Welcome to another edition of the Weekly Recap, where we take a look at the movements in prices that dictated the behavior of the market through the week, review some important news and quickly review the best performing tokens of the week, the DeFi sector and stablecoins. Let’s begin:

Top Cryptocurrencies

BITCOIN (BTC)

The giant of the market maintained similar levels during the entire week, with changes below 1% at the time of writing. This comes as an interesting development, since last week we saw BTC dropping from its $40,000 all-time high to nearly $30,000. which had analysts and investors on edge about whether the drops would continue or if BTC would find a new baseline for the time being, which seems to be around $34,000 now.

Besides this, BTC did experience a spike that brought it close to $39,000 in the early hours of January 29th, but bounced back down by the end of the day, with data suggesting that a possible cause for this surge was Elon Musk, CEO of Tesla and SpaceX, added the word “Bitcoin” to his profile on Twitter. Given his massive following and eccentric personality, the general population is always following his statements and posts of social media closely, and they often tend to sway public sentiment one way or another, and this is just another example (even if it was temporary).

Among other news that had great impact in the market, during the week we’ve seen how Wall Street and multiple hedge funds struggled against actions taken by a multitude of individual traders meddled with their attempt to short the stocks for GameStop (GME). After beginning the week at $15, the stocks of the barely-alive videogame stores franchise managed to surpass the $500 line on Wednesday and closed at $325 on Friday, disrupting funds like Melvin Capital and making them face terrible losses and forcing them to renegotiate the terms of their short trades.

The effects of this event are quite noticeable, with most of the market indicators showing negative changes for multiple days in a row, and the uncertainty of how long will the users hold their assets keeps worsening the situation as the short traders have no guarantees for the renegotiation of terms.

The users who bought GME seem to have purposes beyond monetary gains, since most of them are not willing to sell their stock even when massive profits could be achieved. The following week will be crucial to determine the outcome of this event, since certain trading portals (notably Robinhood) are implementing tight restrictions on their users to mitigate the damage on the hedge funds, something the trading community is not taking nicely and could lead to further movements like this.

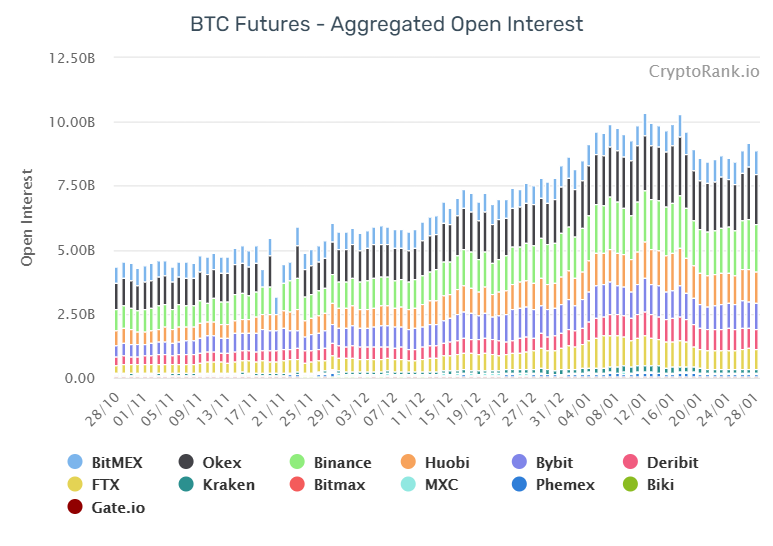

In terms of the future market, we are already seeing the effects of the news about BitMEX’s CEO and his team facing charges for violating AML measures, as their platforms steadily falls behind in the ranks of both daily trading volume and current open interest. On the wider aspect, there was a clear spike in trading volumes on the January 27th, which matched an increase in aggregated open interest, meaning that the events of the week had a certain effect in people trusting the future of BTC enough to make these transactions.

