Continuing our last article, we will now take a quick look at some of the best crypto-to-crypto trading platforms, that compete against one another in terms of quick transactions and low fees. Besides these factors, some platforms might gain advantages when interface and ease-of-use come into consideration, and it’s very important to remember that using these platforms requires previously owning a certain amount of crypto (in most cases, Bitcoin or Ethereum) before being allowed to use them.

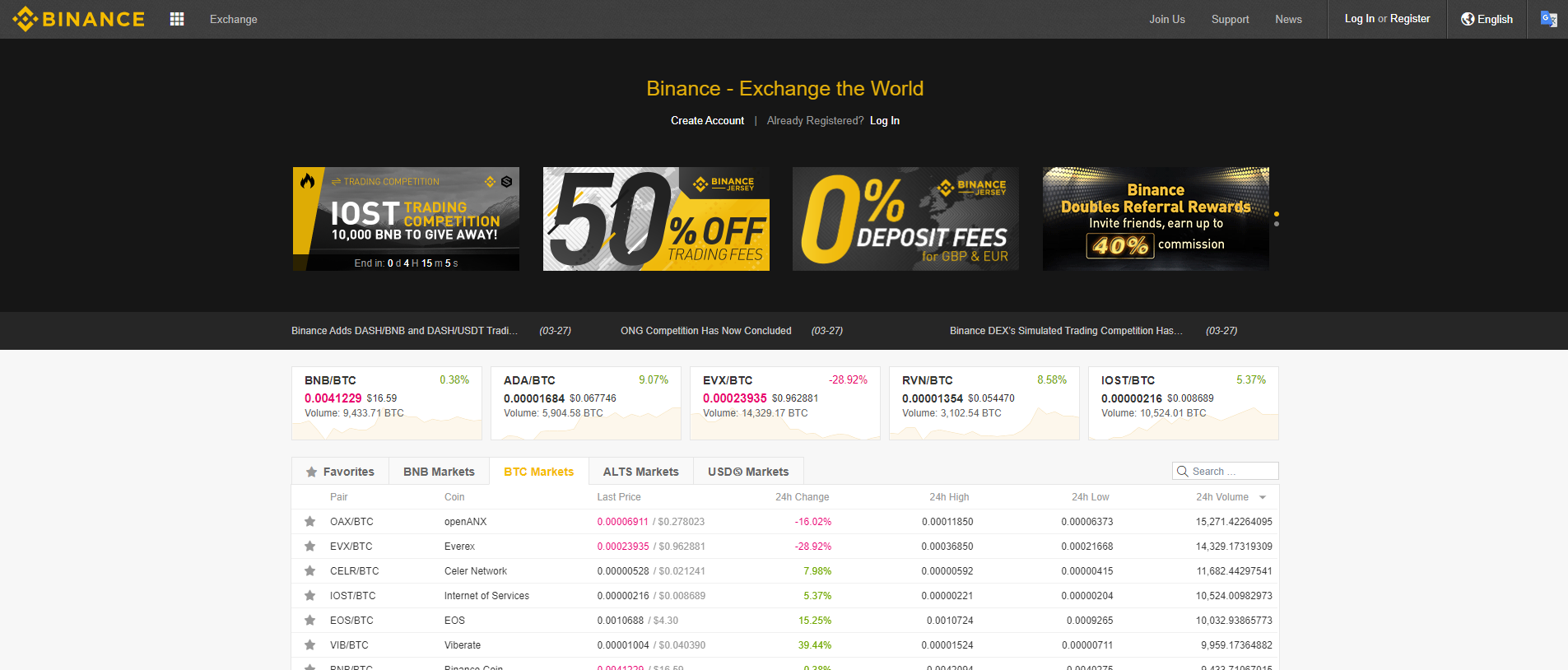

Binance

One of the best performing exchanges currently, with outstanding trading volumes in recent times, Binance has grown to be considered a great option among the crypto-trading community.

Some of its high points include two different interfaces to choose from, depending on your level of experience, low transaction fees (around 0.1%), an incredibly high number of coins available for trading and complete worldwide service.

Besides, Binance has been in the spotlight during the recent months for their multiple announcements including:

Their token, Binance Coin (BNB) has been behaving quite nicely, with steady climbs and relatively small drops since the beginning of the month and almost quadrupling its market cap since last October.

Confirming they will implement their own blockchain, Binance Chain, which means they will transfer their BNB from Ethereum and work as the foundation for their new platform, Binance DEX, a decentralized alternative to the original one (which will continue to run as usual).

