Welcome to another edition of the Weekly Recap, where we take a look at the movements in prices that dictated the behavior of the market through the week, review some important news and quickly review the best performing tokens of the week, the DeFi sector and stablecoins. Let’s begin:

TOP CRYPTOCURRENCIES

BITCOIN - BTC

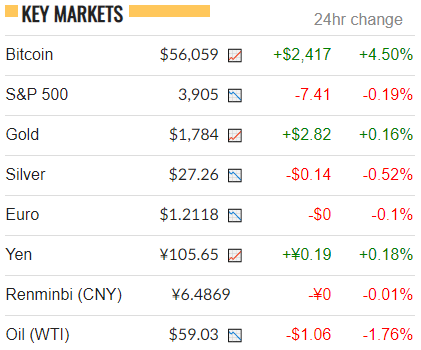

It finally happened: BTC blew past the $50,000 line. At the time of writing, the crypto giant trades comfortably above this mark and managed to reach $57,000. The mid- to long-term effects from numerous events in the past year (BTC’s third halving, for example) are starting to show, boosted and strengthened by the increase of institutional involvement in not only this token, but the cryptocurrency market as a whole, and this can be seen when comparing the behavior of crypto to other markets of great value, since it constantly seems to overperform in daily and weekly changes.

With this rise in price, BTC surpassed another important mark: reaching $1 trillion in market capitalization. This not only marks a digital asset reaching the status of an institutionally recognized asset, rather than just being a buzzword or hot-topic on the internet. The cryptocurrency market has kept a strong trend long enough to break these important marks, and it might get even stronger as more respectable companies and institutions catch the wave and a sort of “domino effect” continues to develop, a phenomenon that, at this point, is impossible to predict where it might lead us.

An important piece of institutional news that could have swayed the market comes from MicroStrategy. A couple of weeks back, we covered their ongoing effort to convert a large portion of their treasury to BTC through the initial operation of ~$425 million in 2020 and more recent smaller purchases. Now they announced a new debt offering which initially tallied at $600 million, but it was later upsized to $900 million with a potential $150 million add-on, which was expected to close yesterday. This has both resulted in a boost for the market and their own stock, which has risen from $145 in August, at the time of their first conversion, to over $1065 during this week, showing how the current state of BTC can be fruitful for interested top-level investors and the individual user simultaneously. In other news, Stone Ridge Asset Management’s BTC firm, NYDIG, claimed that their holdings are projected to reach $25 billion by the end of the year, according to their CEO, Ross Stevens, in a web conference with MicroStrategy’s CEO Michael Saylor.

