Welcome to a new edition (and version!) of our weekly recap. From this week on, we will focus on relevant news regarding the top cryptocurrency platforms, we will give more detailed information regarding different sectors of the market and continue to display the cryptocurrencies with higher value. We hope you enjoy this new format.

Cryptocurrencies - Market Value

Bitcoin (BTC)

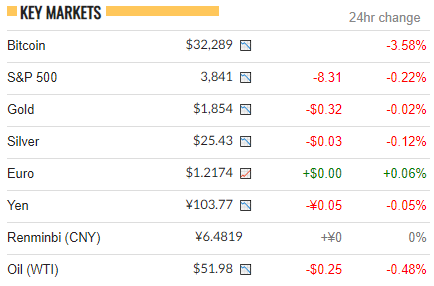

Had a drop from last week of 8.44% at the moment of writing this letter. And a bull trend in the last 24 hours 1.78%.

The interest of institutional investors continues to rise around the globe, specially in the US when groups such as Sky Bridge Capital and its founder Anthony Scaramucci reiterated recent statements from NYDIG CEO Robert Gutmann noting that the high-dollar institutional interest in 'crypto' is exclusively limited to Bitcoin, in his experience. Mr Gutmann explained:

100 out of 100 of the last conversations I’ve had with investors seriously looking to allocate, let's say over 50 million dollars, 100% of those conversations have been about Bitcoin and 0% of them have been about any other crypto asset

Scaramucci added:

We [at] SkyBridge are also focused exclusively on #Bitcoin and feel it will be the big winner. FWIW most institutions we talk to have a similar view.

ETHEREUM (ETH)

During the week, the second largest cryptocurrency token in the world reached an all-time high of nearly $1,440, reaching over 60% in year-to-date increases and widening the gap between in and the following tokens on the list. Some argue that this increase could be the first of the effects of Ethereum 2.0, since Phase 0 of this transition began on December 2020 and Phase 1 is expected to launch during the year.

