Welcome to a new edition of the Bitcoin recap. Where we analyze the core stats and metrics on the Bitcoin Markets.

Remember to subscribe to our Deep Tech newsletter here (https://www.mobileyourlife.com/) which we send on a weekly basis to our Investors & Audience, reviewing the trends and technologies we are working on our portfolio.

BITCOIN (BTC)

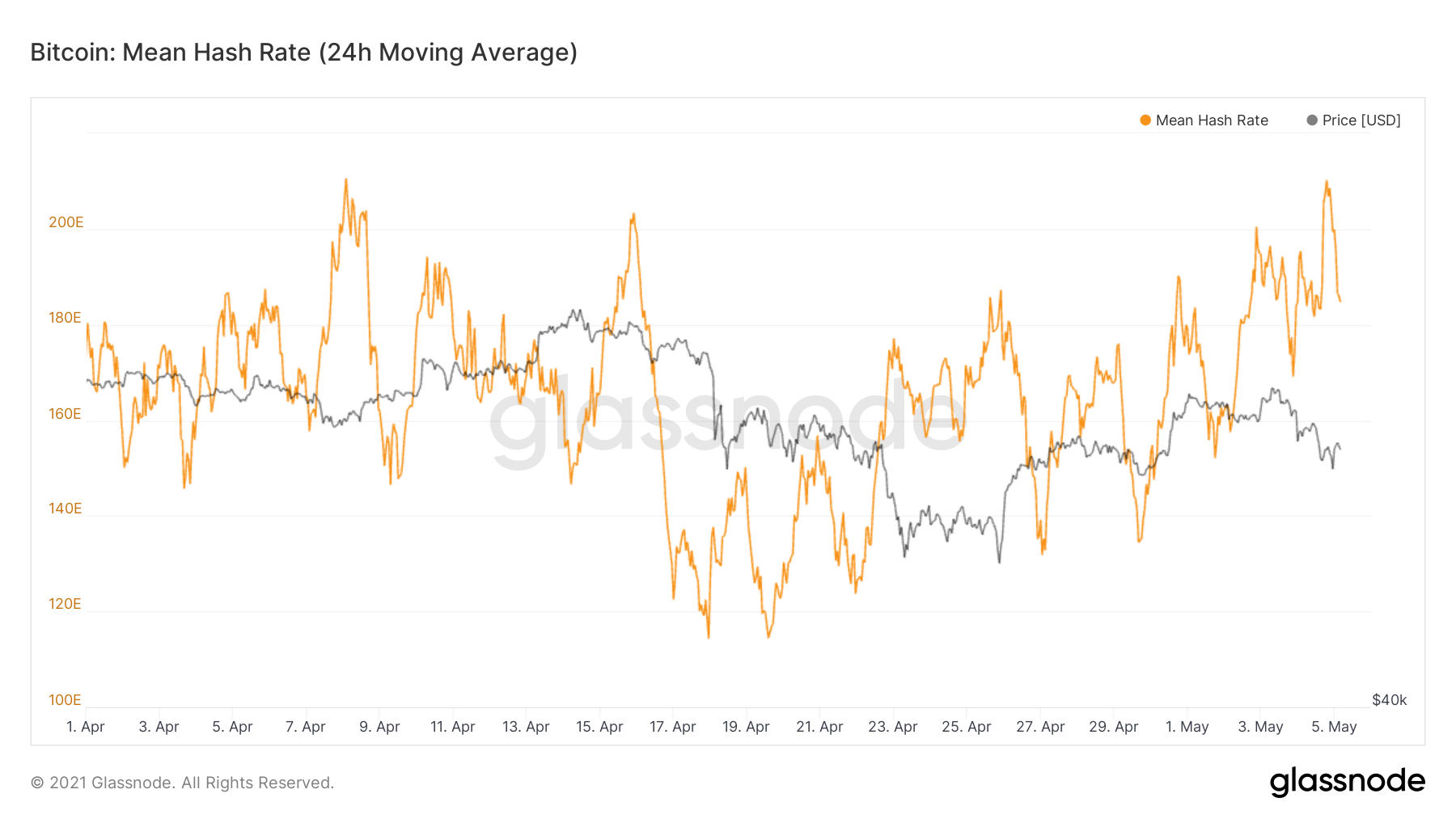

From our last report we covered how the Bitcoin network due to the blackout in China primarily got affected in its network and the hash rate dropped significantly following it with the price as well. If you want to read our previous post where we go in detail on the event happened with the Bitcoin Network and the technical on-chain analysis please read it here.

