Welcome to another edition of our Weekly Recap, where we take a look at the movements, behaviors, statistics and news regarding the most relevant tokens in the market, along with a quick review of the state of the DeFi sector, the best performing tokens and stablecoins during the week. Let’s begin:

TOP CRYPTOCURRENCIES

BITCOIN - BTC

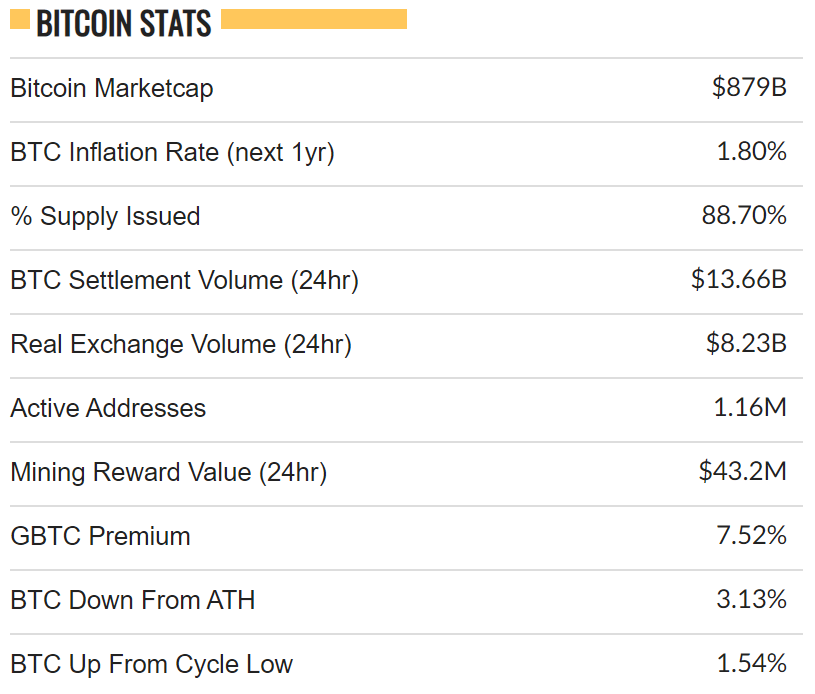

Another great week for the cryptocurrency market in general, as the biggest token of them all reached a new all-time high of over $47,000 and it’s currently trading steadily around that line since a large climb that took place on February 8th. And for the third time in a row, we are seeing the effects of Elon Musk’s ability to create the right amount of chaos at the perfect moment, since Tesla, Musk’s electric car manufacturing company, bought $1.5 billion in BTC on this date and is currently discussing plans about accepting the token as payment for their vehicles, which obviously sky-rocketed the value of both the token and the market as a whole, which is on the verge of reaching $1.5 trillion in market capitalization.

The last few weeks have been indisputable proof that BTC is still majorly swayed by sentiment, and it may only take a couple of names to publicly hop on the ship for its value to keep growing. Adding to the list of big names jumping in, BNY Mellon, the oldest bank in the U.S.A., announced that it will “hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients”, which could later translate into mainlining the handling and trading of BTC through their platform and allowing their clients to expand their portfolio into digital assets.

Mastercard also weighed in claiming that they also have an intent of enabling the use of cryptocurrencies on its network, saying that “to reach [their] network, crypto assets will need to offer the stability people need in a vehicle for spending, not investment”, which limits their adoption to certain stablecoins for the time being. PayPal has also shown their intention to expand on their current cryptocurrency approach, by planning to offer these services in the U.K. and the digital peer-to-peer transactions platform Venmo, a movement more focused towards the individual end-user than to the institutional side.

Additionally, an investing arm of Morgan Stanley is also considering adding bitcoin to the list of possible bets, according to Bloomberg, and Jack Dorsey and Jay-Z currently announced the creation of a 500 BTC fund (around $23.6 million) to develop bitcoin-based economies in Africa and India, despite news coming from Bloomberg that India could outlaw almost all forms of cryptocurrency in the near future, giving investors up to 6 months to liquidate their holdings, and this could impact the market negatively.