Market News

BTC

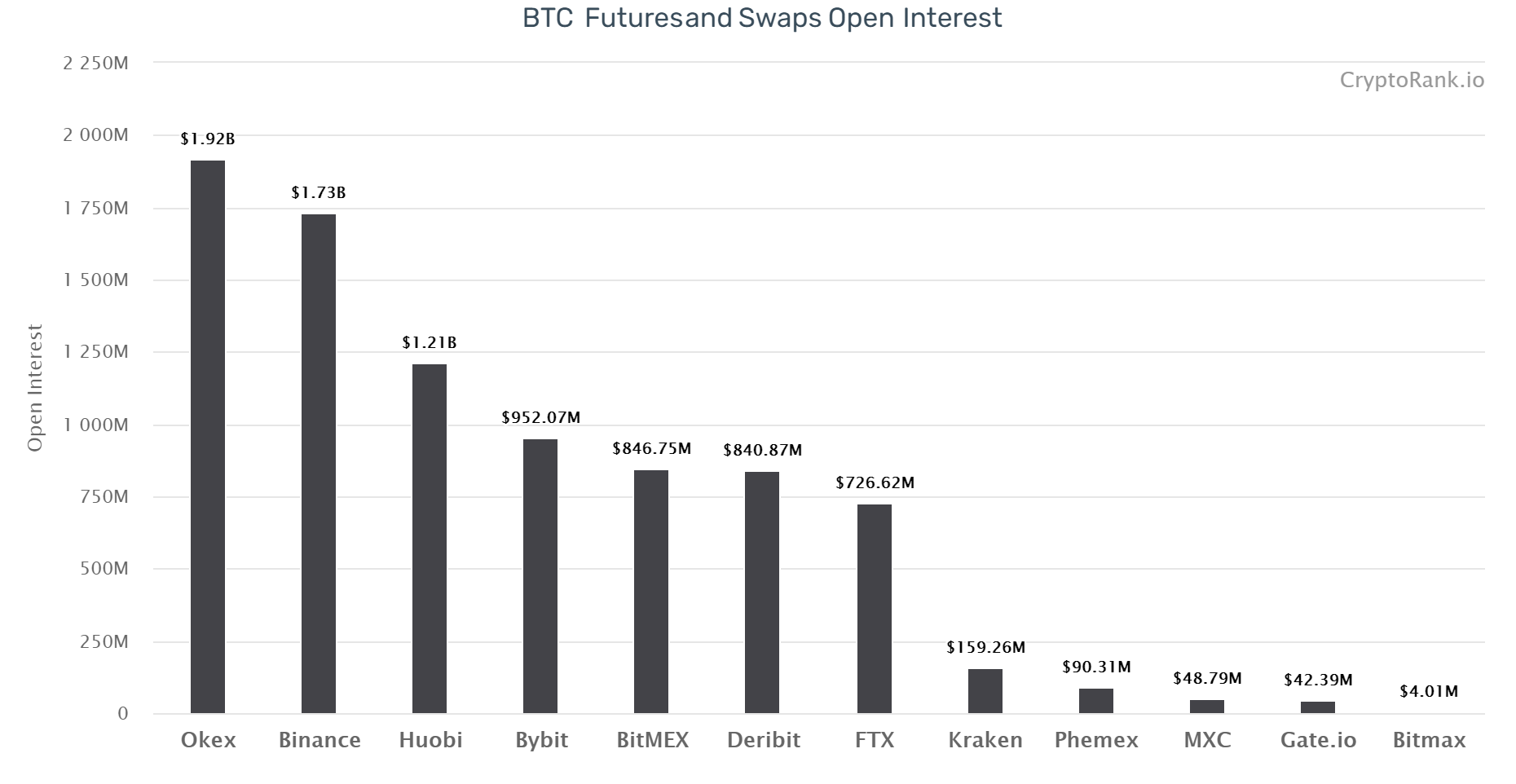

Big news came this week as the CEO of BitMEX, Arthur Hayes, and his Co-Founders were charged for breaking AML measures and could face up to 10 years in prison. The charges come from the office of the U.S. Attorney for the Southern District of New York, on account that the Seychelles-based exchange “has long serviced and solicited business from U.S. traders”, meaning that the U.S. legislation could be enforced, including the Bank Secrecy Act, which is what BitMEX’s higher-ups are charged with violating.

The effects of this news are not yet entirely noticeable on BitMEX’s performance in the futures market, but it is too early to tell whether the platform as a whole will be held accountable or if it will remain as one of the top 5 platforms in the derivatives sector regardless of the outcome of the trial, as it will most likely end up enforcing the implementation of more strict AML measures.

We also saw a filing to the SEC from the U.S.-based investment management company BlackRock, who currently hold over $7 trillion in assets-under-management. By the language used in the filing, it could be assumed that the company is looking to venture into the BTC futures market, but this cannot be considered direct proof just yet, and clarification is needed on whether the futures contract they are interested in are settled in BTC or cash, but it does show that there is also interest from high-level clients like BlackRock in aspects related to cryptocurrency rather than entering the market itself.

A final important piece of data to consider is how the number of private addresses registered in the Bitcoin chain has been in a constant increase, except for the past few weeks when is has been moving downwards, just as the price of BTC started going down after the $40,000 peak. This will be an interesting point of development to follow as prices stabilize, but the rising interest of institutional clients might cause this number to keep decreasing as whales and other big holders keep increasing in number and holdings, as we mentioned last week with Grayscale (BTC holdings in the last three months seen in the graph below)

ETH

Although main interest and focus from institutional investors is Bitcoin (BTC); it is worth mentioning that Ethereum has grown since 1200% since the coronavirus-induced market crash back in 2020 compared to the growth of BTC of around 700%.

Beside the growth of Ethereums competitors such as TRON, Polkadot, Cardano, Cosmo and Tezos, Ethereum remains the leader.

An aspect that could clearly benefit from this future-centered trend is the futures market, as we can see that both trading volumes and open interest have increased in a flat way, instead of the peaks experienced in the past few weeks. If this behavior continues to show for the following weeks, then it would point at a potentially strong trend that could carry ETH past the $2,000 line.

POLKADOT

While cryptocurrency staking is considered a relatively new thing in the industry, an increasing number of institutions and enterprises have been expressing their interest in the service.

Fireblocks, an enterprise-grade platform for moving, storing, and issuing digital assets, said that the significant demand from customers pushed them to introduce the service to its platform.

In a press release published on Jan. 14, the platform announced the launch of hosted proof-of-stake (PoS) services for Polkadot (DOT), Tezos (XTZ), and Ethereum 2.0 (ETH). To enable staking to their 165 enterprise and institutional clients, the platform partnered with infrastructure providers Staked and Blockdaemon.