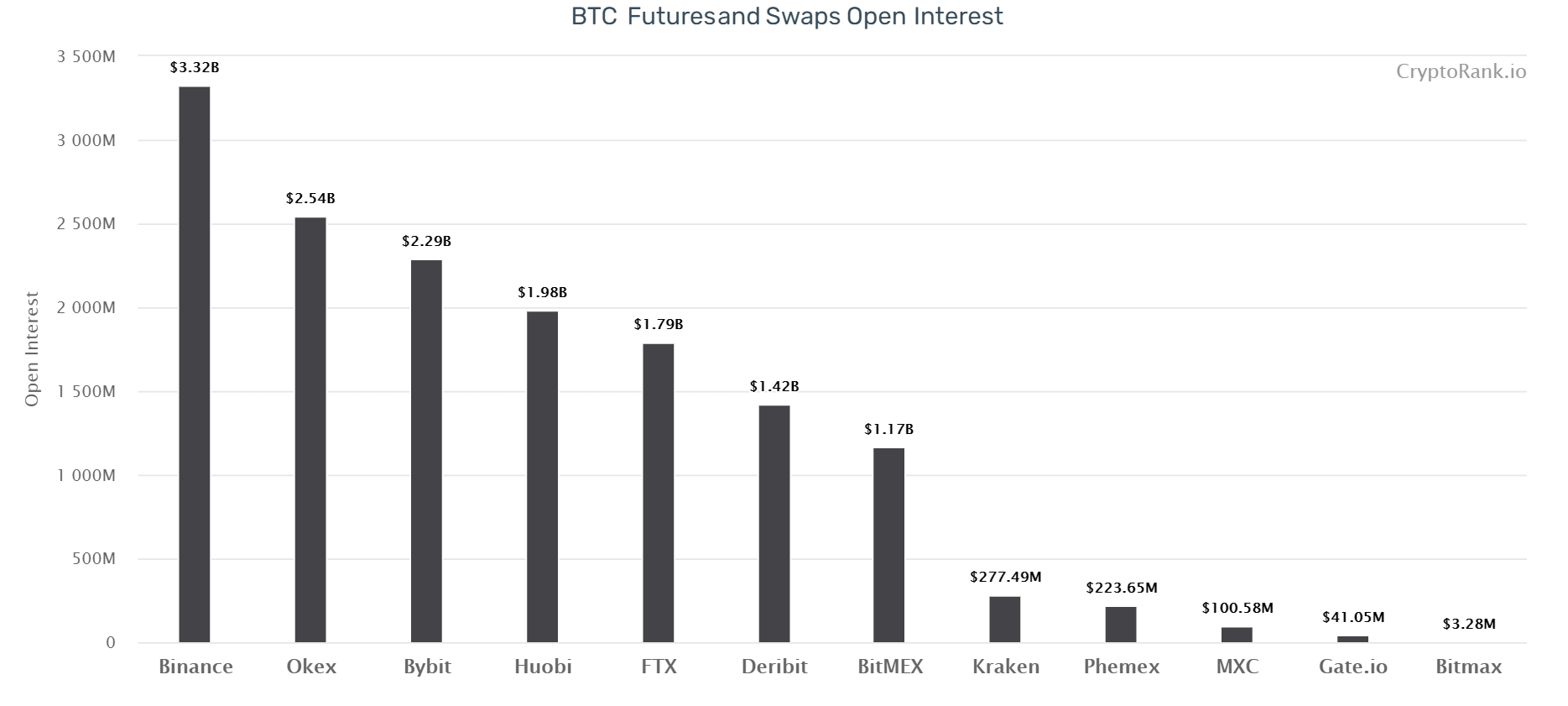

The derivatives market reacted as expected to the great news of BTC, with trading volumes breaking the traditional week-long cycle and reaching another high point on the 17th, as prices kept climbing and people probably were capitulating on the trend to create more contracts, as evidenced by the continuing increase and high stability of the open interest. Metrics like implied volatility also point towards a strong bullish trend taking place and possibly continuing through the following weeks, and even months.

Grayscale’s strategy continues to pay off, as both their holdings and assets-under-management continue increasing as BTC’s price keeps climbing. However, they have not been entirely passive through this positive wave, as the transaction flow has remained positive and increased during this last week, meaning that they continue to purchase the token, though at a much slower pace, to play their part in the climb triggered by institutional involvement.

ETHEREUM - ETH

Similar to BTC, Ethereum also broke the important milestone of $2,000, not only reaching an all-time high of $2,025, but achieving a completely astounding increase of 10 times in less than a year, as the token was trading around $200 by April, 2020. This not only works to solidify the presence of the more accessible token in the market, but also gives an additional boost to all the projects with tokens based on the ERC-20 protocol that trade on the network.

