Welcome to a new edition of the Bitcoin recap. Where we analyze the core stats and metrics on the Bitcoin Markets. We also touch base and cover the Institutional news.

Remember to subscribe to our Deep Tech newsletter here (https://www.mobileyourlife.com/) which we send on a weekly basis to our Investors & Audience, reviewing the trends and technologies we are working on our portfolio.

BITCOIN (BTC)

Bitcoin the last two weeks has been consolidating between 53K USD and 61K USD price per coin.

Having had a resistance levet at around USD 53,969 on March 16th, it continued to fluctuacte on that range up to USD 59,425 per Bitcoin on March 18th. From that date it begun a bearish trend which ended on USD 51,383 USD per bitcoin on March 25th where it prepared again for a bull run reaching levels ATH of USD 58,793 per bitcoin on March 29th 2021.

Taking a look on the percentage (%) of drawdown on the Bitcoin price from its ATH we can see that it went down to -0,1617 on March 25th when the price of Bitcoin decreased to USD 51,704. While the Bitcoin have been moving on the resistance levels mentioned above, one of the most important topics of discussion in Bitcoin and its ecosystem is the energy supply and how much it consumes electricity from non-renewable sources.

ARGO BLOCKCHAIN

Argo Blockchain (listed on the London stock exchange under $ARB) today announced the formation of a bitcoin mining pool powered exclusively by clean energy.

From the press release:

Terra Pool represents the first ever opportunity for the creation of 'green bitcoin'. The initiative aims to expedite the shift from conventional power to clean energy and reduce the impact of Bitcoin mining on the environment. The mining pool will provide a platform for cryptocurrency miners to produce Bitcoin and other cryptocurrencies in a sustainable way.

Peter Wall, Chief Executive of Argo Blockchain, said: "Addressing climate change is a priority for Argo and partnering with DMG to create the first 'green' Bitcoin mining pool is an important step towards protecting our planet now and for generations to come. We are hopeful other companies within the Bitcoin mining industry follow in our footsteps to demonstrate broader climate consciousness."

Dan Reitzik, Chief Executive of DMG, said: "DMG's increased innovative strength and continued focus on eco-friendly Bitcoin mining has the opportunity to drive transformations in how the Bitcoin mining community acts towards a climate-conscious future.

DMG's ongoing commitment to clean energy-based capital deployment is a key industry development. We believe this is an opportunity for continued growth as we develop a better understanding of climate-friendly operations while simultaneously integrating the newest and most innovative blockchain technologies."

Bitcoin mining currently uses 40% renewables or more, and that portion will likely grow substantially in the future.

Blockstream

Continuing the Bitcoin Mining updates and institutional companies. Bitcoin development company Blockstream is launching a token that is tied to the company’s Bitcoin mining production and which is redeemable in bitcoin. One Blockstream Mining Note (BMN) represents 2,000 terahashes per second of hashrate from one of Blockstream’s mining facilities. The first tranche of 62.5 BMN will go on sale next week, April 7, and can be redeemed after three years for the bitcoin equivalent to the total hashrate the note represents. Blockstream is issuing the token on its Liquid sidechain, a semi-privatized, trusted blockchain that runs in parallel with Bitcoin, and will sell it initially through a private token sale on STOKR. The first batch of tokens will go for £200,000 ($275,836) each, and there’s a purchase minimum of 1 BMN (payable in bitcoin, or BTC and USDT on the Liquid network).

Hashrate tokens

Hashrate tokens are a recent development in the Bitcoin derivatives market, lead by Bitcoin miner Poolin and the Binance exchange.

These contracts exist as a way for high-caliber investors to gain exposure to bitcoin and bitcoin mining without owning the bitcoin outright or fumbling with mining hardware. Typically, they are traded OTC before being integrated on exchanges.