The influence of Bitcoin in the global economic landscape has become too large to ignore, which is the reason why not only public figures like Musk and Dorsey are publicly supporting its use and finding more ways to implement it, but also the world of traditional finances is recognizing the potential of cryptocurrency even beyond BTC so we will continue to see large names and movements in the following weeks.

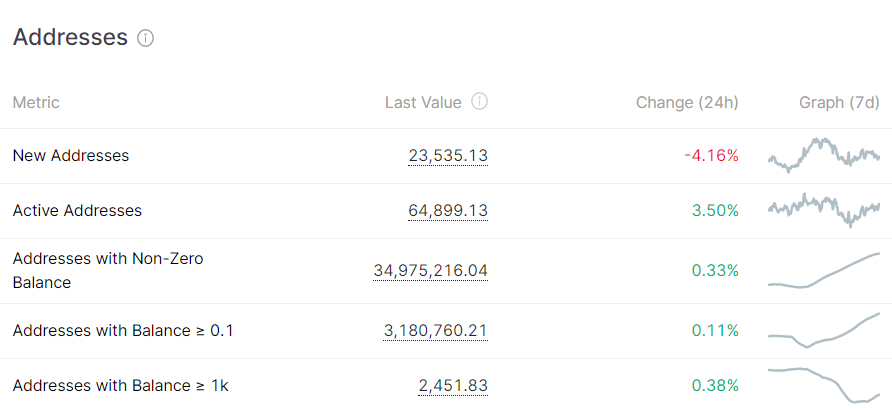

The derivatives market reacted expectedly to the great news, by having open interest rise constantly and transaction volumes growing and staying at a healthy level, compared to previous weeks where we only saw spikes in the middle of the week. This look at the futures market works as an indicator of the strength of the bullish trend triggered early in the week, since a rise in open interest means that more futures contracts are being created and this translates into users trusting in the future value of the token.

And for today’s additional piece of news, we take another look at Grayscale’s holding, since their CEO, Michael Sonnenshein, appeared on CNBC’s program Squawk Box on Thursday to discuss how the demand for bitcoin from treasuries and institutions is increasing, claiming that he is “very pleased to say and encouraged that momentum is not only continuing this year but is actually accelerating”. This comes as joint news with Bill Miller’s fillings to the SEC pointing towards him investing 15% of his Miller Opportunity Trust into Grayscale, which would only increase the percentage of circulation held by the bitcoin trust, which is quickly approaching 5%.