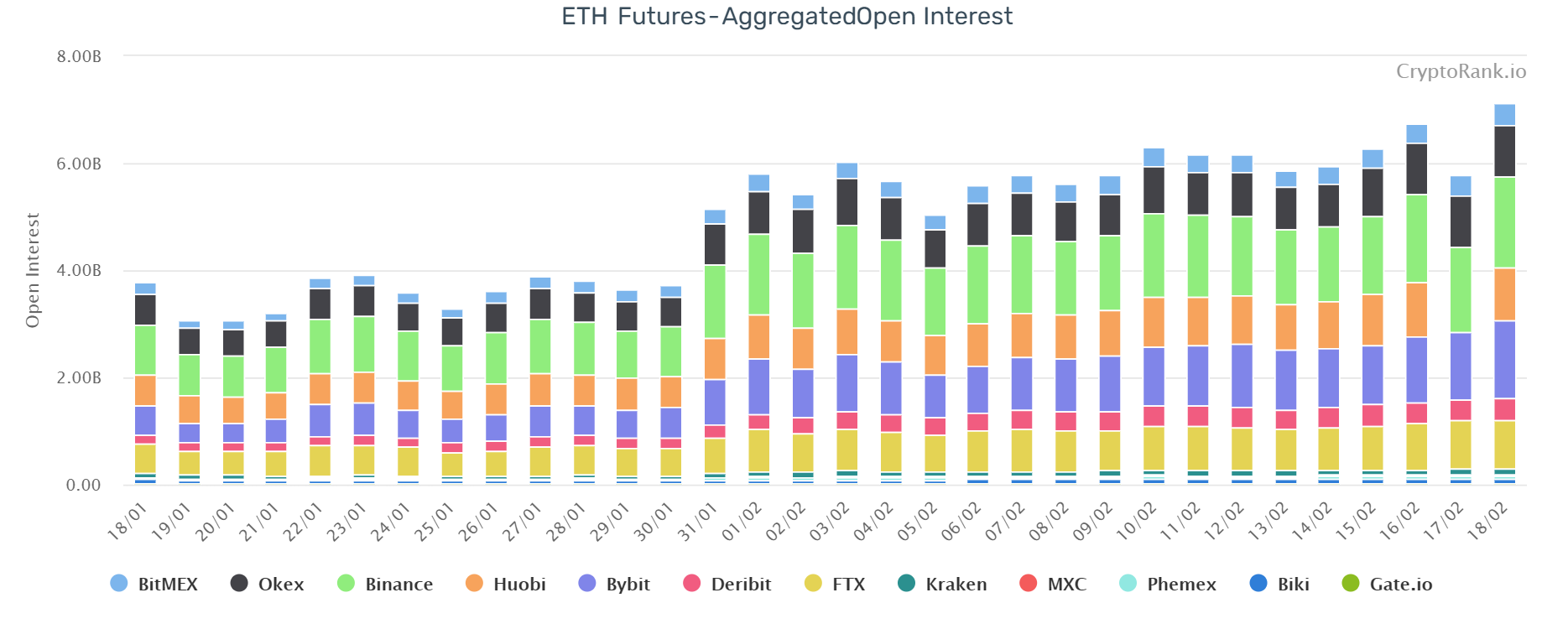

The derivatives market also behaved as expected, with trading volumes peaking twice in a single week and open interest continuing to increase. However, an important outlier to look at is the drop in open interest on February 17th, the day of the week with the largest change in ETH price in 24 hours (over $200, or nearly 12% at the time) which may have triggered the release clauses of a large number of contracts, representing a sizeable fraction of the trading volume and reducing the open interest. More on this can be seen in the DeFi section below.

POLKADOT - DOT

The main competitor for ETH has ride the momentum built by the largest two tokens of the market and has achieved the status of the biggest mover of the week, reaching a market capitalization of nearly $42 billion by climbing over 20% and managed to surpass the $40 line. We will continue to see how the behavior of the market influences the state of DOT in a couple of weeks.

CHAINLINK - LINK

Directly affected by being an ERC-20 token, LINK also continues to climb in value and market capitalization, reaching $36 and climbing constantly but as a slower pace than its “parent” cryptocurrency.

