Welcome to a new edition. This time we take on part II on what`s been happening in the Bitcoin space the last 2 weeks.

Remember to subscribe to our Deep Tech newsletter here (https://www.mobileyourlife.com/) which we send on a weekly basis to our Investors & Audience, reviewing the trends and technologies we are working on our portfolio.

Here we go.

Last recap we published on Bitcoin markets and on-chain anaylisis, which you can check here. We covered not only the swings and movements on the price but also the correlation of Bitcoin and the Metcalfe Law, movement on the Crypto whales wallets , the bitcoin mean hash rate, Grayscale Premium and its recent rise of competitors such as the Bitcoin Fund (QBTC premium) and Purpose Bitcoin ETF.

We wanted to continue our report this time with the recent drop Bitcoin had on the last few days and the impact on the institutional updates specially with Elon Musk and his recent statements.

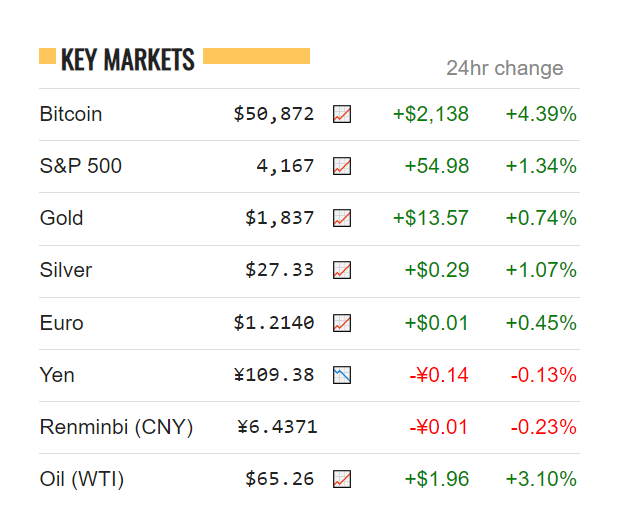

From reaching an ATH on May 10 of 59,325 USD per Bitcoin to falling to a price of 48,011 USD on May 13th. Currently trading at 50,820 USD per Bitcoin at the moment of this press release. The decrease on Bitcoin comes after the recent comments from Elon Musk when suspending any purchase of vehicles using the digital asset.

