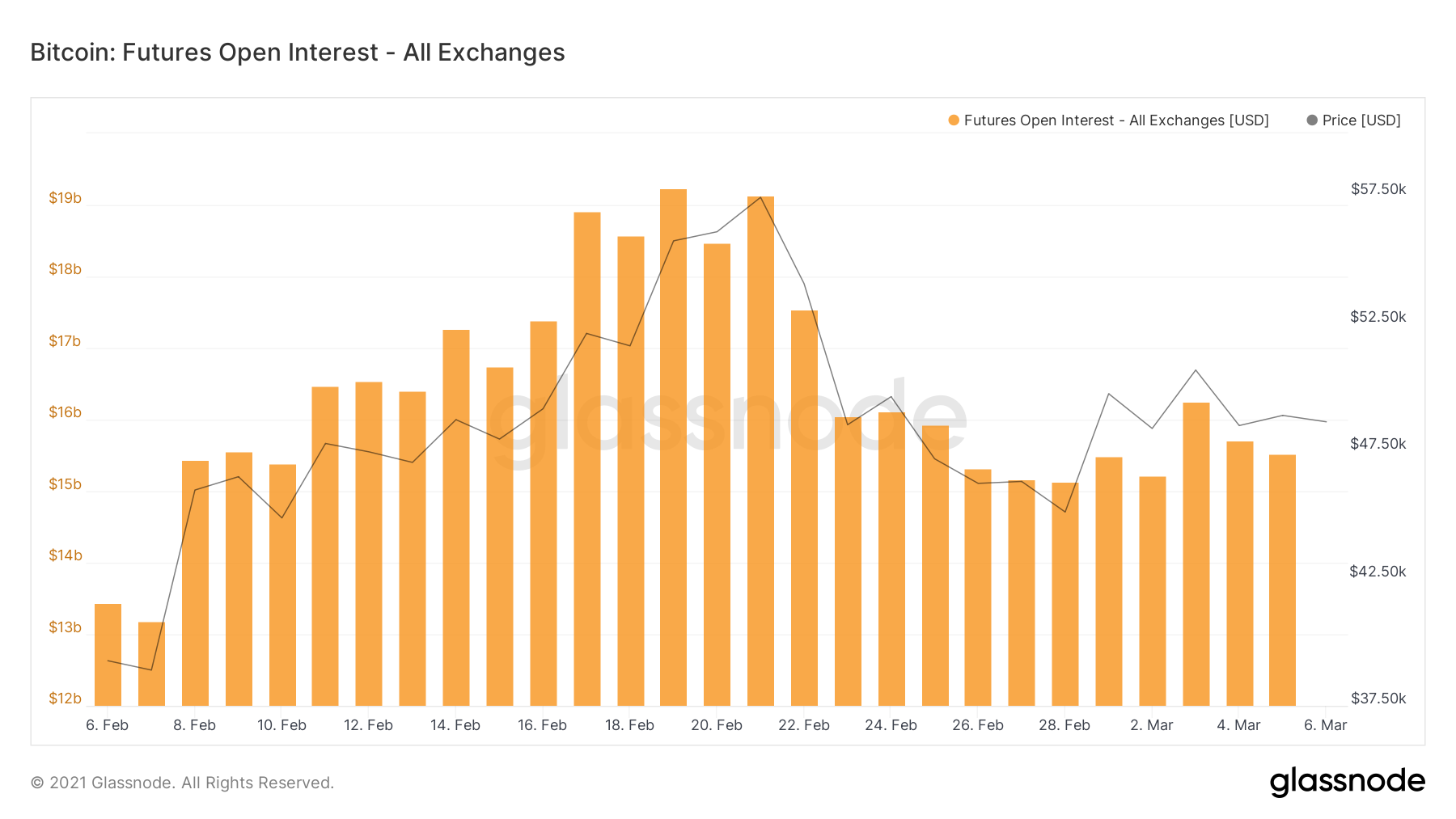

BTC FUTURES

Bitcoin Futures interests on the other hand hits 19 billions USD on February 22nd.