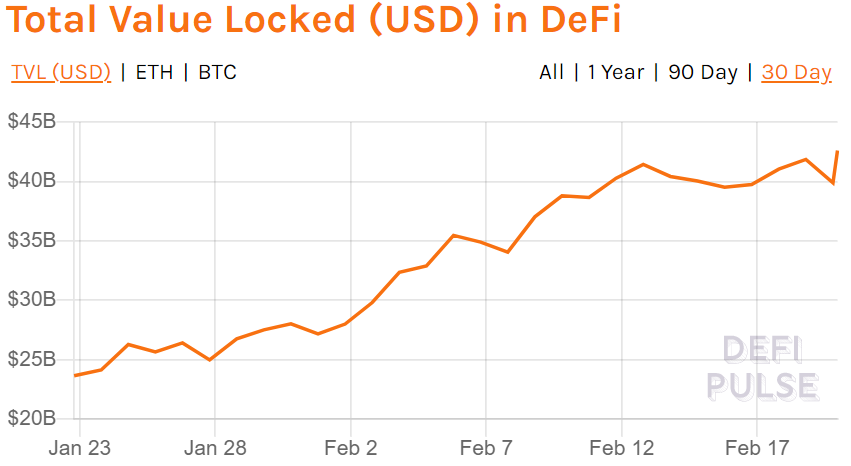

DEFI

As for the DeFi sector, this week did not show any significant changes. After breaking the $40 billion mark, the overall TVL did not break any other significant boundaries, which comes as a surprise seeing how ETH did climb quickly during the week, representing a separation between the behavior of Ethereum and the DeFi sector, or there is the possibility of a significant number of contracts settling after ETH reached $2,000, effectively reducing TVL.

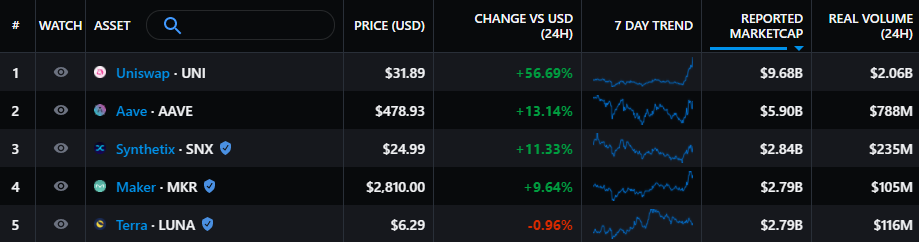

UNISWAP - UNI

Boosted by the recent climb of ETH, UNI broke the $30 line and is now not only the most relevant name in DeFi (in terms of market capitalization), but also one of the best performing tokens of the week, reaching nearly 60% of increase compared to last week.

COMPOUND - COMP

Similar to UNI, COMP dropped heavily at the beginning of the week, but managed to recover gracefully enough to break the $500 mark by not only capitulating on the rise of ETH, but also on the increased interest of users in yield farming through their platform as the supported tokens continue to rise in price.