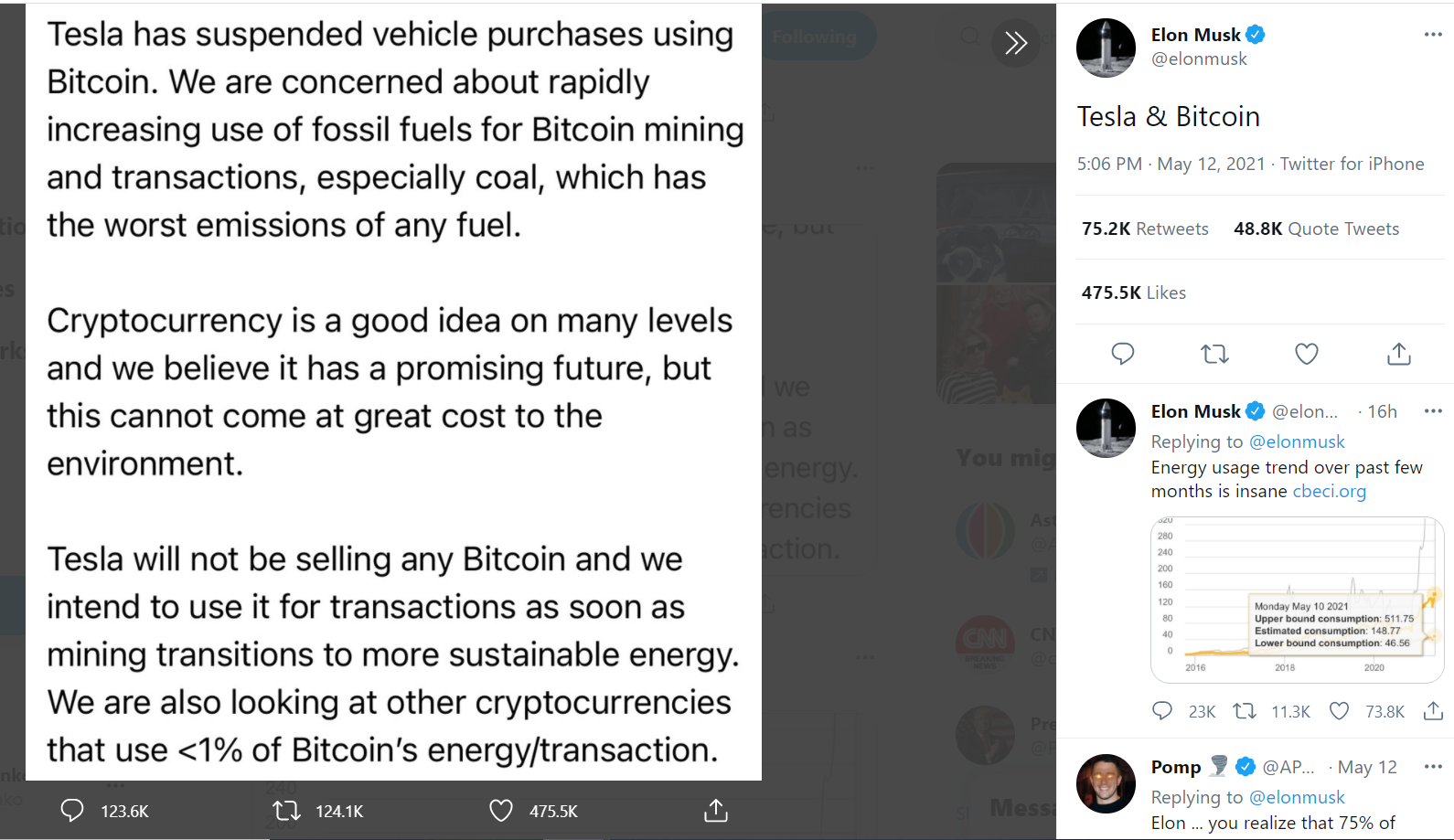

Elon Musk CEO, early stage investor and product architect of Tesla Inc. Announced on May 12th that Tesla suspended vehicle purchases using Bitcoin. The updates comes as the concern from Elon Musk on the use of fossil fuels for Bitcoin mining and transactions.

He clarified on his twitter account that believes in Cryptocurrencies and that are good idea in many levels but that it can not come at great cost to the environment. It is good to note that Tesla has not sold any Bitcoin(BTC) they have in their balance sheet and will intend to use it for transactions as soon as mining transitions to more sustainable energy.

It is worth noting a few metrics on the Bitcoin Network we always touch base. Such as the Bitcoin hash rate, the net inflow of Exchanges and SOPR metric. The Bitcoin mean hash rate has been recovering since the blackout in china and the collapse on the network. It went from a low point of 106 EH/s to recovering to a level of 185 EH/s per second. On the other hand we notice an inverse trend on the net inflow volume from /to exchanges and the Bitcoin Price.

Comparison (BTC price vs Net Inflow from/to Exchanges vs Hash Rate vs SOPR).

You can see in the first two weeks of May, when BTC price was around 56K USD it was a negative inflow on exchanges of -6,094 BTC following up in one day to a positive net inflow volume from/to exchanges of 27,000 BTC which was completely inversed as while the inflows to exchanges were increasing, the Bitcoin price went down from 56,714 USD to 49,729 USD per Bitcoin.