What we can notice is that after the collapse on the network in mid April, the Bitcoin network started recovering coming from a low of 114 EH/s hashes per second to 153 EH/S hashes per second by April 30th and currently this first week of May reached an ATH of 210 EH/s hashes per second.

During the second half of the month, although the Bitcoin network has been recovering quite fast from its attack. Bitcoin prices went down as low as 47,296 USD on April 23rd and 47,579 USD on April 25th. From that point Bitcoin started a bull run to recover, reaching highs of 55,508 USD on April 28 and 57,122 USD on April 30th.

CRYPTO WHALES

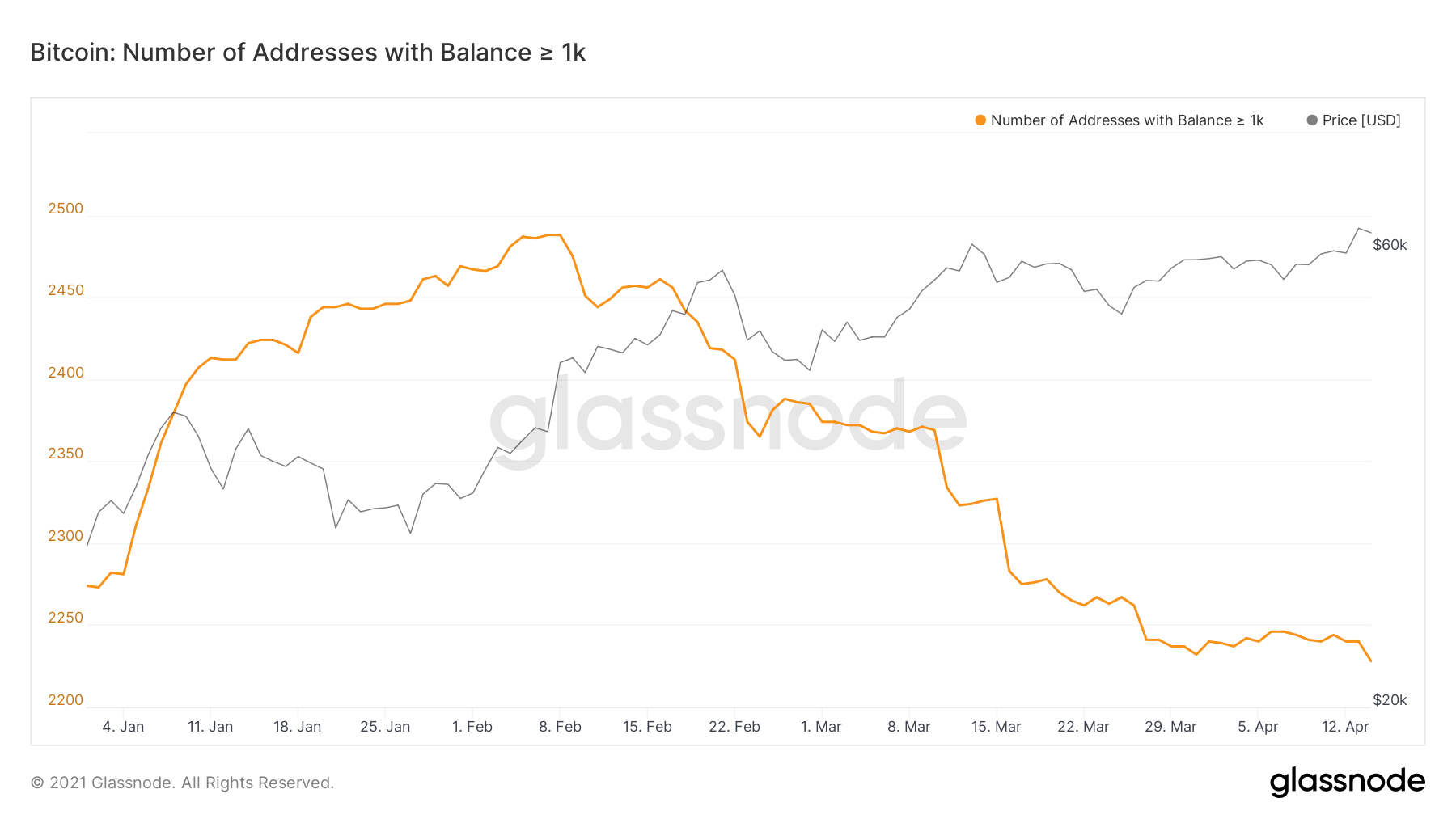

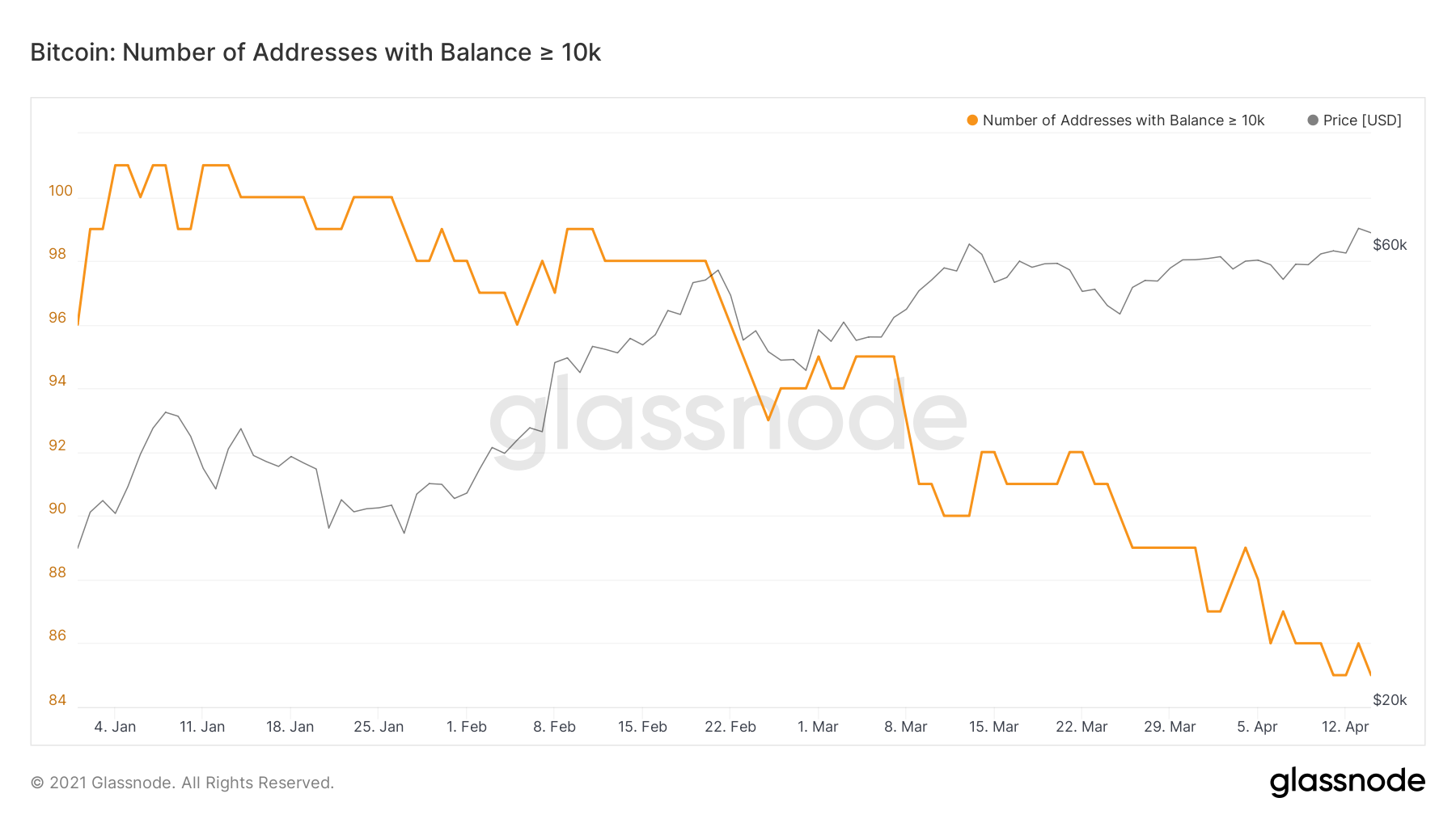

It is worth noting that Crypto whales and major investors, with Bitcoin balance higher of 1K BTC and of 10K BTC respectively; have been declining since February 2021. From 2,488 wallets ≥ 1K coins at the beggining of February down to almost 2,228 number of addresses on the 30th of April.