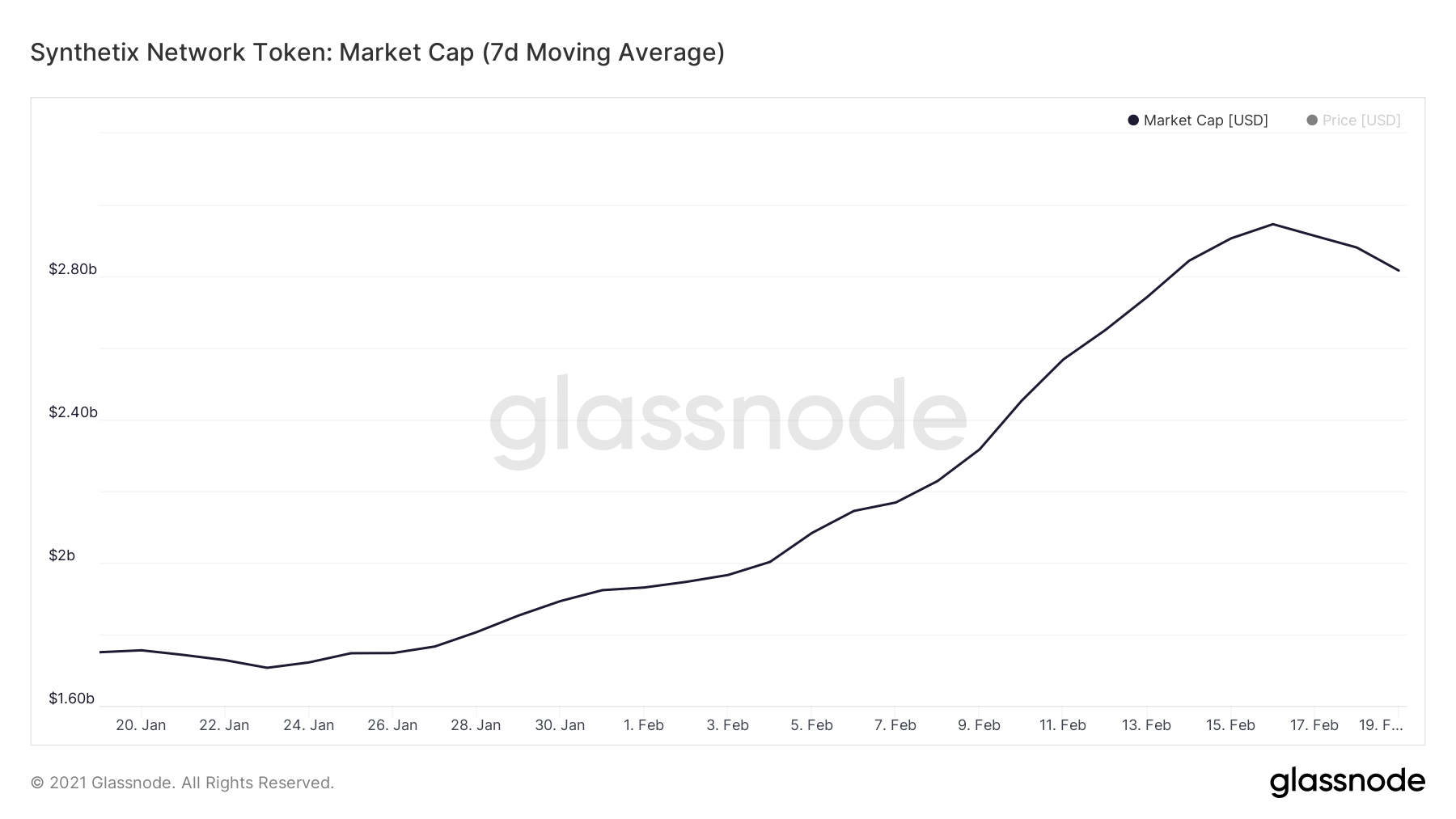

SYNTHETIX - SNX

Again, in a similar manner to other big DeFi tokens, SNX experienced a drop at the beginning of the week, after peaking a couple of hours after its peers. It reached a low point of $21 and it is reaching $24 once again at the time of writing.

LENDING PROTOCOLS

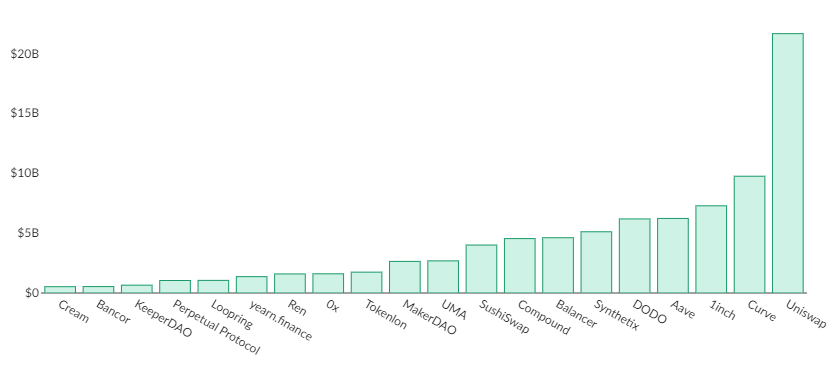

Lending protocols continue to assert the expected dominance over the market, as they continue to hold nearly 60% of the entire market, with AAVE, Maker and Compound continuously dominating the distribution.

BIG MOVERS

STABLECOINS

1 - USDT: $ 0.9996, with a market cap of $ 34.12 B and a trading volume of $ 604.05 M.

2 - USDC: $ 0.9998, with a market cap of $ 7.57 B and a trading volume of $ 278.59 M.

