Welcome to another edition of our Weekly Recap, where we take a look at the movements, behaviors, statistics and news regarding the most relevant tokens in the market, along with a quick review of the state of the DeFi sector, the best performing tokens and stablecoins during the week. Let’s begin:

Top Cryptocurrencies

Bitcoin - BTC

It appears as if the cryptocurrency giant began recovering after the relatively lower average of last week. This was not entirely unexpected, since analysts claimed that a bounce back could happen after BTC reached an all-time high of over $40,000 in the early days of the month. The top token of the market has now been in a steady state of growth since February 1st, and indicators point towards this trend continuing for a while. We will have to wait and see how this develops, especially with digital markets being in everyone’s sights for the past couple of weeks.

Some would say that this behavior could be linked to the effects of the “Reddit vs. Hedge Funds” continuing tug-of-war seeping into cryptocurrency, as more and more people (especially tech-savvy users interested in finances) are becoming aware of the vulnerabilities of the regular stock markets. Some rumors are spreading about fake numbers being published by certain exchanges to pretend shorts are covered force the holders of GME, AMC and other stocks to sell, which only exacerbates the negative feelings towards the market and drives people to look for decentralized alternatives, which benefits cryptocurrency in multiple ways, along with the market being seemingly flooded with new users yet again by Elon Musk’s tweets, this time oriented towards the so-called “meme token”, Dogecoin, which experienced a surge of nearly 50% in the week and over 400% compared to last month. We will continue to cover these topics as weeks go by and the effects on the market are more evident and clear.

Dogecoin is the people’s crypto

— Elon Musk (@elonmusk) February 4, 2021

In terms of institutional news, the CEO of MicroStrategy, Michael Saylor, recently tweeted that his company acquired $10 million in BTC, which represents their second largest move after they converted the majority of their treasury to Bitcoin six months ago. This did not surprise many experts on the field, and they are in fact expecting MicroStrategy to continue making large BTC purchases (possibly of $10 million at a time) in the near future, but this could depend on the behavior of the currency in the following months.

MicroStrategy has purchased approximately 295 bitcoins for $10.0 million in cash, at an average price of ~ $33,808 per #bitcoin. We now #hodl ~ 71,079 bitcoins acquired for $1.145 billion at average price of ~ $16,109 per bitcoin.https://t.co/lmj3QCgKbw

— Michael Saylor (@michael_saylor) February 2, 2021

Also, in an interview for CoinDesk, a crypto lead for Visa, Cuy Sheffield, announced a suite of APIs that offers banks the tools necessary to implement BTC-related transactions, including buying and selling. This comes as good news, after Visa left their partnership with Facebook’s Libra and took a reluctant position regarding cryptocurrency, and could certainly drive more big names towards either adoption or development of their own toolkits.

In the BTC futures market, the most obvious change to note is the continuing drop of BitMEX’s presence in the market after the news regarding its CEO and other board members. Besides that, trading volumes seem to be holding or increasing slightly (the spikes of the 9th and the 27th makes the scale less noticeable) and open interest continues on the rise. Could this be taken as an indicator of a strong positive trend for BTC?

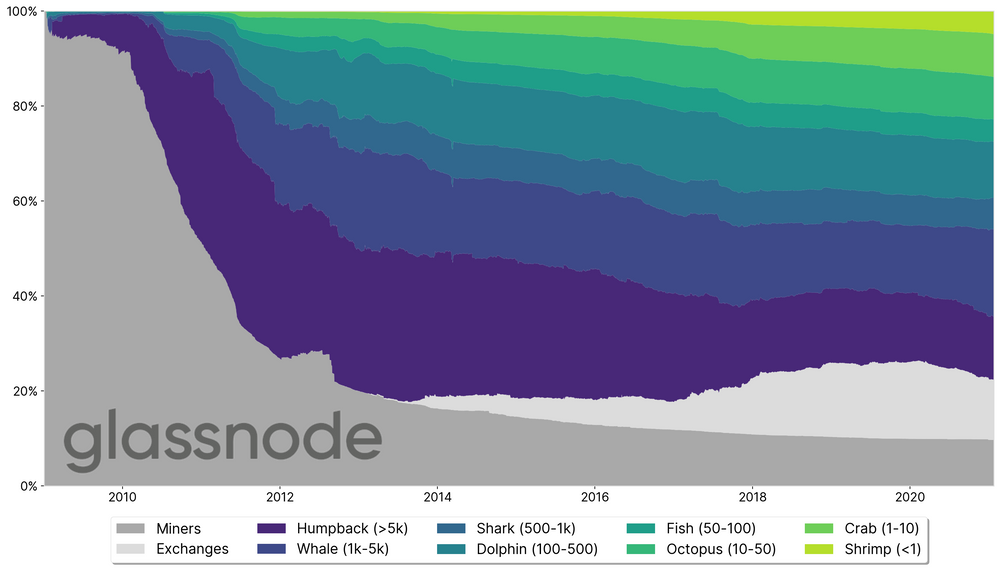

In today’s additional piece of news, we are once again covering the BTC holdings of Grayscale (pictured above), which seem to have slowed down their growth in the last couple of weeks. This follows the trend explained by Rafael Schultze-Kraft in a post for Glassnode, where he shows how the perception of Bitcoin ownership progressively concentrating in less users over time is wrong, and that lesser-scale users (with less than 500 BTC) represent nearly 40% of the market.

However, they do point that "whale” ownership has in fact increased during the last year along with the number of users that qualify as whales, proof that institutional interest in cryptocurrency is at its peak.