The same pattern is happening with addresses higher or equal to 10K Bitcoin, which dropped in mid February. From a total of 98 addresses ≥ 10K coins with a price of 56,134.54 USD by February 20th to 86 addresses on April 30th. Currently trading at a price of 54,843 USD per coin at the time of press release. The reason we mentioned this is that the movement on whales have been decreasing dramatically despite the bullish market we have had the last year.

From the last halving event in 2020, to the entrance of institutional investors and companies such as Microstrategy and Tesla buying billions of USD in Bitcoin, we have seen in the last few months corrections in the market starting from February 2021, since the decrease on the number of wallets with amounts higher of 1K and 10K coins.

According to crypto capital advisor Timothy Peterson, there has been the largest reduction in BTC wallets of that size or greater in history. He claimed back in March that the reduction is the largest historically across a 40-day period, beating even the 2014 and 2018 bear markets in “both absolute and percentage terms.”

Metcalfe Law in Bitcoin.

The movement on Crypto whales (users with the highest amount of Bitcoin currently) will take us to Metcalfe Law.

According to the research of Timothy Peterson on Metcalfe Law and using Bitcoin as an example. It provides convincing empirical evidence that bitcoin’s price formation is not a noisy result of emotional investing but instead is founded on economic principles of value that have only recently begun to be recognized: network economics.

There is compelling evidence that suggests that the growth and price of bitcoin and other cryptocurrencies are likely to proceed according to a relatively straightforward mathematical model similar to the growth curves of Facebook and other networks. So the long-term growth rate in users has considerable effect on the long-term price of bitcoin.

The internet is an ideal tutorial for network economics instruction. It is apt for comparison to Bitcoin because Bitcoin relies on internet connectivity to function. Both have had varying degrees of acceptance by among various countries, yet both grew in acceptance over time (Exhibit 1).

To date, the typical approach to cryptocurrency valuation has been via Metcalfe’s law. Commonly expressed in shorthand as n2 , it is the approximate value of P when n is large. We show that price is a function of n users, as Metcalfe’s law states.