As a measurement of the involvement of institutions in Bitcoin, we can look at how the holdings of Grayscale keep increasing at a steady pace week after week, this time reaching nearly 650,000 BTC, representing around 3.5% of the total BTC mined and in circulation. Should this number increase, the potential ability of institutions to determine the future of the token also grows, so we should focus on the response by the community to this.

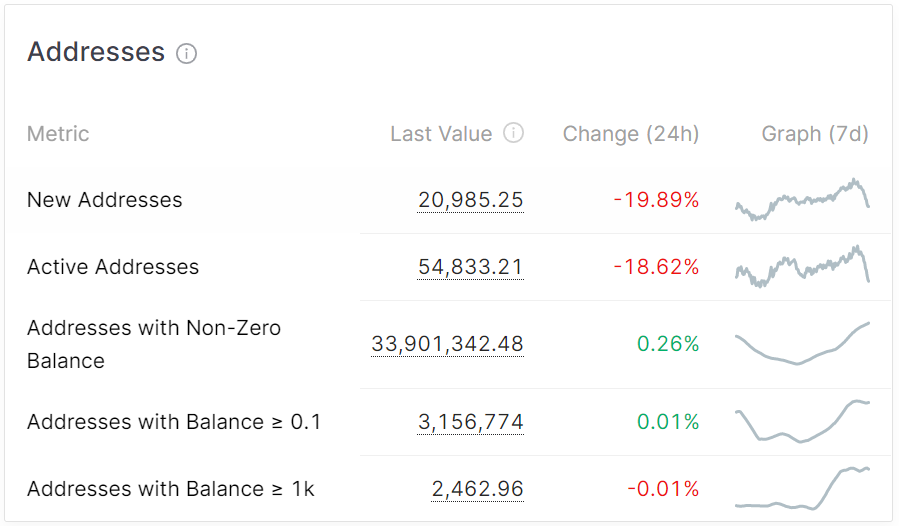

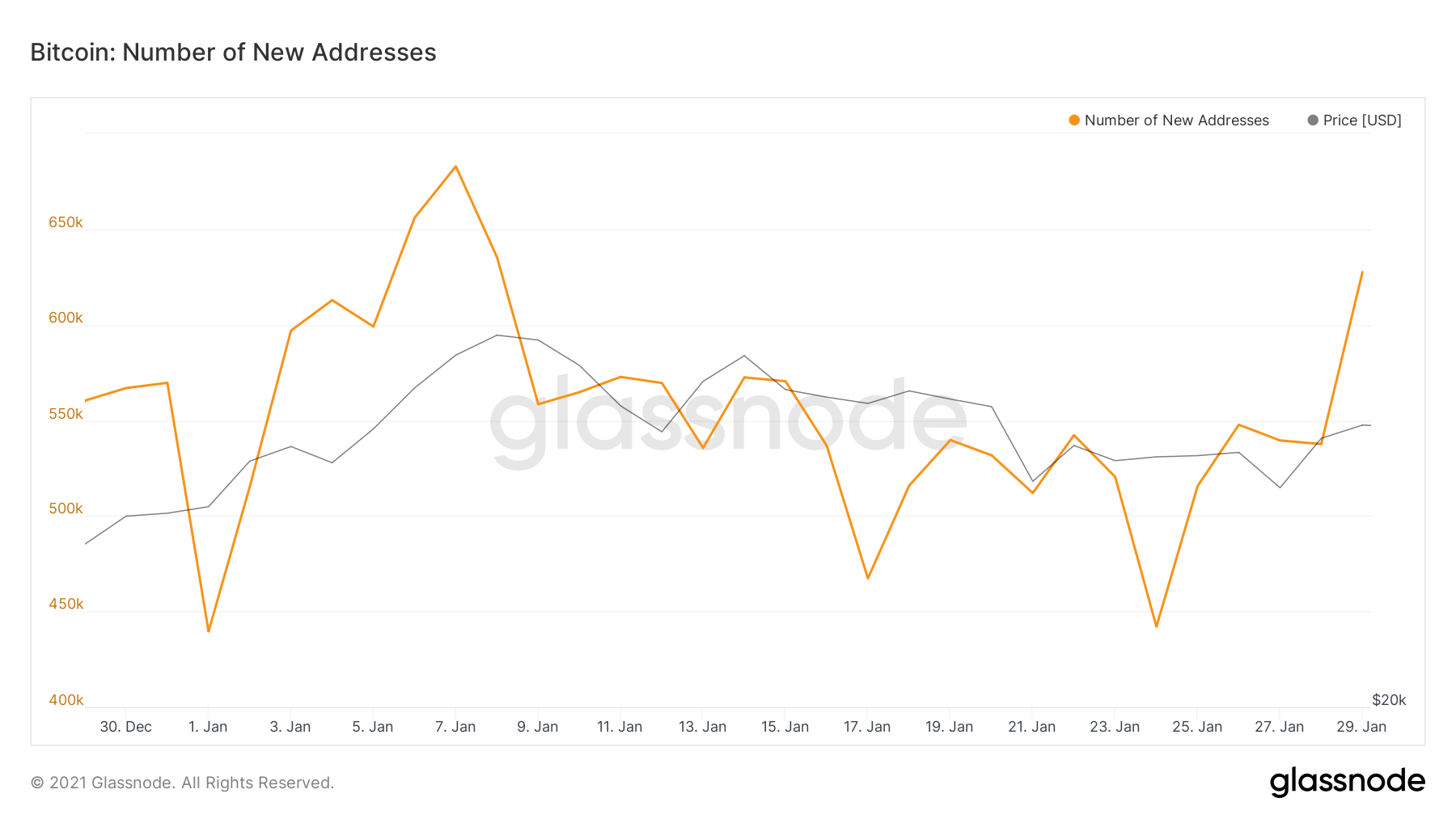

And for this week’s piece of additional information, we take a look at the number of new addresses created and mining information about BTC. As we can see, the creation of new addresses to handle BTC saw a significant drop on the 24th, but recovered nicely and now shows over 600,000 new addresses only yesterday, which is also motivated by Elon Musk’s moves on Twitter, showing how the general public can be motivated by the influence of a popular name.

On the side of mining statistics, we are still seeing the traditional oscillation in metrics like number of blocks mined per day and average block size, which spike at an average of 2 times per week, but the most noticeable trend seems to be the increase in transaction fees. We are currently still seeing the effects generated by the pandemic. BTC’s third halving, and the price increase seen in the later months of 2020.

ETHEREUM (ETH)

ETH continued with the trend shown last week, with wide oscillations around the $1,350 mark every few days, which seem to be reducing not only in amplitude (lesser variation) but also in width (less days between each wave). These are both signs of reaching a stable point, but it is a matter of time to see how the token behaves on the following weeks.

Other important aspect to look at is the options market, which saw a relative increase during the week in terms of open interest and, much like BTC, a spike in trading on the 29th as a possible consequence of Elon Musk’s movement towards BTC.

In the ETH derivatives market, we also saw increasing in trading volume compared to last week, despite the lack of the great spikes seen on January 4th and 11th, which could be an indication of this market stabilizing instead of concentrating all transactions in a single day.