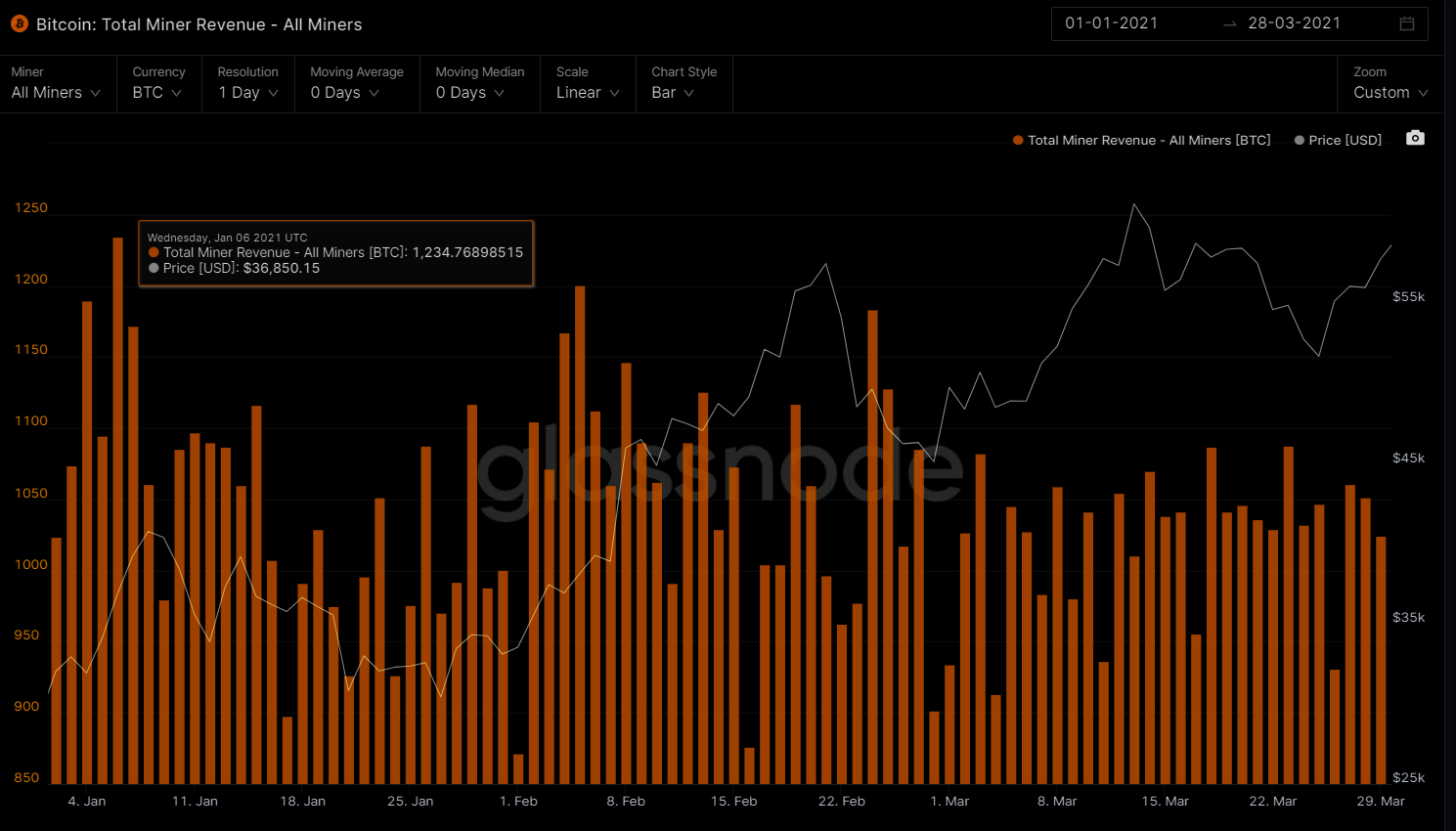

On the other hand and reviewing again the Bitcoin mean hash rate which as we mentioned last week is the computer power of the Bitcoin network. Which not only measure the speed but also the security of the network. On the second half of the month on March 14th reached a level of 174 EH/s.

Chicago Mercantile Exchange (CME)

Derivatives exchange Chicago Mercantile Exchange (CME) will launch smaller-sized bitcoin futures contracts in May, potentially expanding the number of people who bet on the future price of the leading cryptocurrency.

"The introduction of Micro Bitcoin futures responds directly to demand for smaller-sized contracts from a broad array of clients and will offer even more choice and precision in how participants can trade regulated bitcoin futures in a transparent and efficient manner at CME Group," Tim Court, CME Group global head of Equity Index and Alternative Investment Products, said in a press release.