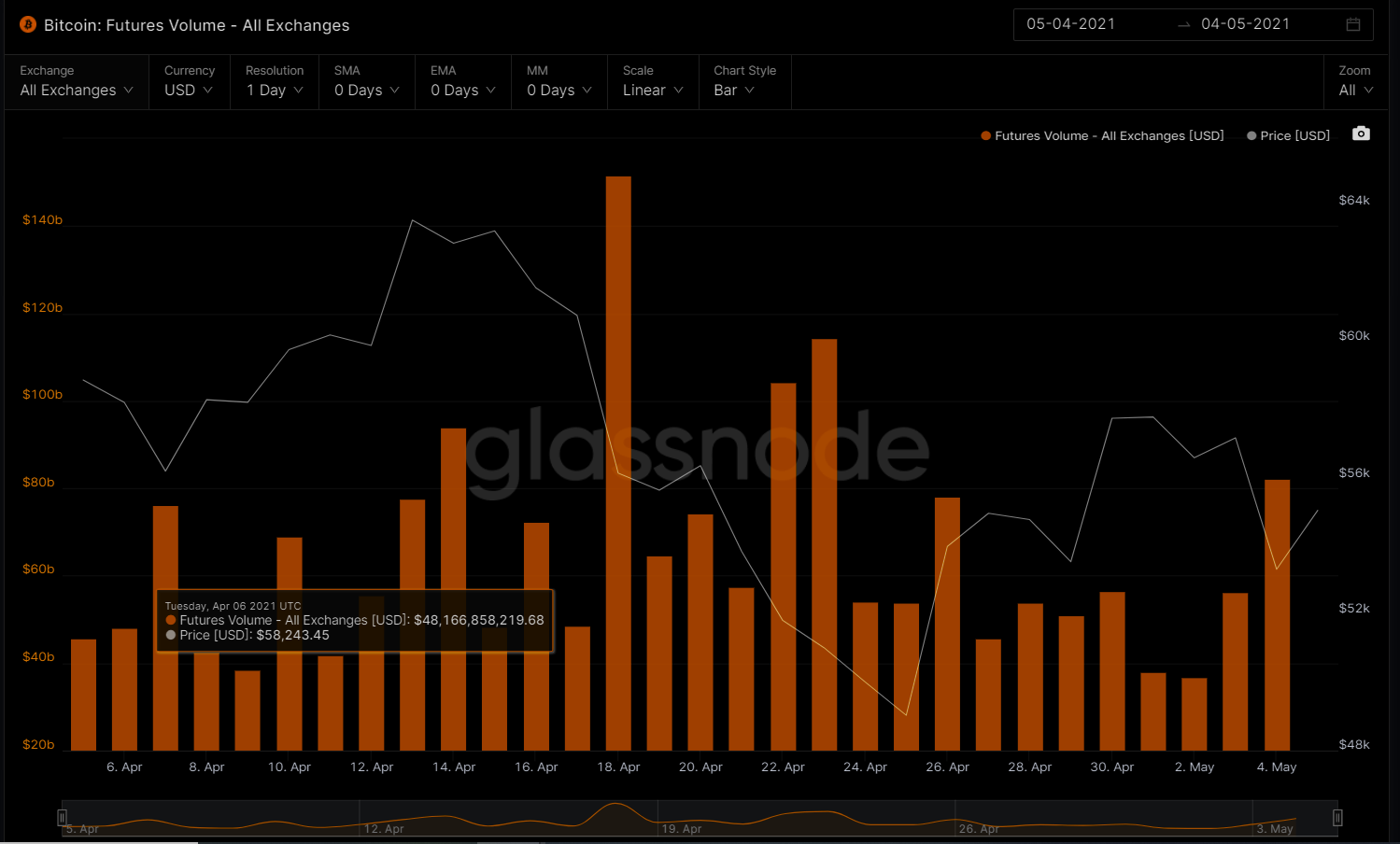

BTC FUTURES

Current future open interest on Bitcoin is above 3.50 BN USD on Binance followed by exchanges such as Okex, Huobi, FTX and CME with open interest ranging from 2.00 to 2.50 BN USD.

As bitcoin gradually matures and the ecosystem surrounding it expands further, the original cryptocurrency is increasingly behaving like a commodity.

Thanks to a robust futures market that continues to grow, derivatives contracts on bitcoin also gain popularity and meaningfully impact its pricing structure. This has resulted in a unique development that has unfolded over the last several months.

Future volumes reached an ATH on April 18th with an amount surpassing the 151 BN USD to then decrease by the end of the month to an amount close to 56 BN USD

Known as “contango,” bitcoin futures contracts to be settled months down the road are trading at a significant premium to spot prices. This delivers a serious arbitrage opportunity that could temporarily result in relatively high returns with minimal risk.

Contango has already defined bitcoin pricing for a considerable period and could continue, but how long remains the chief question on traders’ minds. The reasons attributed to this pricing differential are numerous, but it’s hard to pin down one exact catalyst given the decentralized nature of cryptocurrency and lack of data.