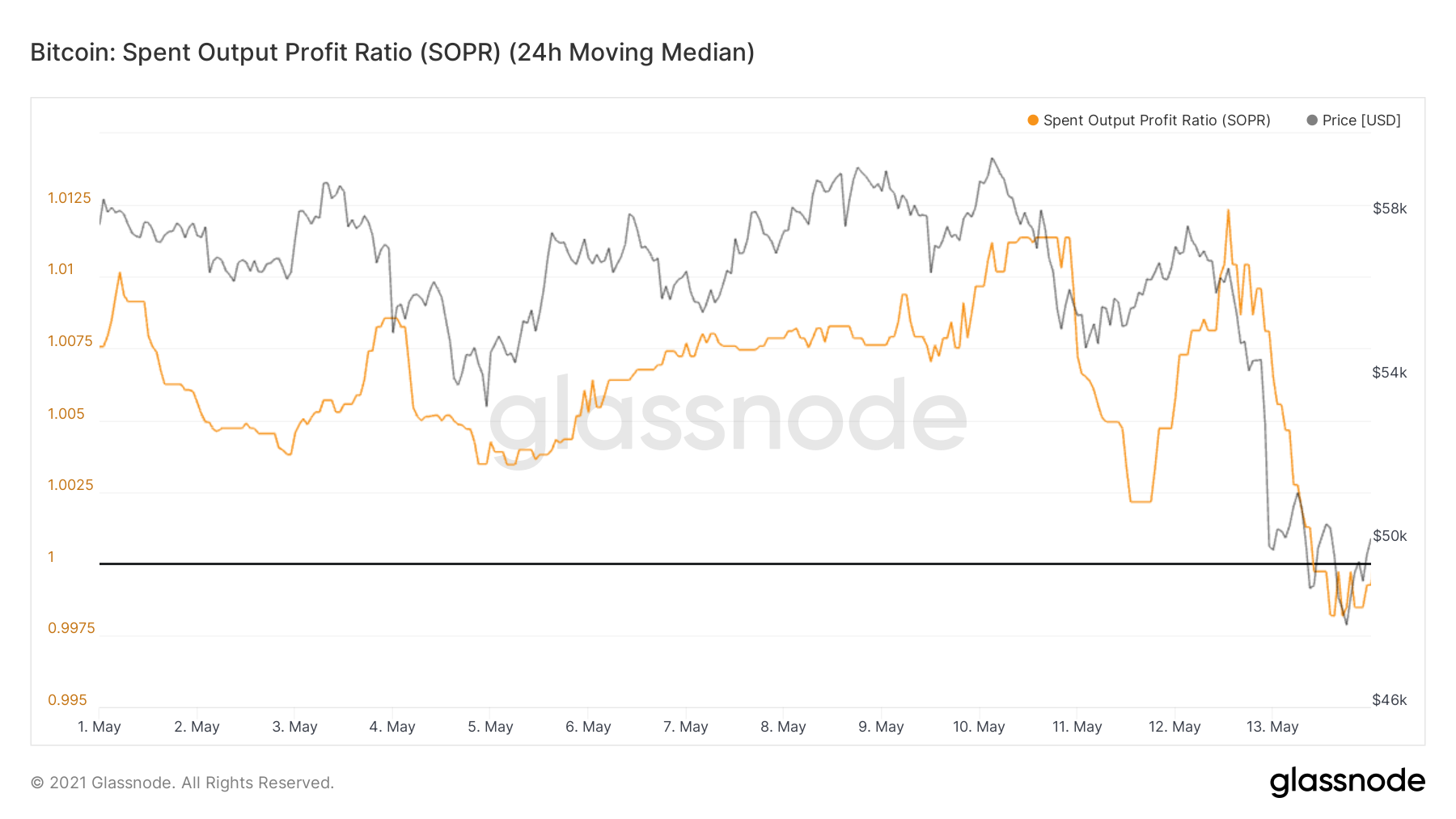

With the recent decrease on the Bitcoin price we can notice as well that the spent Output Ratio is also below 1 since may 13th. Meaning that the owners of the spent outputs are in loss at the time of the transaction. Remember that Bitcoin: Spent Output Profit Ratio (SOPR) It’s calculated from spent outputs. It’s the realized value (USD) divided by the value at creation (USD) of the output. Or simply: price sold / price paid.