ETHEREUM - ETH

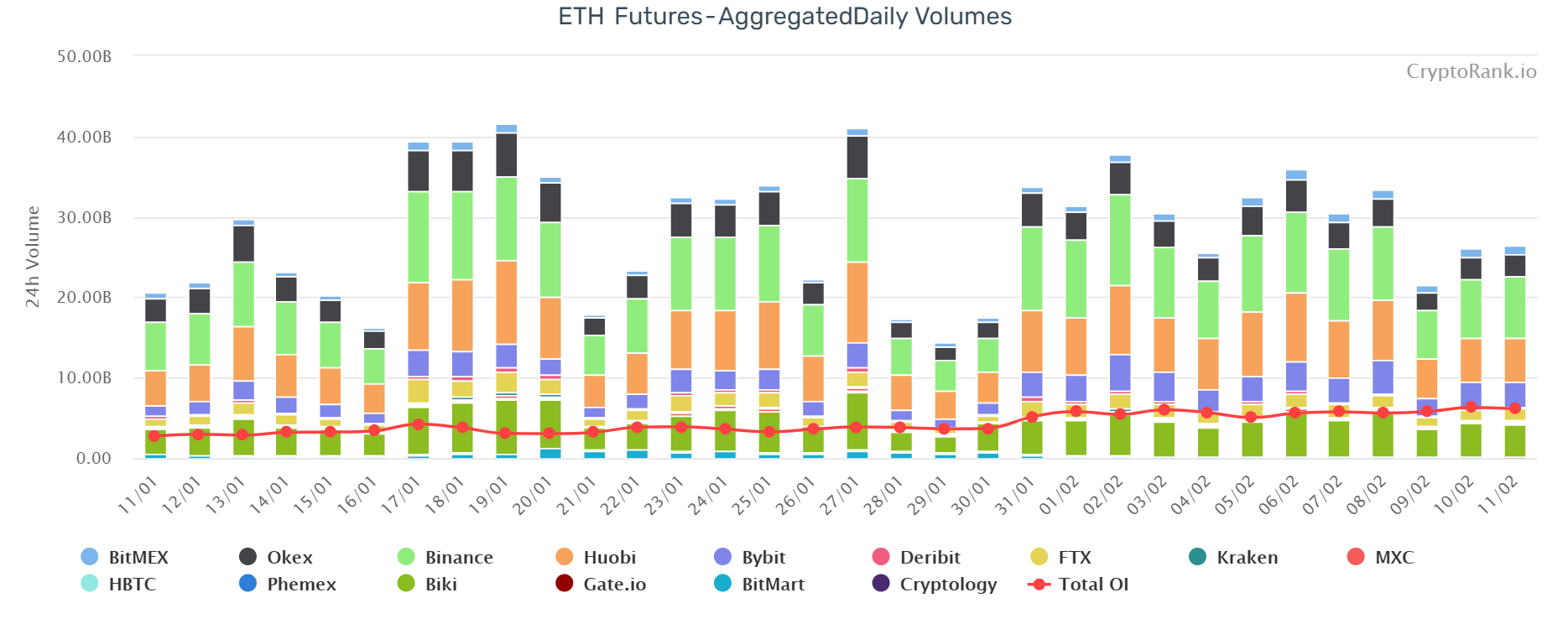

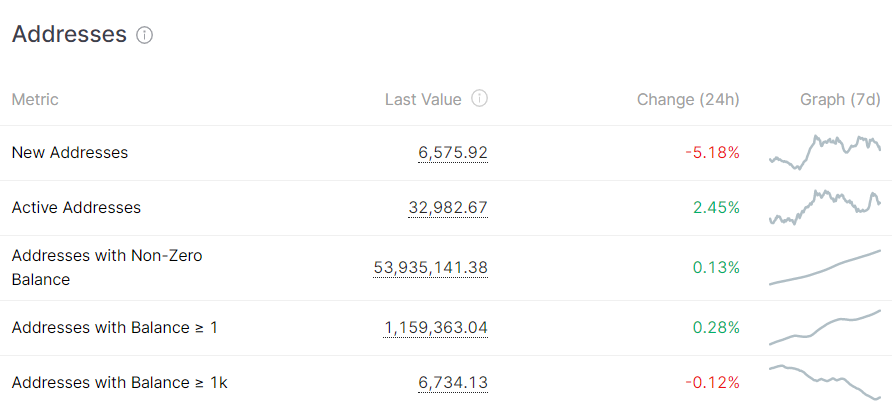

Ethereum keeps reaping what Bitcoin sows, peaking at $1,871 on February 12th and now oscillating around the $1,800 line. This wave of positive sentiment towards cryptocurrency as a whole could show the greatest non-financial effects through Ethereum, since its open-source nature will give enthusiasts on the developing side a friendlier point of entry and a wider variety of possibilities to integrate blockchain and cryptocurrency into their projects, which later transmits the positive sentiment generated on the financial landscape to a drive to innovate using the technology.

The futures market is seeing these effects as well, with trading volumes maintaining the high average of last week while open interest is still on the rise. Similarly to BTC, these behaviors are indicators of strong trends continuing and painting a positive picture for the near future.