DeFi

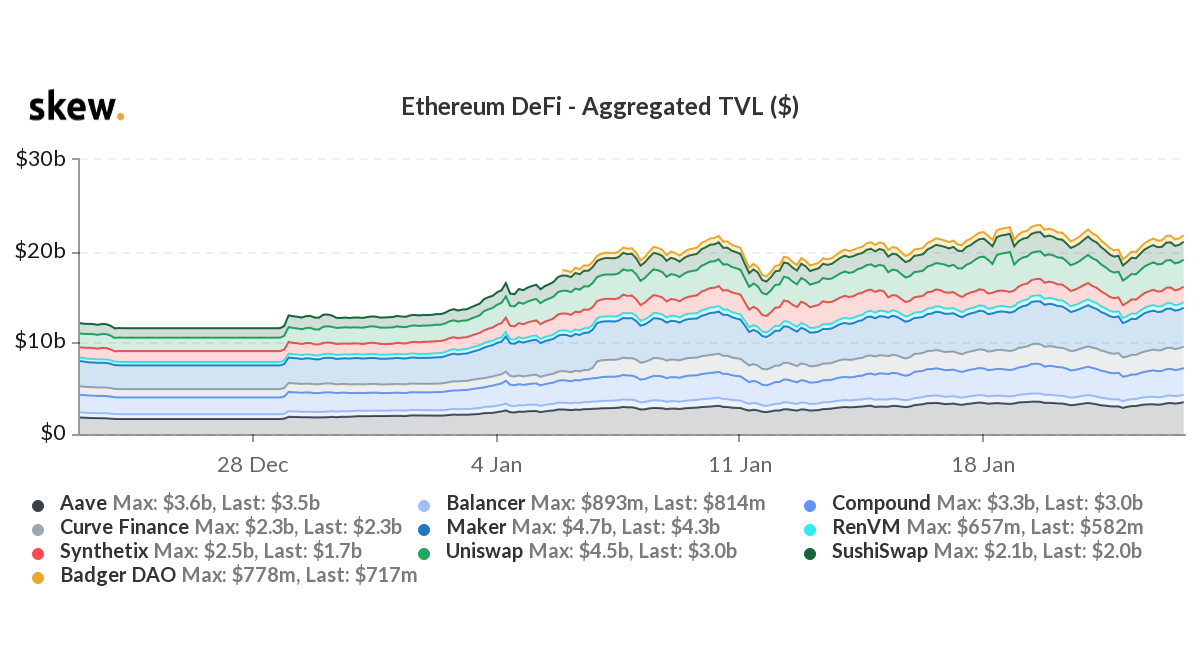

The increase in ETH also caused an increase in the Total Value Locked in the entire Decentralized Finance sector. A new all-time high was reached at over $25 billion, with the metric currently swinging around the $24 billion line.

UNISWAP

Uniswap (CURRENCY:UNI) traded 17.7% higher against the dollar during the 24 hour period ending at 14:00 PM ET on January 24th. One Uniswap token can currently be purchased for $11.09 or 0.00035476 BTC on exchanges. Uniswap has a total market cap of $3.18 billion and $3.25 billion worth of Uniswap was traded on exchanges in the last day. During the last seven days, Uniswap has traded up 24.2% against the dollar.

CHAINLINK

Chainlink's decentralized oracle network provides reliable, tamper-proof inputs and outputs for complex smart contracts on any blockchain.

ChainLink hit an all-time high this weekend. Chainlink (LINK/USD) appears to have stalled its corrective pullback from the record highs of $25.51 reached Saturday, as the bulls regain control after taking a brief breather early Sunday.

The seventh most traded cryptocurrency enjoys a market cap of $9.857 billion, having risen almost 25% over the past seven days

As expected, the distribution in the platforms has not experienced any drastic changes in the last months, with the only noticeable change being Synthetix’s slight decrease in TVL and the appearance of Badger DAO in the early days of the year. However, it will become important to see how the market reacts to the movements in ETH and the ongoing implementation of Ethereum 2.0

Top 10 - Best Performing

Top 5 Stablecoins - Market Capitalization

1 - USDT: $ 1.00, with a market cap of $ 24.81 B and a trading volume of $ 347.71 M.

2 - USDC: $ 1.00, with a market cap of $ 5.52 B and a trading volume of $ 116.92 M.

3 - DAI: $ 1.00, with a market cap of $ 1.43 B and a trading volume of $ 12.84 M.

4 - BUSD: $ 1.00, with a market cap of $ 1.19 B and a trading volume of $ 195.92 M.

5 - TUSD: $ 1.00, with a market cap of $ 413.72 M and a trading volume of $ 14.42 M.