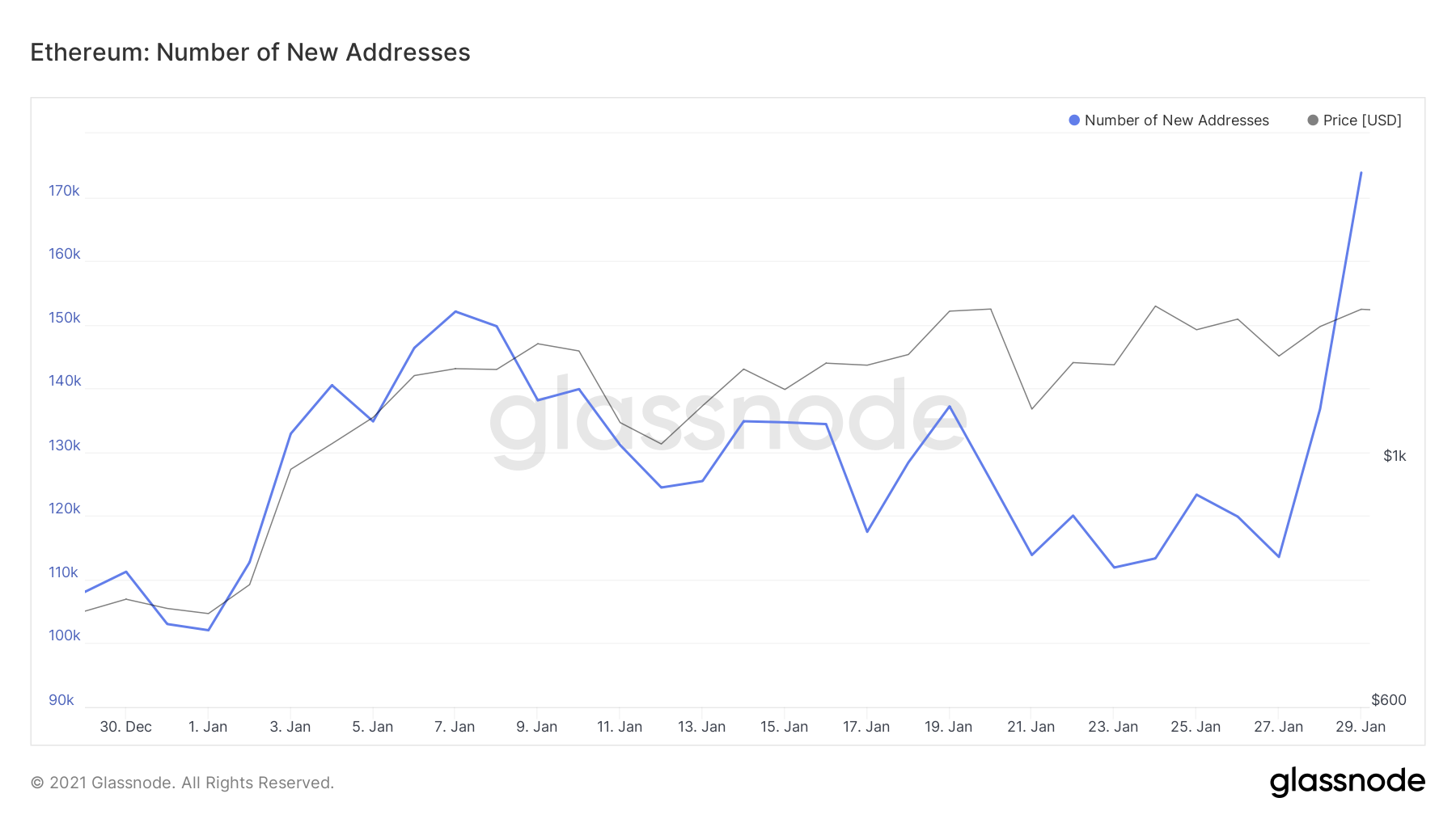

Similar to what we mentioned in BTC, let’s also take a look at metrics for addresses and mining for ETH.

The amount of new addresses created daily across the last months shows a massive increase in the recent days, most likely motivated by all the relevant movements driving more people to enter the market. However, the mining aspect seems to be unaffected, as the regular “cycles” seem to be constantly repeating, while transaction fees seem to have returned to their normal state after the big spikes of January 4th and 11th (correlated to the increase in transaction volume seen those days).

POLKADOT (DOT)

Polkadot maintained its good momentum and reached $19 during the middle of the week, but it has now fallen to nearly $16 and indicators point towards a somewhat stable period in the upcoming weeks.

CHAINLINK (LINK)

Besides a similar behavior to most tokens, LINK also managed to climb up the price charts in the early days of the week, even reaching an all-time high of over $25 on January 24th, but it also bounced back down momentarily and now seems to be stabilizing around $23.