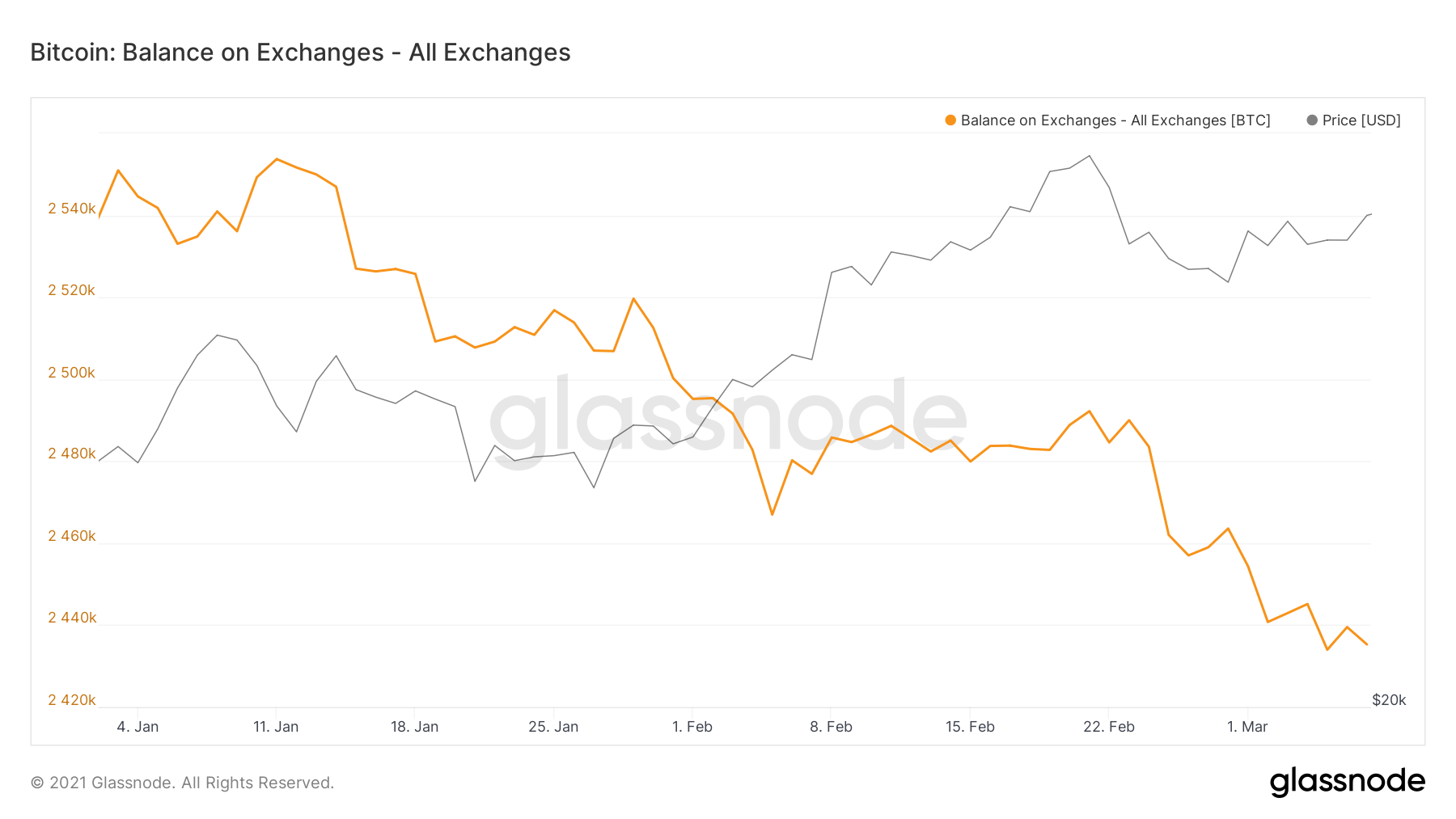

Also BTC Balance on Exchanges continues its uninterrupted march downwards with another 35,200 BTC withdrawn this week.