POLKADOT - DOT

The continuously good performance of ETH continues to boost its main competitor, as we saw DOT reaching a high of over $30 during the week. However, it has dropped since that peak and it’s now rounding the $28 mark. A possible mindset to take towards Polkadot is that its behavior in the near future will most likely be reactionary to the performance of Ethereum, and the gradual rollout of Ethereum 2.0 could also have some effect on the behavior of DOT.

CHAINLINK - LINK

On a similar note to DOT, LINK is also directly affected by ETH, but because LINK is an ERC-20 token traded on the Ethereum Network, so it also reached a new all-time high of $31 and even after a drop it managed to recover partially, now oscillating around $30.

DEFI

This week in DeFi, we saw the total TVL of the sector breach above $40 billion and officially reached a 10x increase in a little over 6 months, which is comparable to ETH’s growth in 10 months to date. However, it can be argued that the main selling point of DeFi, the availability of equivalents to traditional financial services, and the many events that boosted the performance of the sector during 2020 contributed heavily towards its accelerated development.

Market capitalization of the top decentralized apps (DApps) of the DeFi sector.

UNISWAP - UNI

As the main point of news, we saw Uniswap taking over the top spot in terms if market capitalization, following the rising trend we’ve seen in the last few weeks. It is also strongly placed in 5th place in terms of TVL.

COMPOUND - COMP

Compound was not as successful this week, dropping off the top 5 in market cap but still holding the third position in TVL. It also still holds a solid lead in terms of “score”, a measure that compiles data regarding scalability, security and transaction speeds.

SYNTHETIX - SNX

The leading platform in asset digitization keeps going strong, holding spot #3 in market cap and #7 in terms of TVL, but showing constant increases after a drop in the middle of January, showing a great potential of recovery and a relatively fast catch-up to its competitors.

LENDING PROTOCOLS

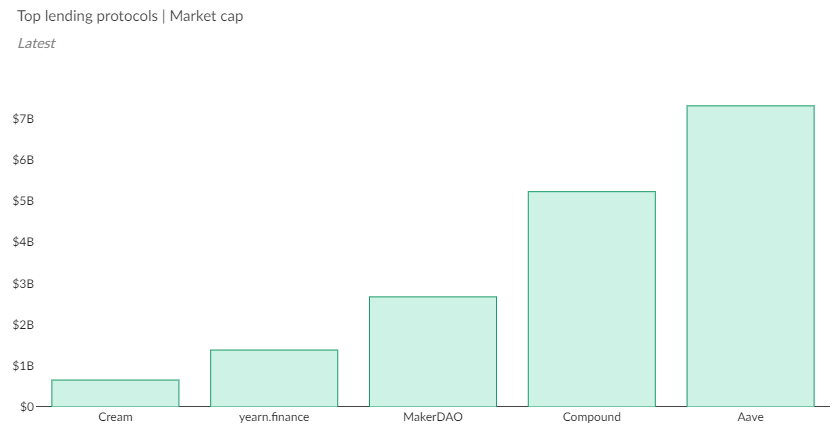

Lending protocols continue to lead the market, despite WBTC taking over the top spot of the platforms by TVL and increasing the portion of the market represented by stablecoins. However, constant increases were seen across the board for lending protocols, with AAVE maintaining the lead.