Even if we look at the metrics regarding addresses in the week, the perception of large-scale users gaining ground over the rest of the market seems to have a strong basis, but it is important to remember that the number of addresses is not the same as the number of users, since there are addresses associated to exchanges and miners, and that there is a possibility of a single user managing multiple addresses or multiple users sharing an address.

They also point out how 96% of the market is still composed of “shrimps” (users who own less than 1 BTC) and that this is probably the fraction of users that has seen the largest relative increase in ownership for the last 3 years.

Overall, even if the growth of institutional interest could seem like a threat to the ecosystem and the decentralization of the supply, the behavior of the small-scale portion of the market vastly out-weights the performance of whales, which should help in keeping a positive sentiment towards the near future.

Ethereum - ETH

As usual, where BTC goes, ETH follows, and this week was no exception. Reaching a new all-time high of $1,754 on February 5th, the second largest cryptocurrency continues to show positive signs of continuous growth, riding the wave created by BTC’s big moves. With a 26% growth week-over-week and nearly 42% month for month, not only do ETH holders have positive views for the next weeks, but also users and owners of platforms built on the Ethereum network.

As for the derivatives market, we see how trading volumes are not necessarily impacted by this climb, following a trend similar to last week’s (lower trading on the weekend with a significant increase during the middle of the week) and with even lower averages. This would be a sign of skepticism towards the climb, if it wasn’t for the open interest growing significantly, meaning that even if the trading volumes were reduced, they were mostly aimed towards the opening of new contracts, giving strength to the trend.

When we compare the metrics regarding addresses of ETH with those of BTC, we see a clear difference, as addresses with more than 1,000 ETH have been decreasing for a couple of weeks straight, while lower-scale addresses are constantly on the rise.

Polkadot - DOT

Polkadot has not fallen behind, reaching an all-time high of $21.50 on February 4th and currently trading slightly above the $20 line. Some are linking this growth directly to Ethereum, in a sense that the influx of transactions in the main competitor of DOT also motivates the users to compete strongly.

ChainLink - LINK

As LINK is an ERC-20 token, it is normal for it to ride the wave of its parent network. This is the reason why the token managed to reach a peak of $27 on February 5th and bouncing back a small amount to trade around $25.50 at the time of writing.

DeFi

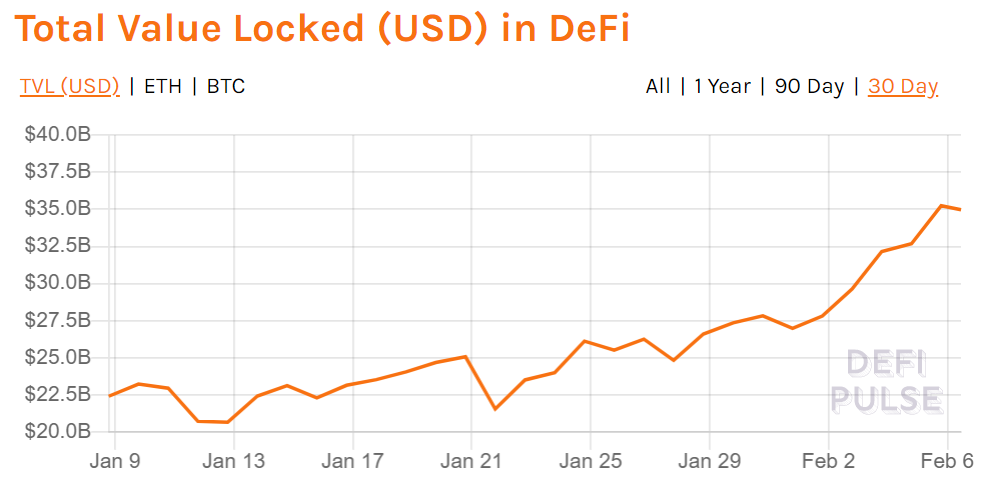

The DeFi market keeps growing healthily and steadily, with TVL breaching the $30 billion line and now aiming for $40 billion in the following days. Yet again, these movements keep correlating to the movement of ETH, so it is expected to keep growing.

Compound - COMP

COMP experienced slight drops in the last 24 hours, but it shows overall growth during the week, reaching over 30% of growth as their platform receives new users every week thanks to the possibilities of yield-farming.

Uniswap - UNI

Uniswap did break the mold of the top DeFi tokens by being the only one to not experience great climbs compared to last week. Even if the variation is under 1%, the comparison with others like AAVE, SNX and COMP. It is still token #15 in the overall market regarding market capitalization, so it will remain relevant for the time being.

Synthetix - SNX

Similar to COMP, SNX also experienced growth in the double digits, but merely 11% as it is bouncing back after reaching a peak of $24.

Lending Protocols

Lending protocols keep dominating the market, but probably the most interesting development comes from Maker overtaking WBTC (a DeFi stablecoin) in terms of TVL, but it still falls behind Compound and AAVE in terms of market capitalization. It is important to remember that market capitalization is directly linked to the value of the platform’s token, while TVL is a measurement of how much money is stored in a platform’s contracts.

Big Movers

Stablecoins

1 - USDT: $ 1.00, with a market cap of $ 28.26 B and a trading volume of $ 477.43 M.

2 - USDC: $ 1.00, with a market cap of $ 6.43 B and a trading volume of $ 160.81 M.

3 - DAI: $ 1.00, with a market cap of $ 1.80 B and a trading volume of $ 22.93 M.