Grayscale Discount could potentially be a signal of start fresh of Bitcoin Rally - Bloomberg`s Intelligence

Mike McGlone, who correctly predicted bitcoins ascent this year to a price above USD 50,000, says according to the recent indicator the so-called Grayscale premium - a closely metric watched in Bitcoin which historically it’s been positive, that the previous swift 21% sell-off to about USD 43,000 might have reset the market for a fresh run. As of Thursday, prices had rebounded to about USD 50,000.

The Grayscale Bitcoin Premium indicator is the difference between the price of bitcoin as implied by cost of shares in the publicly traded Grayscale Bitcoin Trust (GBTC), and the price of bitcoin as traded on cryptocurrency exchanges.

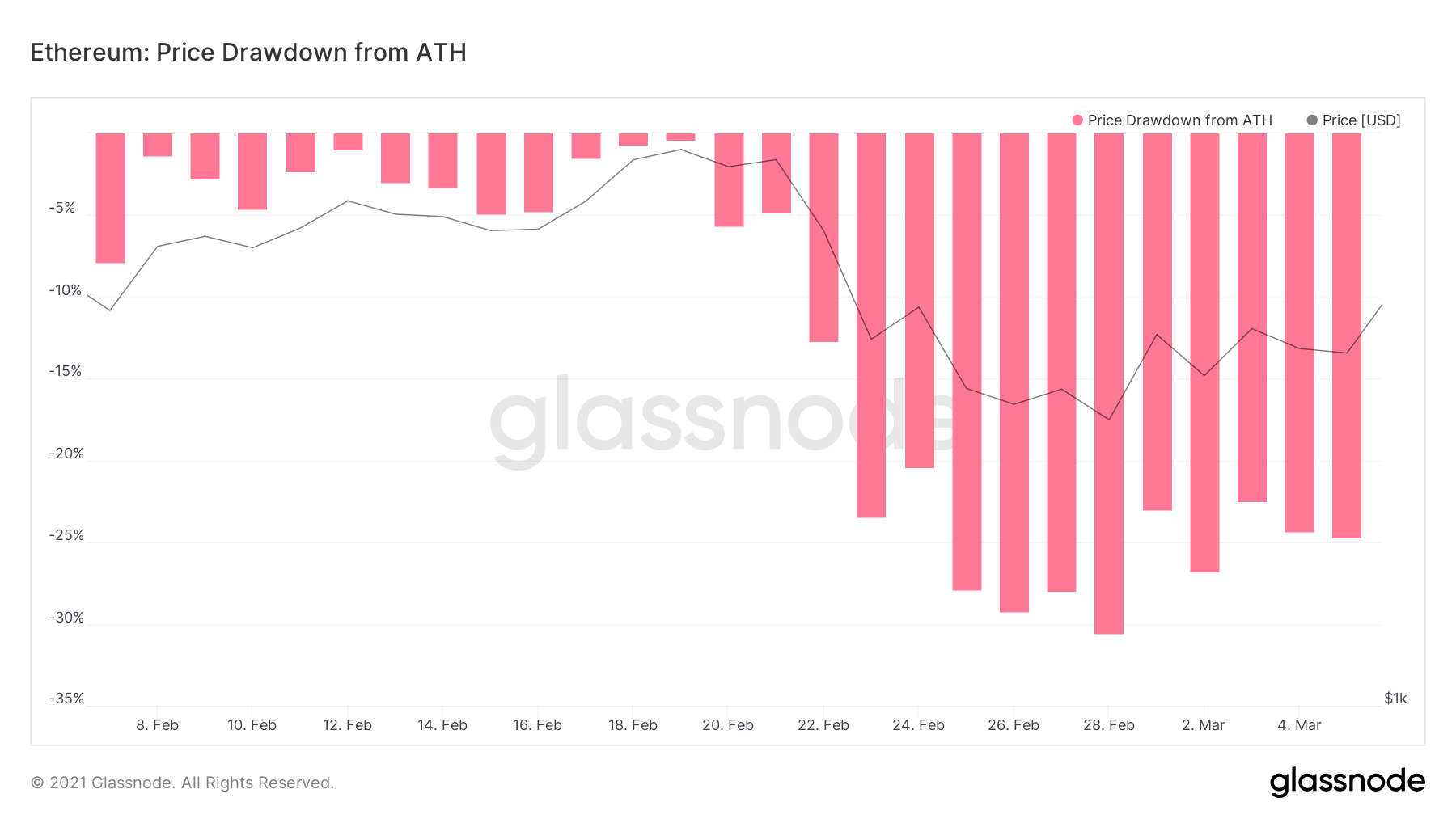

ETHEREUM

Ethereum, after coming from a low point on February 7th at USD 1,555 went up in the following weeks closing during the rally on Feb 20th at USD 2,014.

Following the short-term downtrend on Bitcoin (BTC), Ethereum has also suffered and it went down to USD 1,341 on Feb 28th.

On March 3th Ethereum started a bullish trend reaching highs of USD 1,625 USD before having a short decrease to USD 1,481 on Friday 5th.

On March 6th ETH price surpassed USD 1,600. After the correction on the markets, Ethereum should prepare as well for a bull run. With Ethereum still heavily congested, the market is eyeing other networks as potential competitors. Binance Chain remains a popular alternative to Ethereum, housing DeFi platforms such as Pancake Swap.

Galaxy’s Institutional Ethereum Funds Raise $32M at Launch – From a Select Few

Galaxy Digital’s institutional-grade ether (ETH) funds have raised over $32 million since their February launch, according to documents filed Friday with the U.S. Securities and Exchange Commission.

Early returns – for an “onshore” $22 million fund and its Cayman-domiciled $10 million sibling – reveal a small but deep-pocketed clientele participated in the twin funds’ earliest days. Just five total investors have joined the funds since Galaxy unveiled them in late January.