Being the largest exchange to partake in the new popular practice of Initial Exchange Offerings (IEOs), via their Binance Launchpad, in contrast of the high-risk environment that was created around ICOs.

IEOs allow projects to collect their funding through Binance, where users can exchange BTC, ETH or even BNB into the project’s own cryptocurrency. Binance then charges a small fee for the transaction. We will cover IEOs in extension in a future article, but they are good enough for a platform like Binance to give them a change.

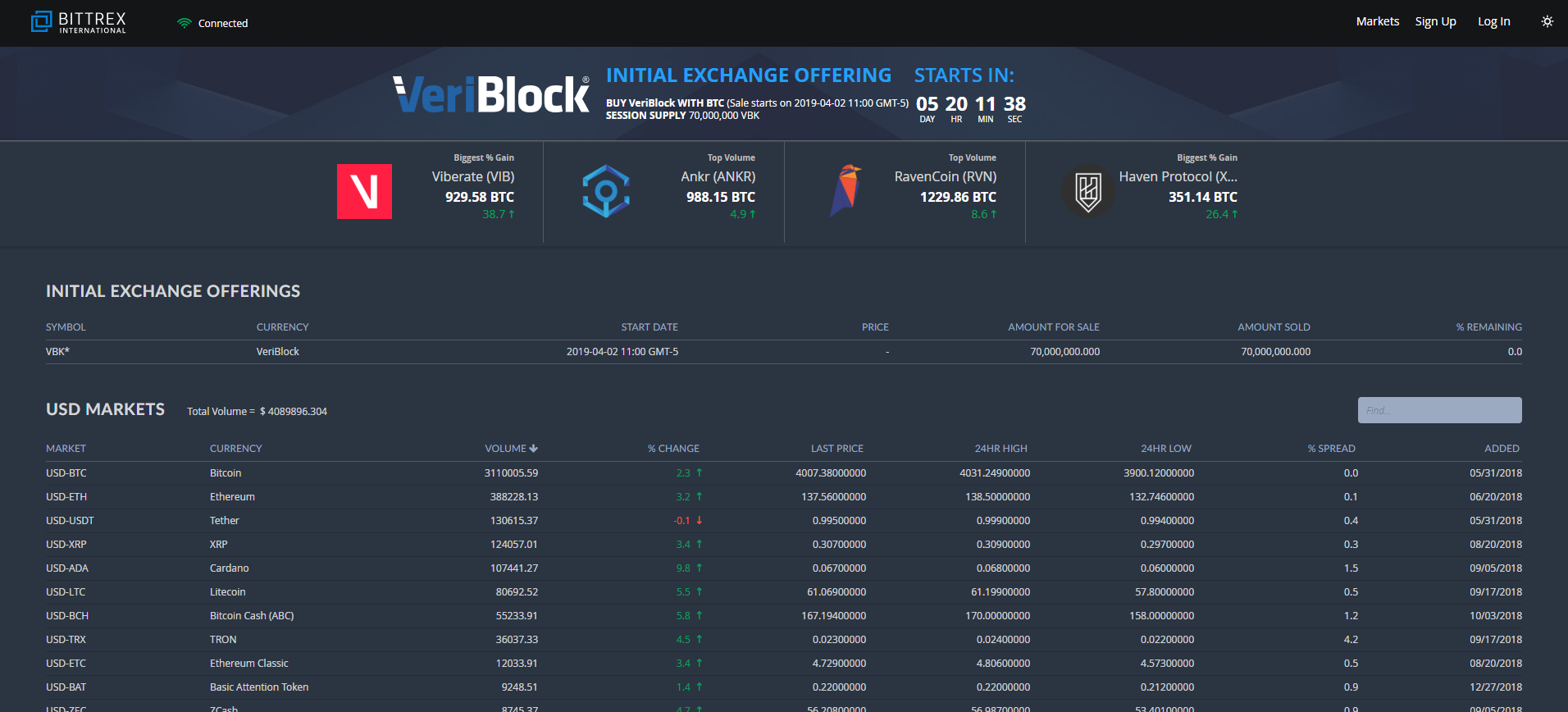

Bittrex

Based on Seattle, US, Bittrex is regarded as one of the most secure exchanges in the market due to the regulations that are enforced in the state of Washington. It’s also very easy to use, and its interface is very friendly towards beginners, and they handle a flat 0.25% fee per transaction, no matter the amount it involves.