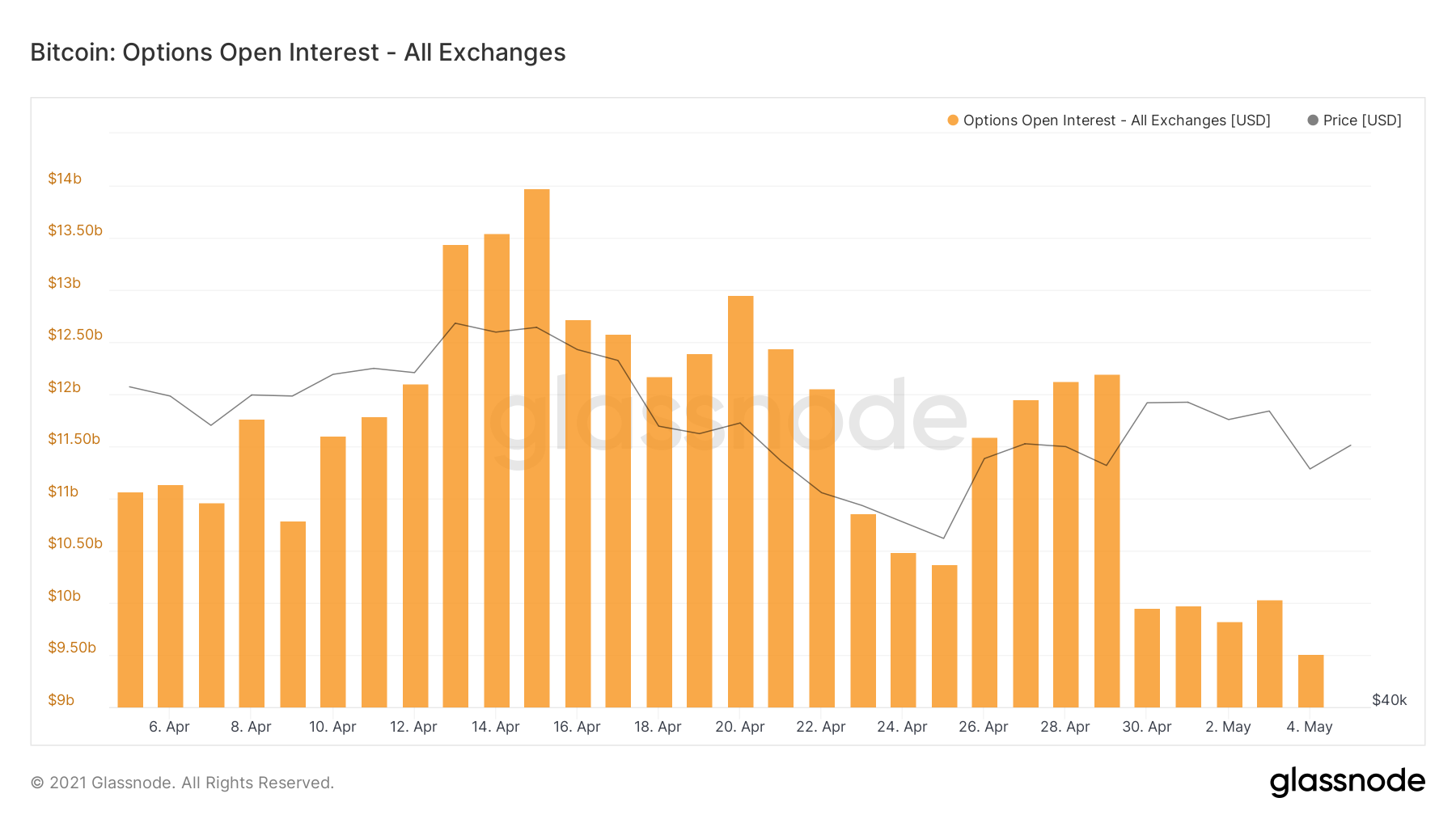

BTC OPTIONS

Bitcoin options contracts—which give traders a chance (but not the obligation) to buy BTC at a set price, can typically be traded up until the last Friday of each month. They offer different price levels at which traders can pull the trigger and buy the asset.

In February, when $3.3 billion in options contracts were due to expire, Bequant head of research Denis Vinokourov told Decrypt, “Options flows are not yet at the size where they can move the market.” In Vinokourov’s estimation, there was more BTC HODLing than buying and selling at that point, meaning the trading would have a neutral effect on prices.

Lunde says that trend is continuing, especially after the mid-April crash, when the price of Bitcoin fell from a high above $63,000 down to $49,000 in 10 days. “In general, there seems to be more holding right now, than earlier in April,” he said.

Some market participants and analysts have pointed to the recent accumulation by corporations, including Tesla, Microstrategy, and Grayscale Bitcoin Trust demand as one factor behind a shortage that has helped push prices higher. If accompanied by miners “hodling” bitcoin in the hopes of further price increases due to the lower mining rewards precipitated by the halving, it could also result in a significant supply shortage.

Grayscale Premium & Institutional Investors

Grasycale Bitcoin Trust (GBTC) which is trading at a negative premium the last 2 months, hits a record low of -18.92%.

That means the market price of GBTC shares is about 19% lower than its net asset value or NAV. A negative premium means the investor expects nothing in return for investing in that product.