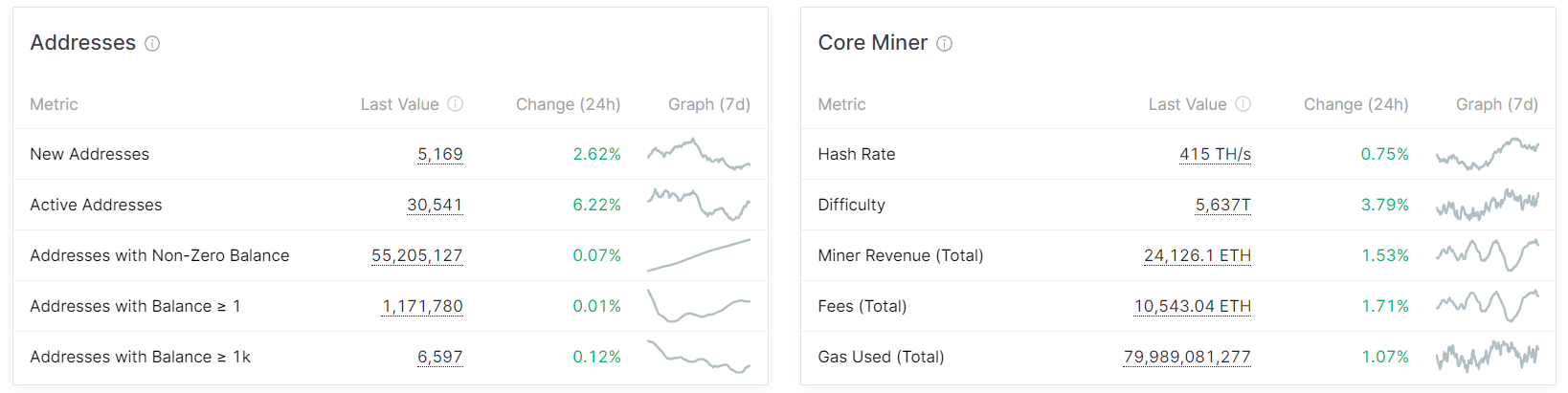

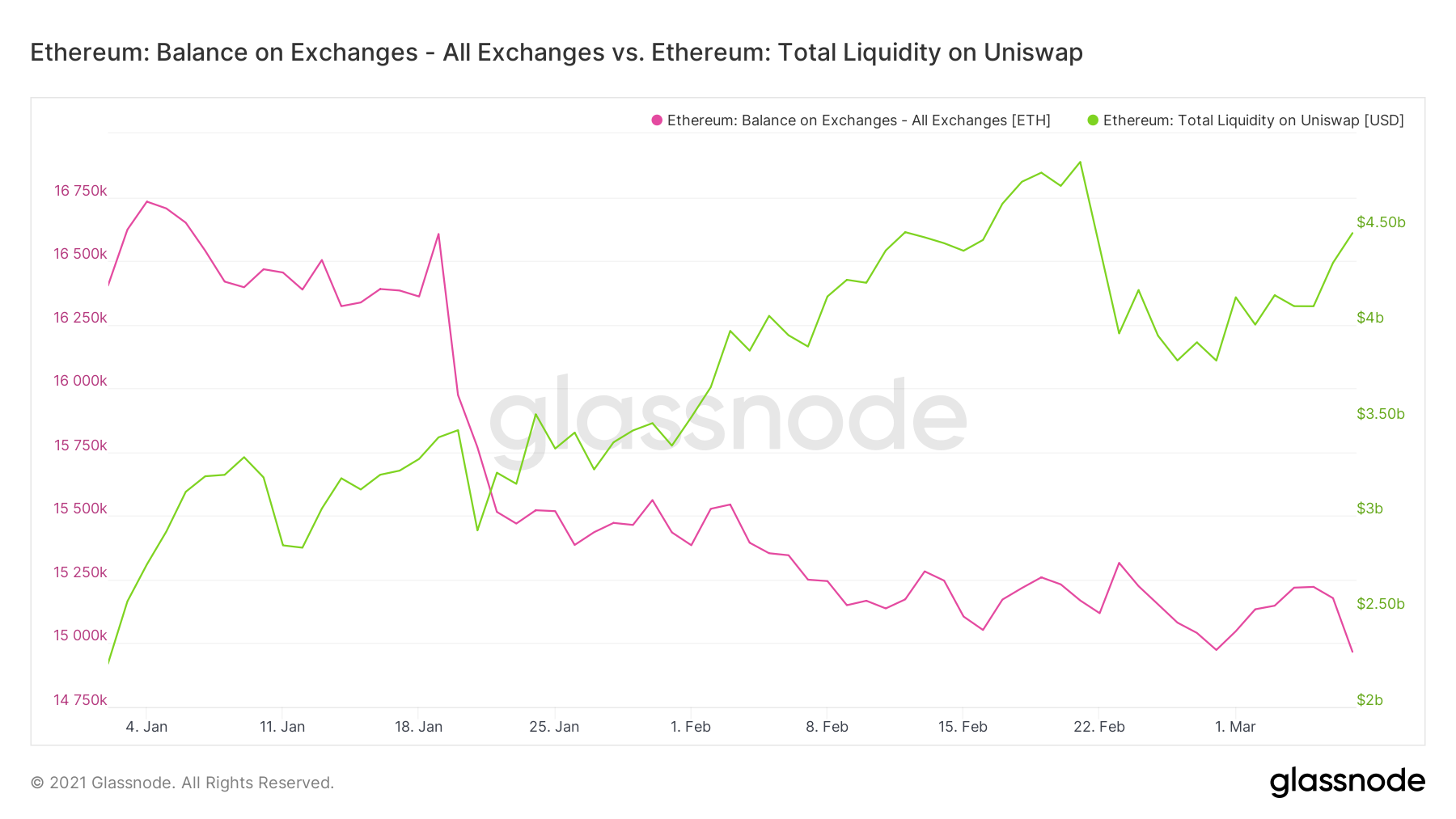

Ethereum: Balance on Exchanges -All exchanges vs Ethereum: Total Liquidity on Uniswap

It is important to show how the bullish trend on the Ethereum liquidity on Uniswap has been increasing compared to the all the ETH Balance on Centralized exchanges. Which confirm us the success of automating the process of market making by Uniswap and how the protocol incentivize activity by reducing costs for all parties.