Decrease of Bitcoin Balance on the Exchanges

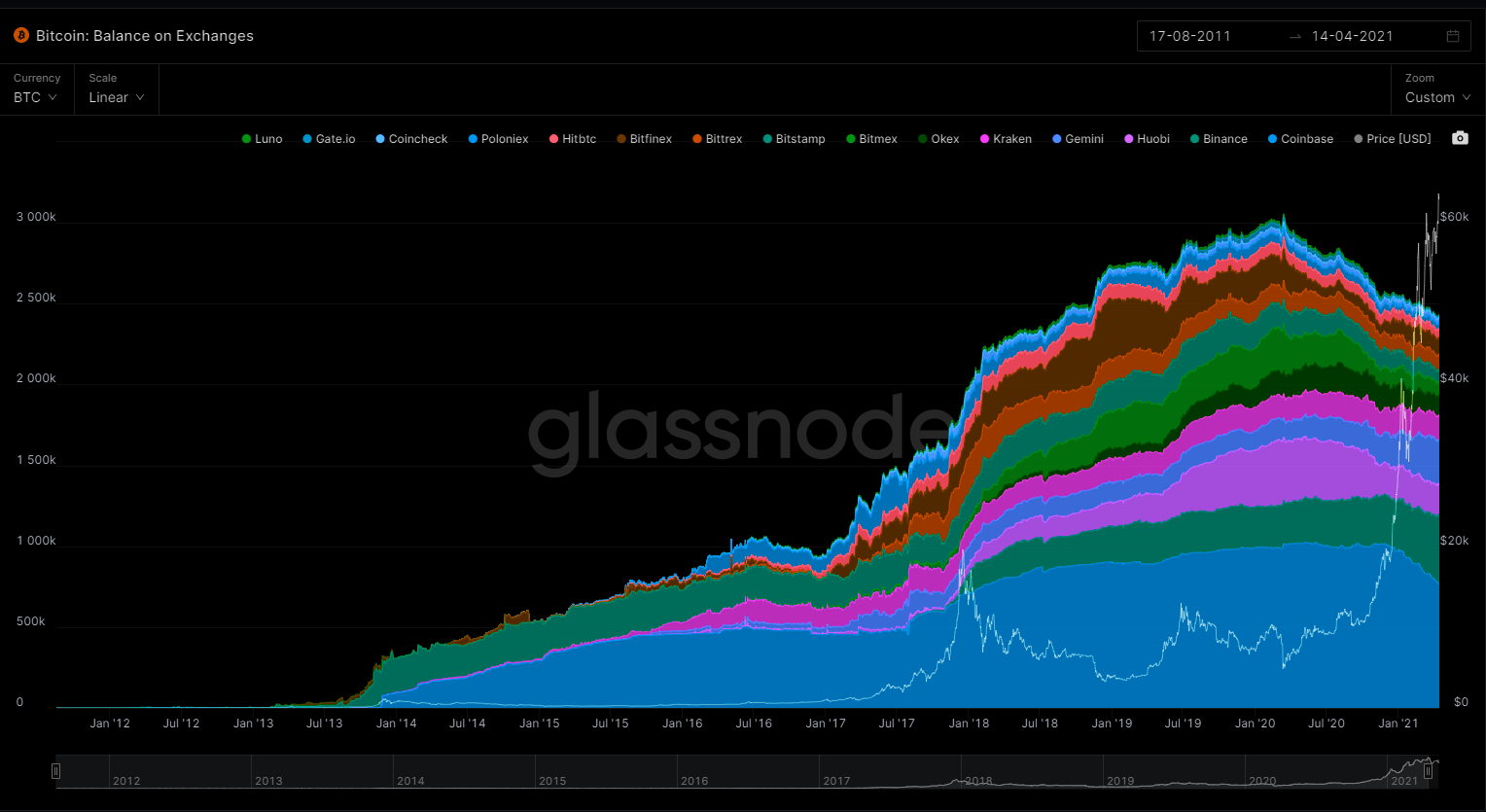

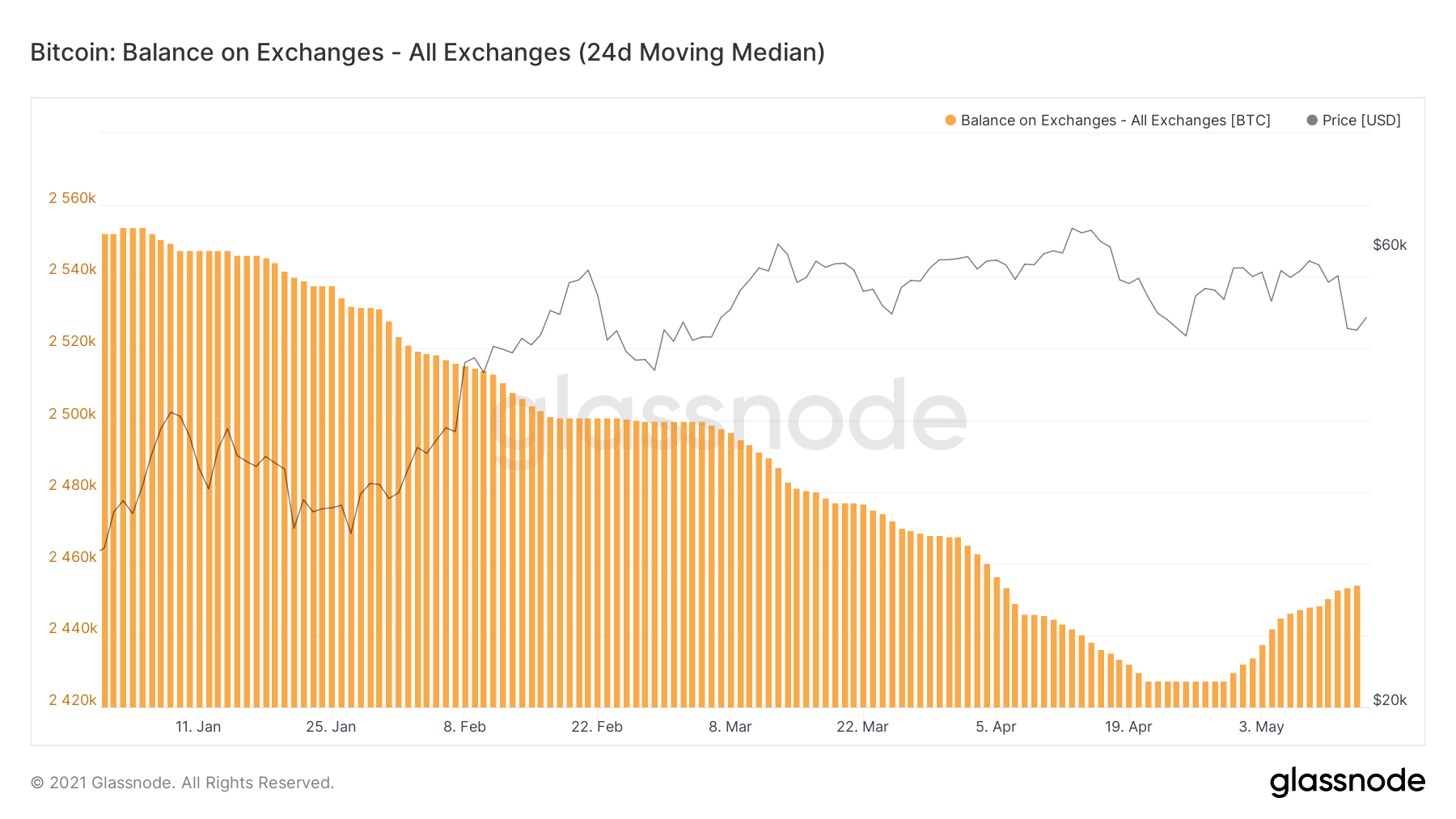

Despite the ATH of Bitcoin the last year. We have seen a decrease of Bitcoin on the Crypto-Exchanges from 2020. The dynamic of decreasing BTC exchange balances gives credence to the notion that investors are less interested in actively trading BTC but would rather custody the asset themselves for extended durations.