They are also starting to offer IEOs, where they offer their users the chance to buy a project’s token with BTC in order for the project to raise funds, and allowing users to set calendar reminders for the beginning of the token sales.

But, like Binance, it offers only crypto-to-crypto trading, so users must make an investment in a different platform before using Bittrex. Also, Bittrex has been the center of some customer service issues in the past.

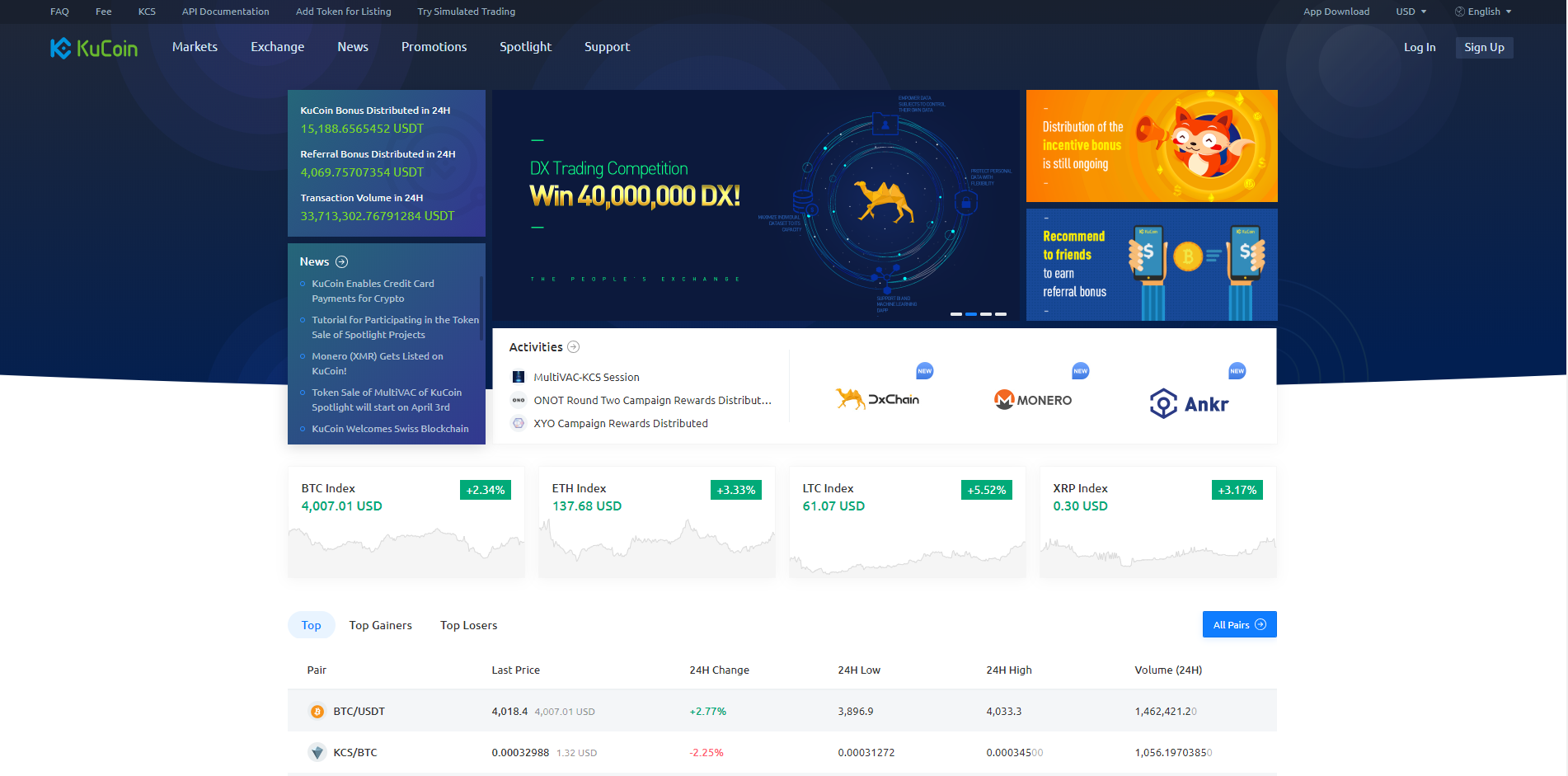

KuCoin

KuCoin is a platform based on Hong Kong that stands out from the others by offering their users to buy KCS, their own token. Holders of this token get to earn a part of the profits that the platform generates, and its other main selling points are their competitively low transfer fees and wide variety of crypto pairs available.