CARDANO

Cardano’s ADA token flipped BNB last week to become the third most valuable crypto project by market cap.

This took many by surprise as Cardano has no ecosystem to speak of. Unlike Ethereum and, to a lesser extent, Binance, there are no apps or smart contracts running on the Cardano network.

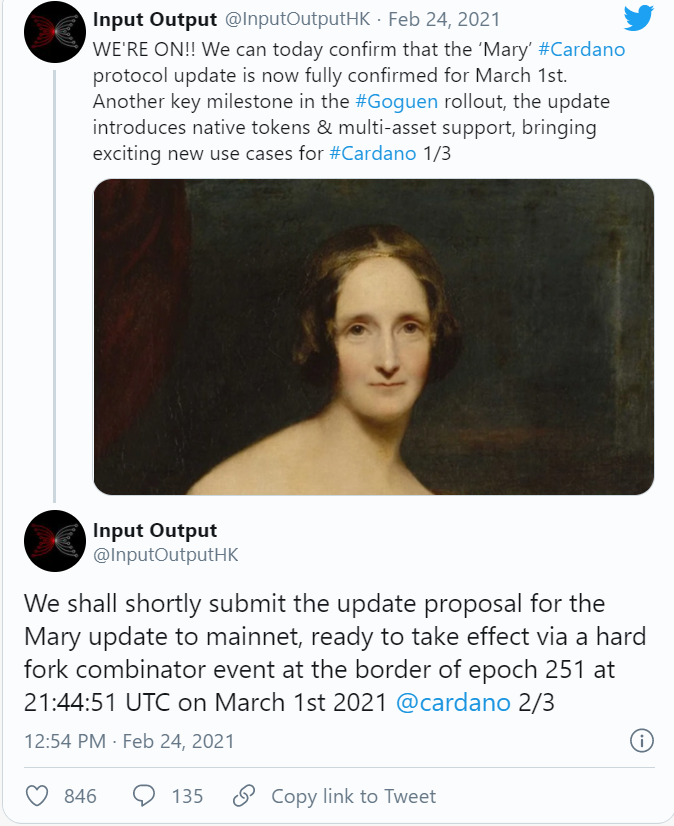

However, the update to change all of that goes live today, enabling smart contracts and native tokens, including versions of Ethereum native tokens.

This is crucial, as it may allow developers to launch Ethereum apps on Cardano for the same user experience but with lower fees and throughput times due to Cardano being relatively unused.

UNISWAP

The live Uniswap price today is $28,30 USD with a 24-hour trading volume of $664.247.789 USD. Uniswap is down 0,15% in the last 24 hours with a live market cap of $14.750.598.788 USD.

Uniswap is a popular decentralized trading protocol, known for its role in facilitating automated trading of decentralized finance (DeFi) tokens.

Uniswap creates more efficiency by solving liquidity issues with automated solutions, avoiding the problems which plagued the first decentralized exchanges.

By automating the process of market making, the protocol incentivize activity by limiting risk and reducing costs for all parties. The mechanism also removes identity requirements for users, and technically anyone can create a liquidity pool for any pair of tokens.

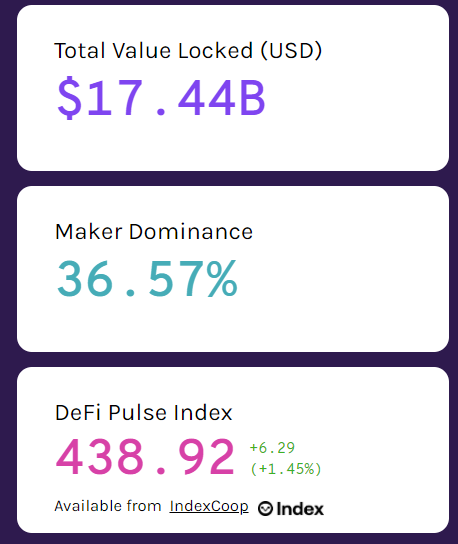

DEFI STATS

As ETH rises on a steady tear, select DeFi tokens are fighting to keep up with the growth. The biggest gainers are those of well established blue chips like AAVE and SNX along DEX governance tokens like SUSHI and UNI.