BIG MOVERS

STABLECOINS

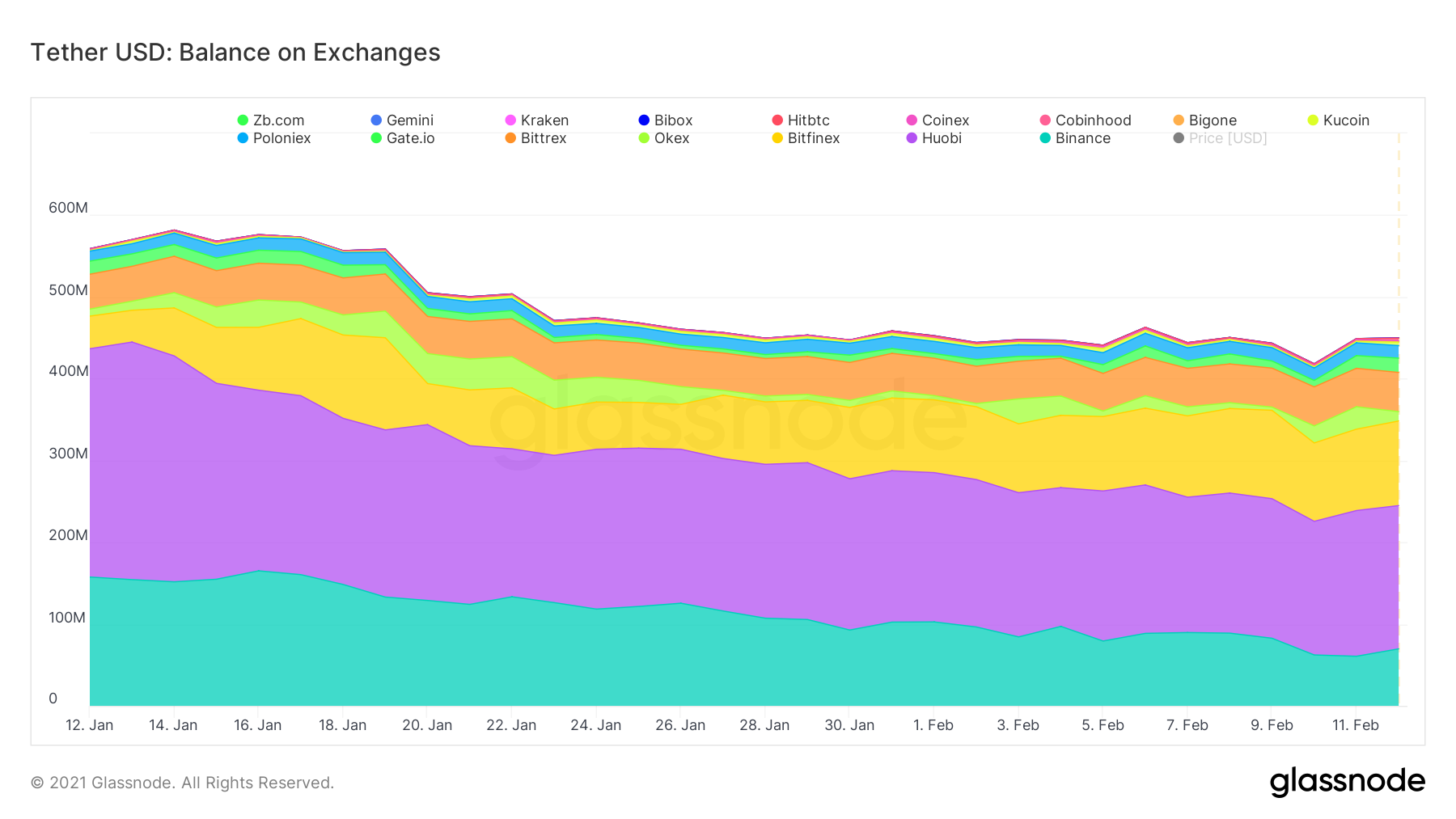

1 - USDT: $ 1.00, with a market cap of $ 31.63 B and a trading volume of $ 580.31 M.

2 - USDC: $ 0.9999, with a market cap of $ 7.14 B and a trading volume of $ 257.40 M.