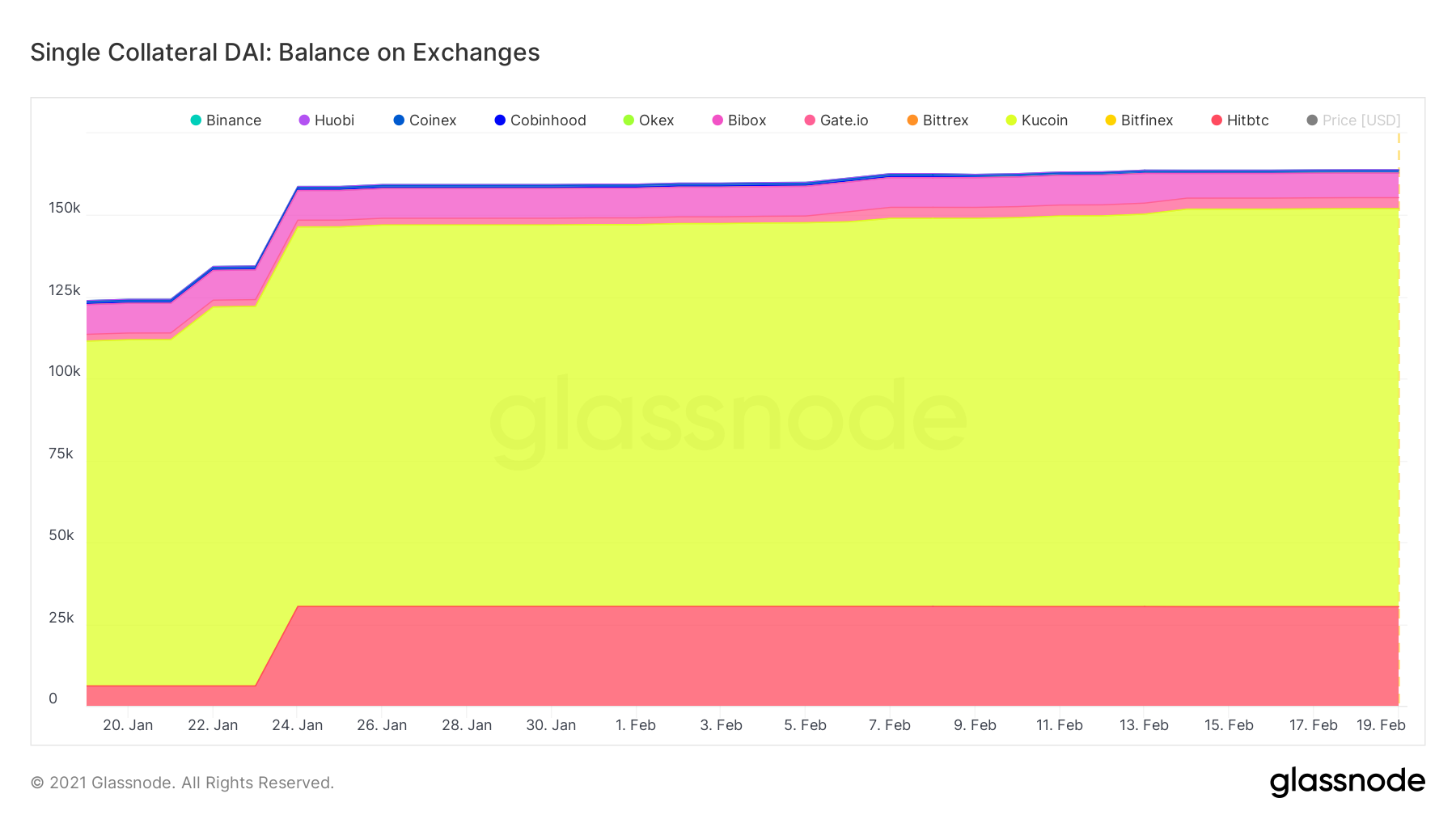

3 - DAI: $ 1.00, with a market cap of $ 2.29 B and a trading volume of $ 24.41 M.