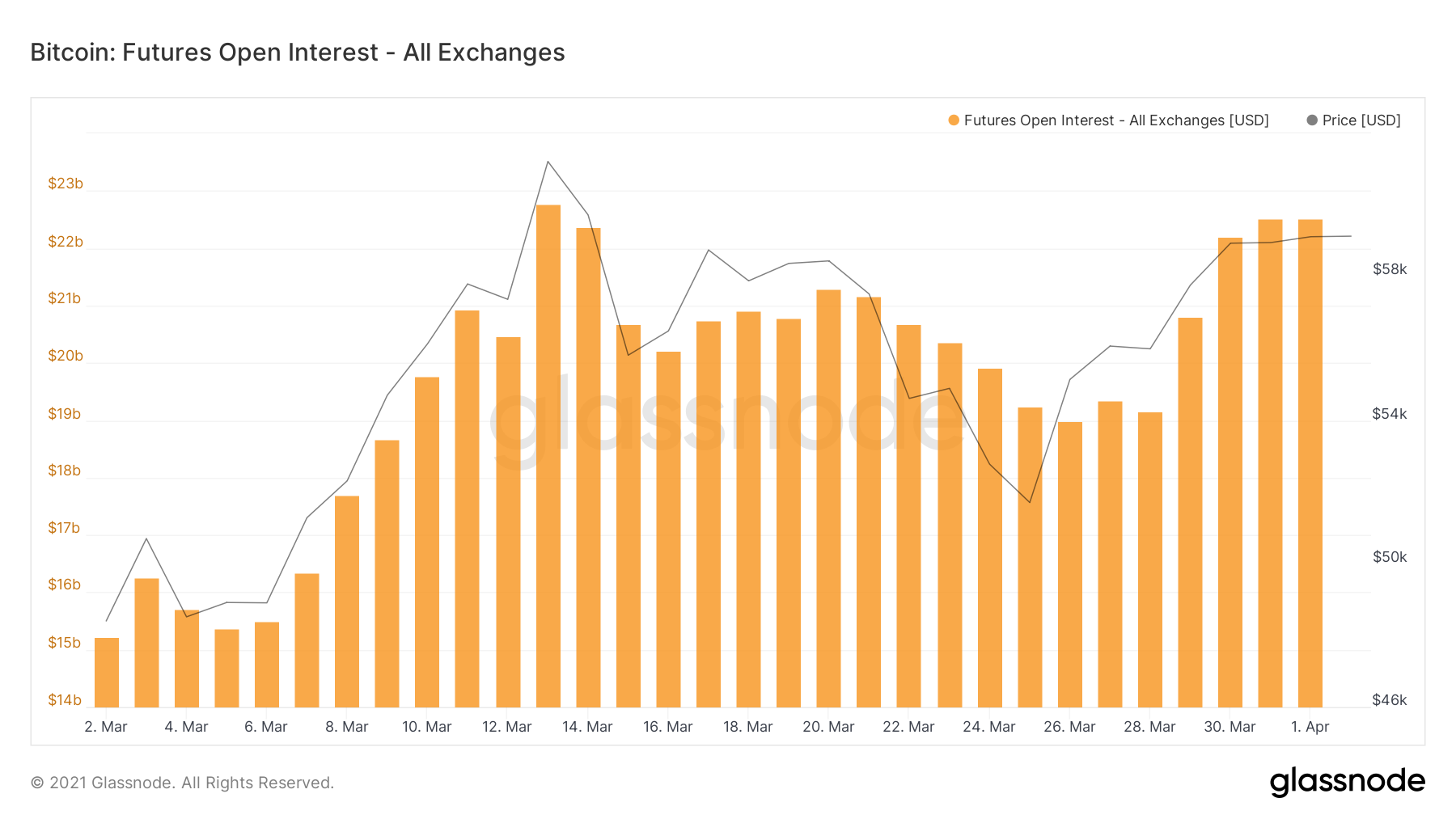

FUTURE OPEN INTEREST

Open interest refers to the total amount of funds that are in open futures contracts. However, it does not show whether these funds are placed in long or short positions.

The surging price of bitcoin from the start of the year has resulted in massive growth in open interest for the asset’s futures as traders seek to hedge their positions on various exchanges. Data indicates by Glassnode that bitcoin futures open interest have grown by 133.74% between January and March 2021.

During the first week of January 2021, the open interest was valued at $9.66 billion, while as of March 30, 2021, the figure was $22.58 billion reflecting the asset’s sustained bull run in the first three months of the year.

