We are currently living through unusual times. The massive spread of Covid-19 is affecting economies all around the world, with curfew and quarantine measures being taken in all the major cities and countries, meaning production and consumption are on their way down. Not only that, but the assumption that the cryptocurrency market was safeguarded against this kind of situations was strongly tested in the past few days, and it failed.

As economies and stock markets become more unpredictable by the day, a sentiment of aversion towards volatility is growing fast among users and enthusiasts, which has hurt the market greatly (to the point that it lost nearly $100 billion worth in the last two weeks).

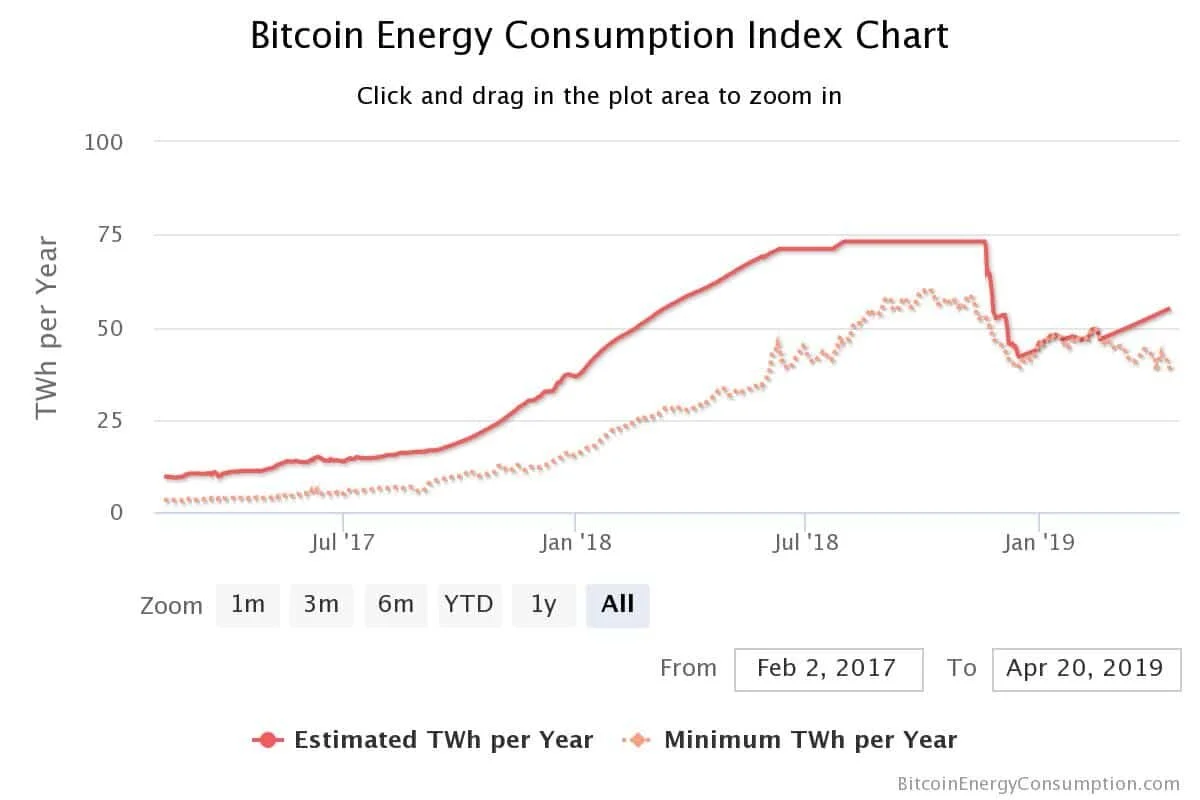

This situation also causes an increase in energy consumption, as more people are staying at home for the entire duration of the day, and coupling it with the upcoming halving event for BTC, miners are certainly worried about the viability of spending increasingly higher amounts of money to keep their ways of income, that will be reduced in half in the upcoming months.

To combat this situation, projects that aim to implement more efficient ways to generate electric energy out of the resources available. We have already covered one on this project on our article about Gigajoule, that wants to create off-shore solar plants that would be implemented in the coasts of Nigeria, but today we will focus on a project that is primarily aimed at the energy necessities of blockchain miners: Metcalfe.

Served on a Silver Plate

A tendency among developing countries is having economies centered around oil production, and that is especially true for countries in the Middle East and Latin America. However, the process of extracting and refining oil generates large quantities of residues in the form of natural gas, that could be used as alternative fuel for vehicles or even energy generation.

Mexico is an example of this. Through gas flares, they are wasting over 500 million standard cubic feet per day (MMSCFD), and Metcalfe, through alliances with IEnova, began their recuperation process back in 2014. However, IEnova opted out of the project in 2018, so Metcalfe has the opportunity to fork part of the energy generated to cryptocurrency mining and blockchain data processing. By selecting the land flares that burn over 20 MMSCFD of gas, evaluating the quality of the gas and choosing electric generators that consume a lower quantity, around 15 MMSCFD, in order to maintain a constant supply.

With this model, they have a projected production of 80 MW per day by intervening a single land flare that burns 20 MMSCFD, which is enough to cover the consumption of 53,000 Antminer S9 BTC miners, and at the low price of 3.5-4 cents per KW/h to reach an annual revenue of nearly $25 million, only for the initial installation.

A Neglected Market

Given how Bitcoin mining will be deeply altered by the upcoming halving, solutions like Metcalfe are necessary to keep miners interested in the process as their revenue gets cut. With a considerable reduction in the maintenance costs, the impact of the event could be properly mitigated by either drawing in more miners before the rewards are halved or convincing new ones to step into the network after the fact.

Via coincentral.com

A steady number of miners is fundamental to keep the hashrate from falling, which is a measure of how many cryptographic computational operations a blockchain network can perform. With more miners, the hashrate goes up, which makes the network safer by giving potential malicious users less time to act, and a sudden exodus of a large number of miners would have the opposite effect.

By reducing the costs of energy for this specific activity and offering a guaranteed stable source of electricity, Metcalfe is focusing on the most crucial part of the entire Bitcoin network (and, ironically, the most neglected one compared to investors and users), in hopes of not only becoming a referent in the environment of energy supplies, but also set the precedents for a better use of the available resources to cover the needs of specific activities or sectors, which may even evolve into populations or urban centers.

This is the first article in a series that will cover a couple of projects that focus on the necessities that are either increasing in relevancy or on their way to become priorities to cover for blockchain technology to be properly maintained.