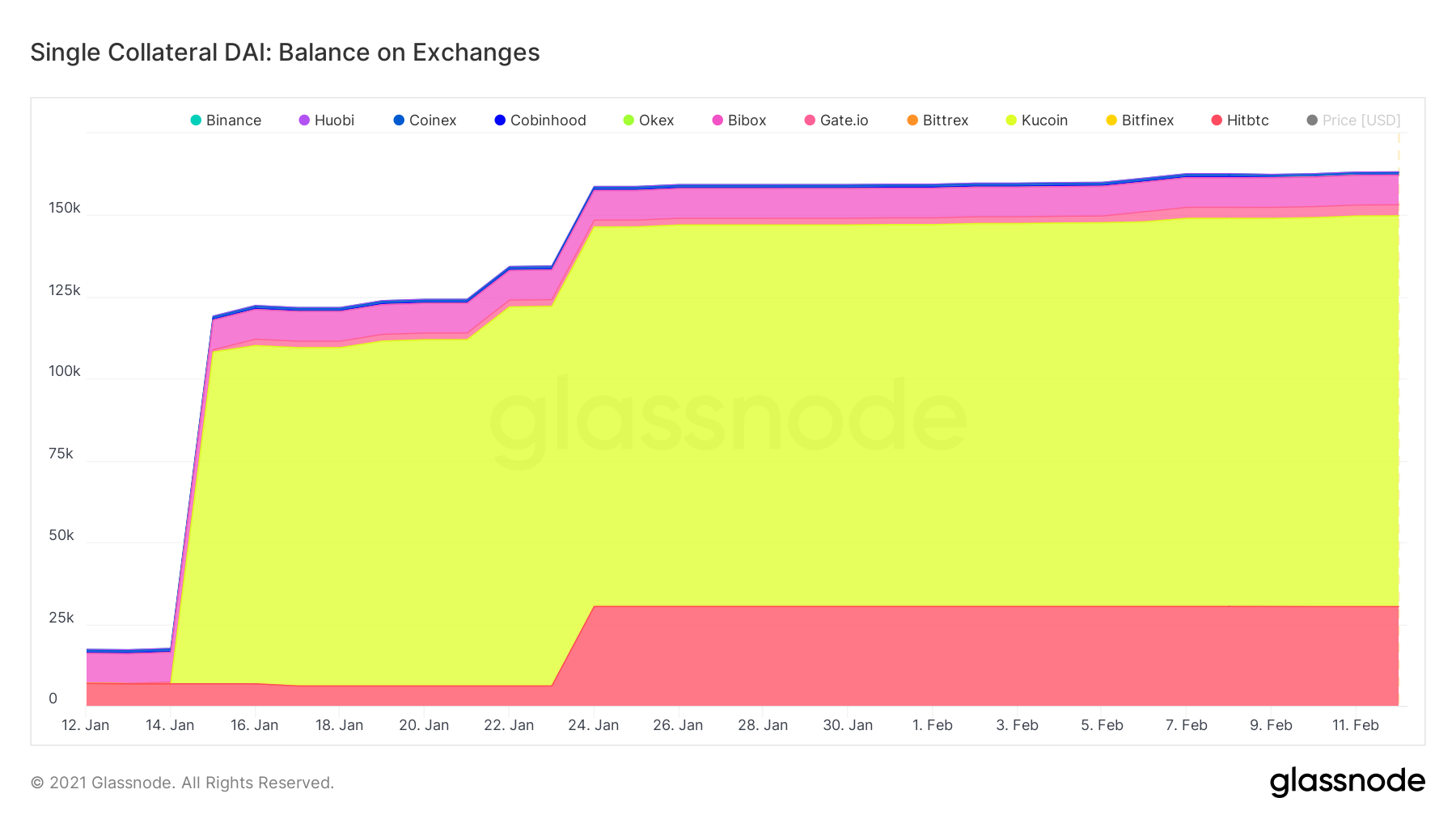

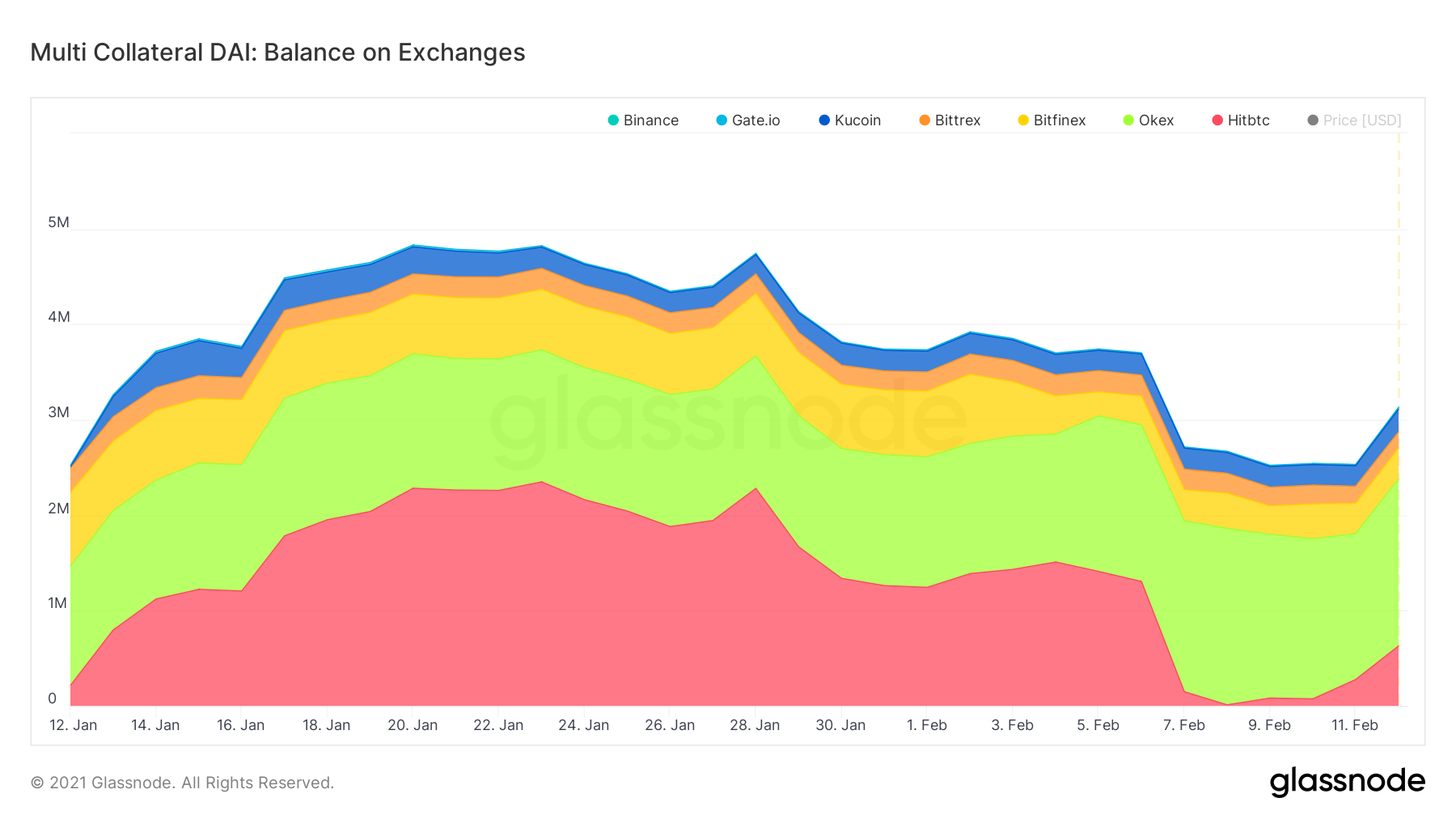

3 - DAI: $ 1.00, with a market cap of $ 2.05 B and a trading volume of $ 36.13 M.