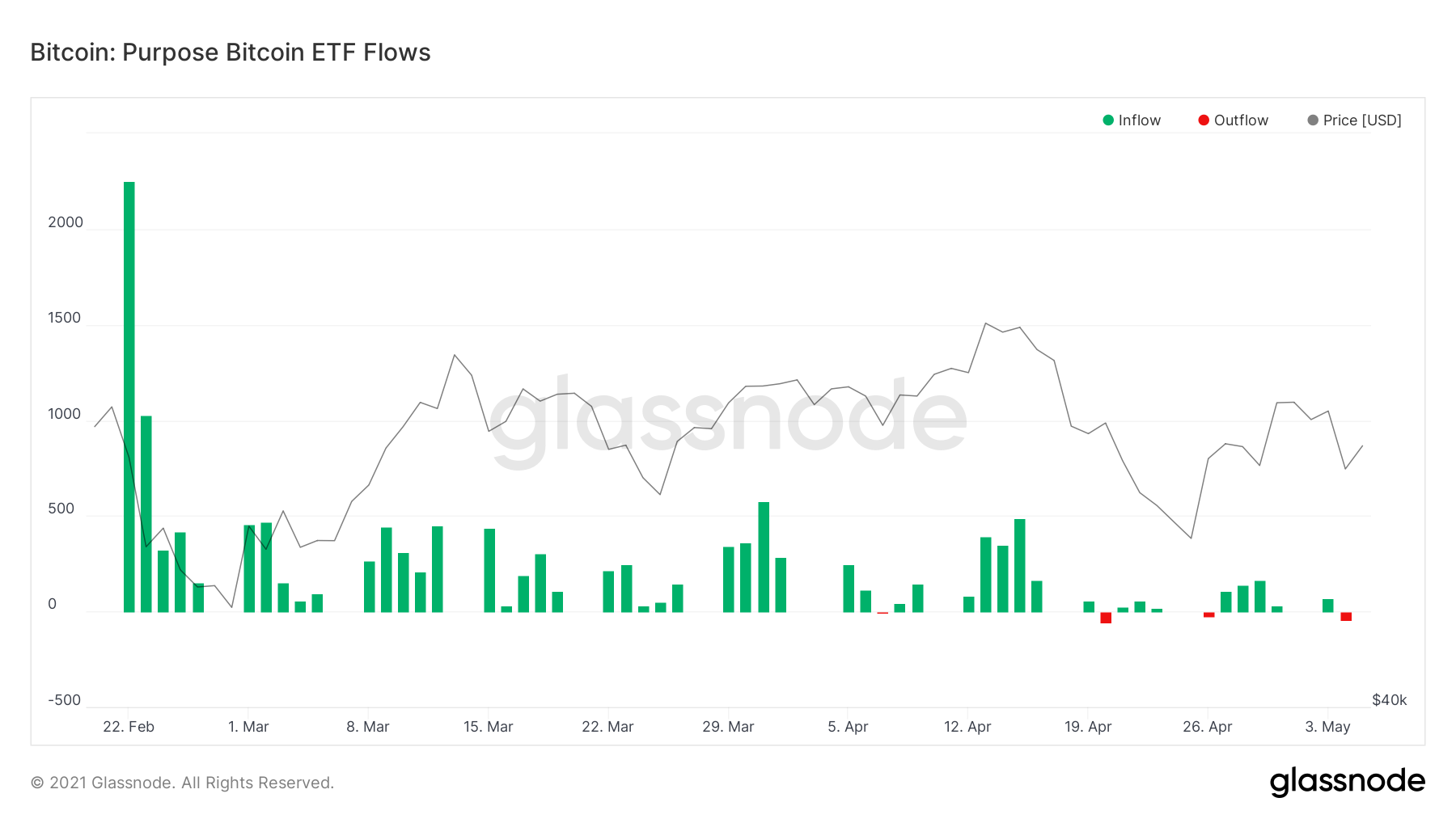

Arcane Research pointed the emergence of alternative instruments like launch of Bitcoin ETF’s, and the purchase of the BTC directly by individual companies as reasons for the discount.

Recently, the Canadian regulator approved a exchange-traded fund (ETF) based on the BTC available to investors in US dollars. A similar instrument was also listed in Brazil.

In the spring of 2021, the U.S. Securities and Exchange Commission (SEC) began reviewing two applications to launch ETFs from WisdomTree and VanEck.

Grayscale plans to convert GBTC into an exchange-traded fund (ETF). Which could potentially be according to market experts the best alternative for Grayscale.

QBTC - The Bitcoin Fund

The Bitcoin Fund is a closed-end fund incorporated in Canada. The fund seeks exposure to digital currency bitcoin and the opportunity for long-term capital appreciation.

The Fund will invest in long-term holdings of bitcoin to provide investors with a convenient alternative to a direct investment in bitcoin. The Fund will not speculate with regard to short-term changes in bitcoin prices.

Within the month of April had a low of -4% in its premium.

That`s all for today folks.

Thank you for reading our Bitcoin weekly recap. Stay tuned as we will be publishing more newsletters on the following markets from Bitcoin, Ethereum - DeFi and Stablecoins.