The dynamic, however, is also likely supported by the proliferation of self-managed wallet solutions, such as Ledger’s hardware wallets, that have made custodying BTC more accessible to a wider range of investors. With almost every BTC investor up, holders are, nonetheless, continuing to defer profit-taking. We would argue that the dynamic underscores the buy-and-hold nature of the current rally.

During 2021 we can see the balance decreasing from 2, 554, 045 millions of BTC held in Crypto-Exchanges to a low of 2,427,541 millions of BTC on April 25th. Having a short increase to up to 2,454,000 mm BTC.

Bitcoin Futures.

Exchange operator CME Group Inc said on Tuesday more than 100,000 micro bitcoin futures were traded in the first six days after the contract's launch.

Micro Bitcoin futures will be one-tenth the size of one bitcoin. The smaller-sized contract will provide market participants – from institutions to sophisticated, active, individual traders – with one more tool to hedge their spot bitcoin price risk or execute bitcoin trading strategies in an efficient, cost-effective way, all while retaining the features and benefits of CME Group's standard Bitcoin futures. In 2021-to-date, 13,800 CME Bitcoin futures contracts (equivalent to about 69,000 bitcoin) have traded on average each day.

Currently on Binance there is almost 4BN USD of open interest or net value of all open positions.

Druckenmiller Sees End to USD Reserve Status, 'Crypto' as Solution

Legendary macro investor, Stanley Druckenmiller, followed up a WSJ opinion piece titled "The Fed is Playing with Fire" with a CNBC interview in which he lays out the ramifications for the dollar given the Fed's QE persistence. He said that the dollar is "more likely than not" to lose its reserve currency status in the next 15 years, and calls out "crypto" as the replacement (note that Druckenmiller holds bitcoin)

Regarding crypto, he said:

5 or 6 years ago, I said that crypto was a solution in search of a problem. And that's why I didn't play crypto the first wave. We already had the dollar, what did we need crypto for? Well the problem has been clearly identified. It's Jerome Powell and the rest of the world's central bankers. There's a lack of trust. So sort of groping for an answer, for a central case, a best guess; and it's hard to make a forecast 3 months from now, much less 15 years from now, I think the most likely replacement would be some kind of ledger system invented by some kids from MIT or Stanford or some other engineering school, that hasn't even happened yet, that can replace the dollar world wide. I don't know what that will be. I just know that if the Fed is forced to monetize the debt.

Bitcoin Puell Multiple

This metric looks at the supply side of Bitcoin’s economy – bitcoin miners and their revenue

It explores market cycles from a mining revenue perspective. Bitcoin miners are sometimes referred to as compulsory sellers due to their need to cover fixed costs of mining hardware in a market where price is extremely volatile. The revenue they generate can therefore influence price over time.

The Puell Multiple is calculated by dividing the daily issuance value of bitcoins (in USD) by the 365-day moving average of daily issuance value.

There are periods of time where the value of bitcoins being mined and entering the ecosystem is too great or too little relative to historical norms.

Understanding these periods of time can be beneficial to the strategic Bitcoin investor.

The chart below highlights periods where the value of Bitcoin's issued on a daily basis has historically been extremely low (Puell Multiple entering green box), which produced outsized returns for Bitcoin investors who bought Bitcoin here. It also shows periods where the daily issuance value was extremely high (Puell Multiple entering red box), providing advantageous profit-taking for Bitcoin investors who sold here.

We can notice that December 2017-January 2018 were periods that Bitcoin investors that sold were in the red box making huge profits as so the same Bitcoin Investors (buyers) who bouth during Crypto-Winter in January 2019 or during pandemic in 2020 were acquiring Bitcoin on an extremely low daily issuance. (green box). The indicator (Puell Multiple) currently on May 2021 is at 2.10.

That`s all for today folks.

Thank you for reading our Bitcoin weekly recap. Stay tuned as we will be publishing more newsletters on the following markets from Bitcoin, Ethereum - DeFi and Stablecoins.