We also mention our Stock to Flow Deflection on Bitcoin. Which gives us an indicator if the price has been under or over valued. As we see in the graph below there was a short period during February according to this metric which showed Bitcoin (BTC) price was undervalued. Besides second week of January and third week of February, the price of Bitcoin has been overvalued.

Stock to Flow Ratio

This model treats Bitcoin as being comparable to commodities such as gold, silver or platinum. These are known as 'store of value' commodities because they retain value over long time frames due to their relative scarcity. It is difficult to significantly increase their supply i.e. the process of searching for gold and then mining it is expensive and takes time. Bitcoin is similar because it is also scarce. In fact, it is the first-ever scarce digital object to exist. There are a limited number of coins in existence and it will take a lot of electricity and computing effort to mine the 3 million outstanding coins still to be mined, therefore the supply rate is consistently low.

Stock-to-flow ratios are used to evaluate the current stock of a commodity (total amount currently available) against the flow of new production (amount mined that specific year). As you can see in the image above the indicator is targetting a price of Bitcoin (BTC) by the end of 2021 of approximately 100K USD and 1MM USD by the end of the decade (2029-2030).

For store of value (SoV) commodities like gold, platinum, or silver, a high ratio indicates that they are mostly not consumed in industrial applications. Instead, the majority is stored as a monetary hedge, thus driving up the stock-to-flow ratio. higher ratio indicates that the commodity is increasingly scarce - and therefore more valuable as a store of value.

BTC Futures perpetual funding rate

Funding rates indicate the premium that futures traders have to pay (or receive) to keep a position open.

If the funding rate is positive, traders with an open long position have to pay a premium to keep the trade open. If the funding rate is negative, traders with a short position have to pay a premium to keep the trade open.

Historically, funding rates have tended to correlate with market sentiment. When the market is bullish or bearish, funding rates tend to be positive or negative, respectively.

During the whole month of March, funding rates have been increasing and decreasing rapidily from a 0.007% around March 5th to up 0.121% the week after. It went down again to 0.005% when it reset and increase in the current levels of 0.074%. The sentiment continues to be bullish and the recent drops in the funding rate during march indicated that it was preparing to bounce back as it did. As we can not the funding rates on each exchange it only went negative for OKEX and Bitfinex around mid March. The rest of the exchanges were positive rate during whole march.

INSTITUTIONS - GRAYSCALE & PURPOSE BTC ETF

According to Nasdaq Grayscale CEO Michael Sonnenshein said the crypto asset management company is taking a wait-and-see approach to filing for a bitcoin exchange-traded fund (ETF). The CEO, who took over Grayscale in January, suggested U.S. regulators still aren’t ready to approve a bitcoin ETF, even though Grayscale is preparing for such an eventuality.

Institutional investors continue to line up, he said, predicting the market remains in the “early days” of a corporate bitcoin adoption trend that may accelerate through 2021.

As we can see in the image below, GBTC premium indicator continues to go down with a new negative record of -14.34% on March 24th. This growth in discount can also be explained as Grayscale Investments gradually shifts focus to altcoins. As reported by news.Bitcoin.com, Grayscale added 174,000 litecoins or almost 80% of the newly minted LTC in February of 2021. Similarly, the investment company also added 243,000 ETH to its ethereum holdings during the same period.

On the other hand the rise of competitors to Grayscale such as the Purpose Bitcoin ETF since its launch in February 2021, grew from 6,036 Bitcoin up to more of 16,462 Bitcoin on March 31th. Most crypto enthusiasts according to Twitter, say that the launch of Purpose Bitcoin ETF has been the primary reason of Bitcoin Grayscale Premium going negative.