There’s a lot of talk around Layer 2 (L2) scalability, especially with gas costs reaching new highs amidst the ETH bull run. With Synthetix planning to move to L2 on January 15th and Uniswap soon to follow with Uniswap V3, its likely that these governance tokens will play increasingly important roles in their respective ecosystems. Compound’s choice to build out Compound Chain signals a sign in this direction, and it’s likely that other key governance tokens like BAL will help shape protocol upgrades in 2020.

Alchemix Protocol and Compound are keeping up the pace of DeFi innovation in the lead up to Optimism and other Ethereum-based scaling solutions. Alchemix brings a new type of synthetic ERC-20 token based on the future value of interest on a deposit, and will reward early adopters with a liquidity mining program.

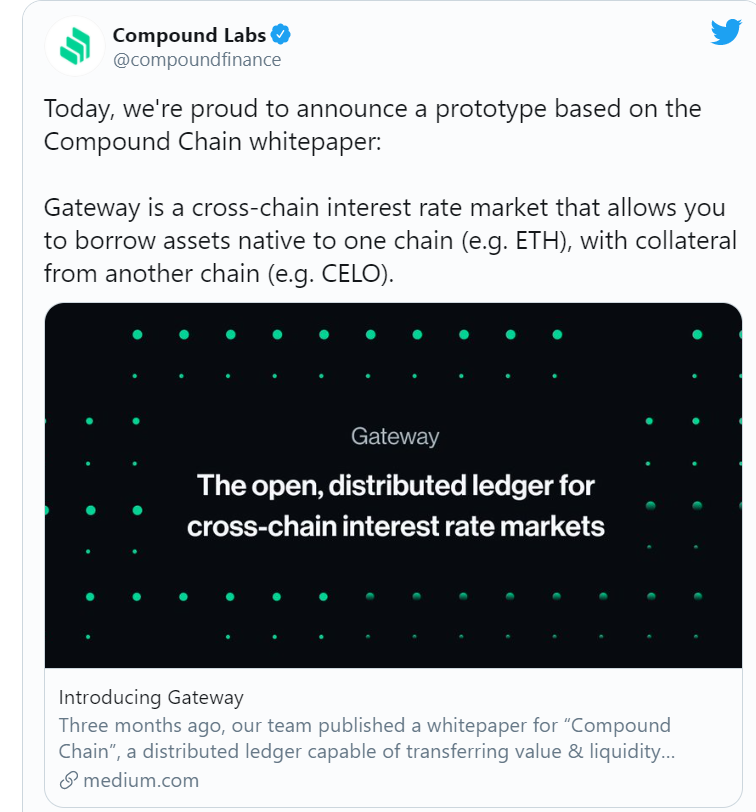

Compound also released the prototype for Gateway, a cross-chain interest rate market for borrowing native assets across different blockchains.

STABLECOIN MARKET 2021

The International Monetary Fund (IMF) estimates that central bank currencies will confront major obstacles in a rapidly digitizing financial system.

In a new blog post, the IMF says that as digital currencies increasingly crop up and the financial sector rapidly evolves, the public and private economic sectors will clash and put pressure on central banks to innovate and keep up with tech powerhouses.

The IMF believes that the best way for central banks to compete with the fast-paced digital currency revolution is to build a system where the private sector can convert its assets into a central bank currency.

Tether will be required to live up to some of the same regulatory standards as its licensed stablecoin competitors. That means tether (USDT, -0.08%) (USDT) stablecoins will be safer for the public to use. A company that seems to be held together with spit and duct tape, has suddenly become one of the largest U.S. dollar payments platforms in the world ranked by customer balances.

Now Tether requires to provide customers with plenty of useful information about how it invests their money. Specifically, each quarter Tether will have to inform the public about the percentage of reserves that are held as cash, loans, securities and amounts due from affiliates. And so for the first time, Tether customers may finally have enough information to verify whether their choice to hold tether is commensurate with underlying risk.

That´s all for our weekly recap. Let us know your thoughts Hope you enjoyed it :)