Unlike the previous two, KuCoin has shown difficulties during periods of time with high concurrence of users, so if latency can become a big issue in your trading strategies, we do not recommend trusting completely in KuCoin.

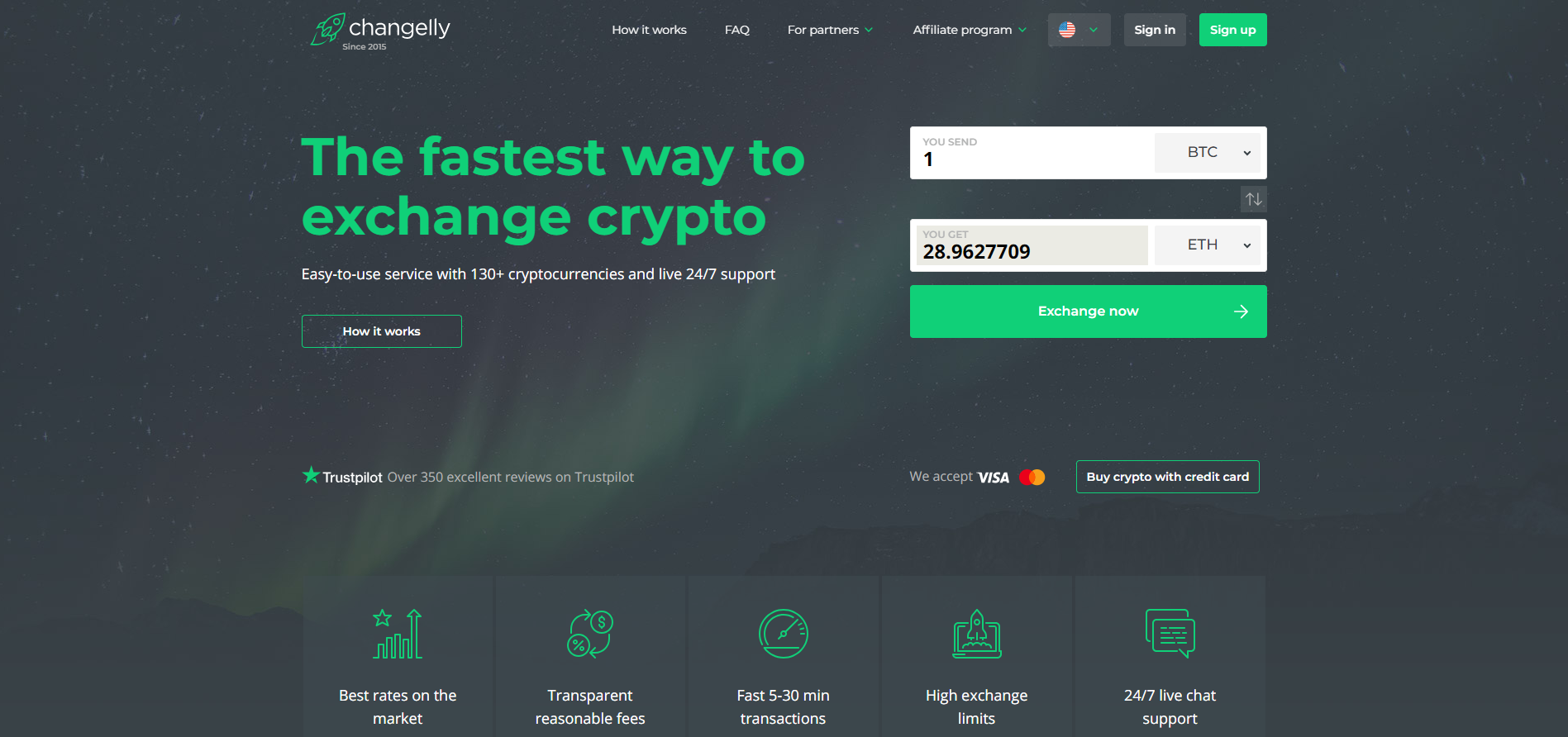

Changelly

Since 2016, Changelly has been operating as one of the fastest platforms for crypto-to-crypto trading. Their fairly simple design and quick registration of users makes it a fairly simple way to exchange small amounts of cryptocurrency, which most people use to fulfill certain restrictions placed by other sites.