DeFi

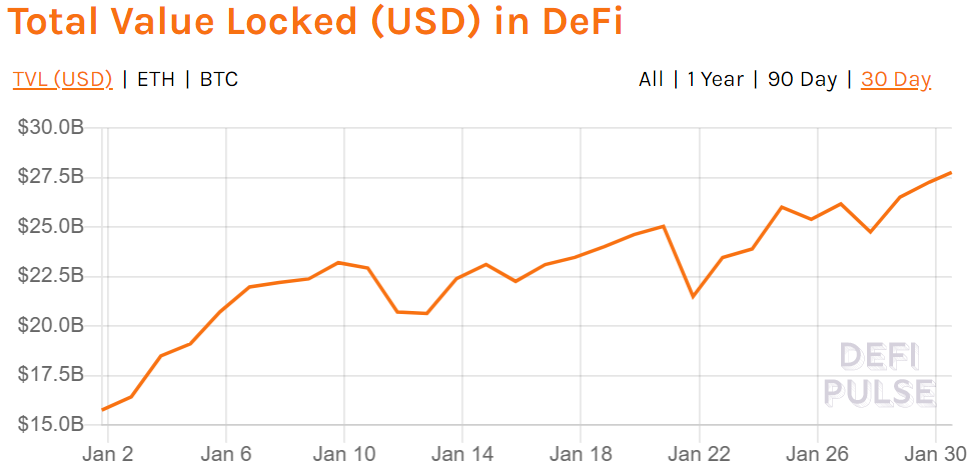

This week, the DeFi market got back on track after certain small drops that continuously worry users and enthusiasts. Total Value Locked across the market reached $27.7 billion, and its possible that certain specific movements and the stabilization of ETH could give DeFi a chance to grow untethered by its underlying network and token.

COMPOUND (COMP)

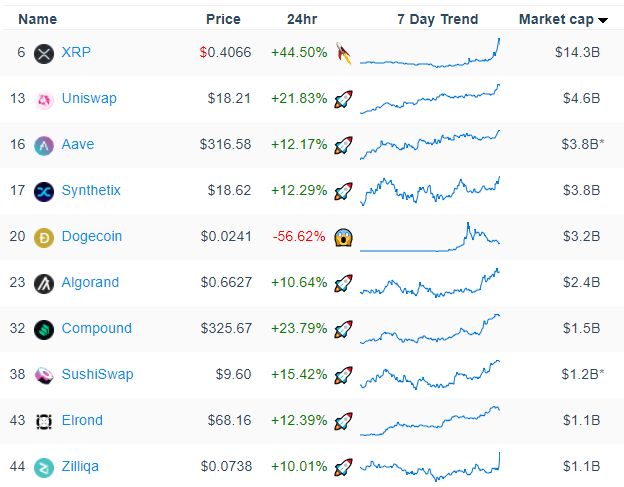

By far the most interesting of the big currencies of the week, showing gains of over 50% and now resting comfortably above the $310 mark, seemingly boosted by strong whale purchases which boosted the entire DeFi sector by nearly 20%.

UNISWAP (UNI)

Uniswap continues to perform better than expected, achieving an entire month of constant gains and resting at $17.85 at the time of writing. The most possible reason for this greater increase in the later days is the perception of users towards centralized exchanges and their terrible handling of the Reddit/Wall Street/Gamestop situation, which is turning people’s attention towards the idea of decentralized exchanges.

SYNTHETIX (SNX)

Another DeFi platform that seems to close the week on a positive note. The asset-digitization and handling platform saw multiple spikes in the last few days, most specifically on January 24th and 28th, so it should not surprise anyone if this trend continues for a moment while the average keeps increasing continuously.

Lending Protocols

Last, but not least, it’s important to remember that lending protocols still represent the larger portion of the DeFi sector, with MakerDAO still holding the top spot not only among lending protocols, but also in the entire market overall.

Top Performers

Stablecoins

1 - USDT: $ 1.00, with a market cap of $ 26.37 B and a trading volume of $ 518.96 M.

2 - USDC: $ 1.00, with a market cap of $ 5.85 B and a trading volume of $ 155.81 M.

3 - DAI: $ 0.999, with a market cap of $ 1.62 B and a trading volume of $ 21.53 M.