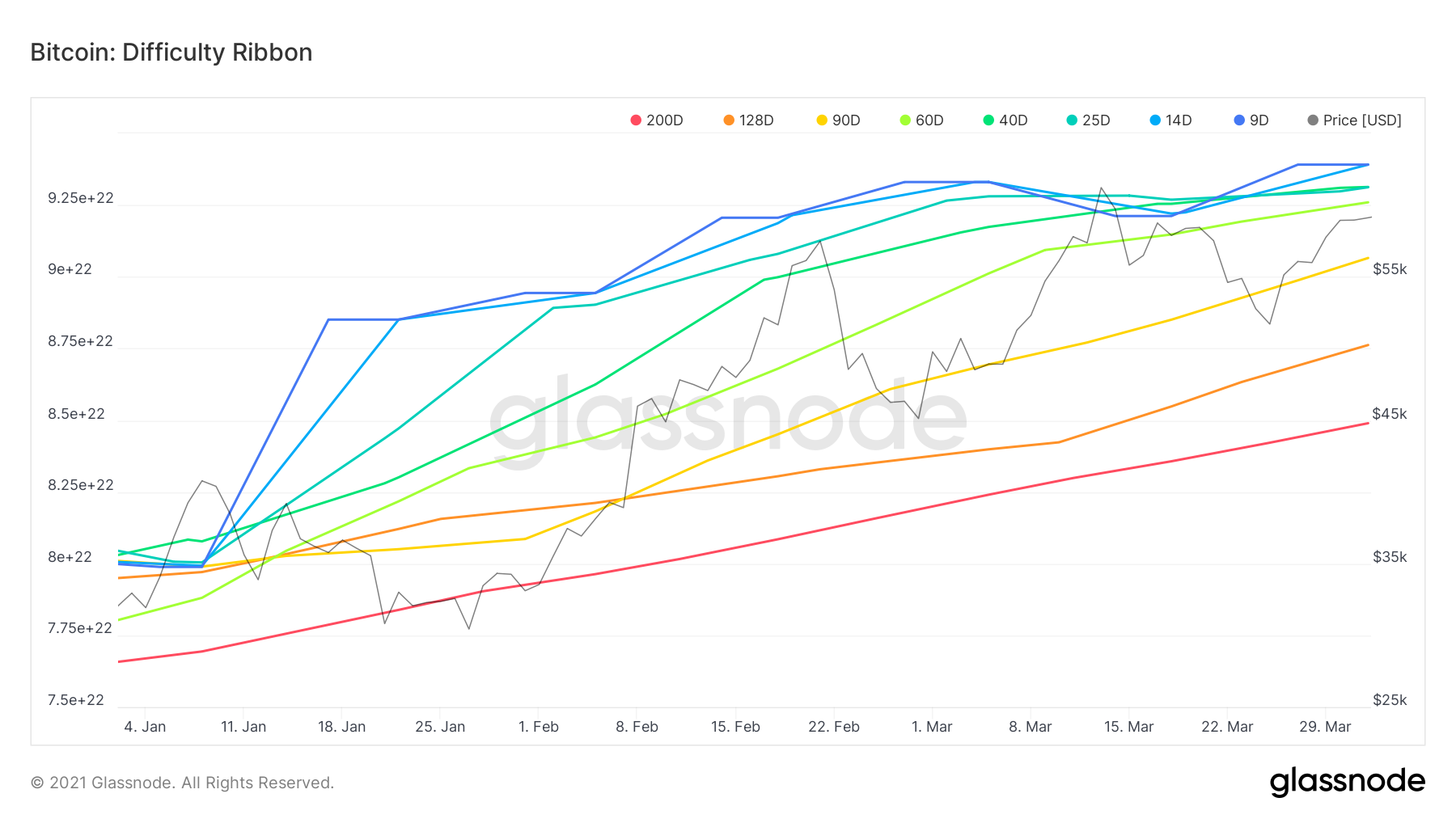

BITCOIN DIFFICULTY RIBBON

Created by Willy Woo is an indicator that uses simple moving averages (200d, 128d, 90d, 60d, 40d, 25d, 14d) of the Bitcoin mining difficulty to create the ribbon. Historically, periods when the ribbon compresses have been good buying opportunities.

The Diffiulty Ribbon speaks to the impact of miner selling pressure on Bitcoin`s price action. When network difficulty reduces its rate of climb, miners are going out of business, leaving only the strong miners who proportionally need to sell less of their coins to remain operational, this leads to less sell pressure and more room for bullish price action. The best times to buy Bitcoin are zones where the ribbon compresses. The ribbon consists of simple moving averages of Bitcoin network difficulty so the rate of change of difficulty can be easily seen.

We see how during march there were a few good moments to buy Bitcoin according to the indicator. As March 4th it was compressing more and the price of Bitcoin had a quick bull run from USD 48,515 to USD 61,217.

That`s all for today folks. Thank you for reading our Bitcoin weekly recap. Stay tuned as we will be publishing more newsletters on the following markets from Ethereum - DeFi and Stablecoins.