A user that would like to use Changelly would only have to input the amount of the currency they want to exchange into a different one. Then, the platform gives the user the address where they must send the initial currency and input the address where the equivalent will be received. Changelly performs the trade almost immediately, charging only 0.5% and saves the transaction in the user’s history.

However, the “light” verification process might lead to security issues in the future, and that’s why the credit card-related services require additional validation from the user.

Huobi

Huobi is a Singapore-founded platform that decided to migrate after the Chinese government decisions on crypto exchanges back in 2017. They originally focused on tending to the Chinese market but has since made great efforts towards a more global reach.

Huobi stands out from the rest when you take into consideration that they support margin trading, an important and more complex trading tool that is very popular among more experienced users and only few platforms offer, and an over-the-counter section, where buyers and sellers can move large quantities of coins, with no need to enter the more advanced exchange platform.

On the other hand, some users might detract from using Huobi because of allegations of falsifying trade volume reports, to probably boost their numbers in rankings. The study was performed last year, and Huobi has not yet confirmed nor denied the allegations, so the final decision is up to the user.

Liquid

Formed in September 2018 from the union of two project from Quoine, its parent company: Quoinex (a Tokyo-based fiat-to-crypto exchange created in 2014) and Qryptos (a crypto-to-crypto exchange launched in 2017), with an estimate of $50 billion in transactions between both as of June 2018.

Liquid offers a great variety of crypto pairs including BTC, ETH, XRP, BCH, LTC, XLM, NEO, NEM, ETC, QTUM, ETN, FSN and many more, while also offering buy-sell options with USD, EUR, JPY, AUD and SGD.

Besides its user-friendly interface and very low fees (except for fiat withdrawals, which can be reasonably high), Liquid offers margin trading and leverage trading tools and very tight security measures for all users, making it one of the most trustable exchanges in the world. These security measures include a thorough ID-verification process (including proof-of-address and requiring a government-issued ID), 100% cold wallet storage, mandatory two-factor authentication, and many other.

The downside is that their offer of fiat currency can take up to three days and carry quite high fees, since their withdrawal services are performed by a third-party. This can discourage users from making use of Liquid’s full potential, but it can still work as a crypto-to-crypto exchange, circumventing these high fees.

Bithumb

Bithumb was launched in 2013, and it’s based on South Korea. This makes their platform oriented towards their Korean audience, while also offering fast trading tools for customers in many different countries.

Their spot among the best exchanges is granted by their high liquidity, which also increases with their popularity, their customer service (available 24/7, in multiple languages), their offer of multiple order types and the fast, straightforward design of their platform.

However, their focus on the Korean market translates into that they only offer fiat currency transactions for users in South Korea (and only in wons), and there may be some errors in the translated versions of the site, so it may not be the best choice for users outside of South Korea.

Besides, in 2017, Bithumb was the center of certain hacking attacks, which compromised the information of the current users, but this forced them to adopt tighter security measures, which allowed them to regain the trust of their userbase.

OKEx

Founded in China in 2014, OKEx followed the steps of Binance and moved to the crypto-friendly environment of Malta in April of 2018. It has since become one of the most powerful names in the industry, with a Bitcoin arm that has reached 1.5 billion USD in volume per day.

Along with their own token, the OKB, which works in a similar way to Binance’s BNB (giving the users certain benefits when trades are performed with OKB), OKEx has a peculiar way to incentivize users from around the world to use it: their OKEx Global Partners Program. Any user can become part of the program if they own 5,000 OKB and refer 50 people to the site every month. As a reward, the user begins earning 30% of the trading fees generated by their referrals, and this reward increases with the tier the user has achieved.

Also, like Binance, OKEx offers their own version of an IEO, called “OKEx Blockchain Capital”, giving blockchain startups an opportunity to submit their white papers and register their tokens into the platform, while providing them with services like consultation and technology resources. They claim that they have a fund of $100 million destined to provide capital for these projects.

As you can see, this type of platform is less diverse than those we covered before, since their focus is usually the same: offering fast, secure crypto exchange options at the best rates, while charging the lower fees possible.

Besides that, there’s not much a purely crypto-to-crypto platform can offer, which is why most of them also offer fiat currency support for buy-and-sell transactions, other offer their own coin to profit from the overall transactions, all of these attempting to draw more users in. It ends up being up to the user to select the exchange that better suits their needs.

So we conclude our series in some of the best exchanges in the cryptocurrency market, but we will publish another article focusing on those that are willing to innovate by introducing new trading strategies or tools for the users, so stay alert!