With the number of customers increasing, the cryptocurrency market must adapt in order to fulfil their necessities. And the main necessity that arises when we look at the current data sites and search engines is the speed in which transactions are processed. Given how global the market has become, even the smallest form of lag, connection issues or security breaches might represent substantial losses for investors or institutions.

The solution proposed by the Beaxy team is a new, built-from-scratch platform that implements a matching engine (ME) that can handle up to 225,000 transactions per second, per pair of coins, which comes close to the number of transactions handled by NASDAQ. This guarantees that every order that’s placed, no matter where it comes from or what currencies it involves, will take place in less than 10 milliseconds (including risk checks, order matching and reporting).

Advanced tools for demanding customers

As Beaxy aims to catch the attention of the most demanding users within the crypto market, they offer a wide variety of advanced trading tools for their customers to properly build their portfolio:

Advanced order types

Beasy is introducing several order types that may be familiar for experienced investors, and represent a more diverse way for the user to manage their assets and establish investment plans. These order types include:

Market order: traditional buy-sale orders.

Limit orders: order to buy or sell at a specific price or better.

Good-til-Cancelled: allowing users to place conditions or their purchase that remain active until the conditions are met or the order is cancelled.

Fill or Kill: Orders that must be completely fulfilled immediately or else they are automatically cancelled.

Stop Loss: Where the user can set a limit where the asset is automatically sold, in order to prevent further losses.

OCO: One-Cancels-the-Other. The user gets the chance to pair two orders, and if one of those is successfully completed, the other one is automatically cancelled.

OSO: Similar to OCOs, but the completion of the first order can trigger one or many subsequent orders.

And many more.

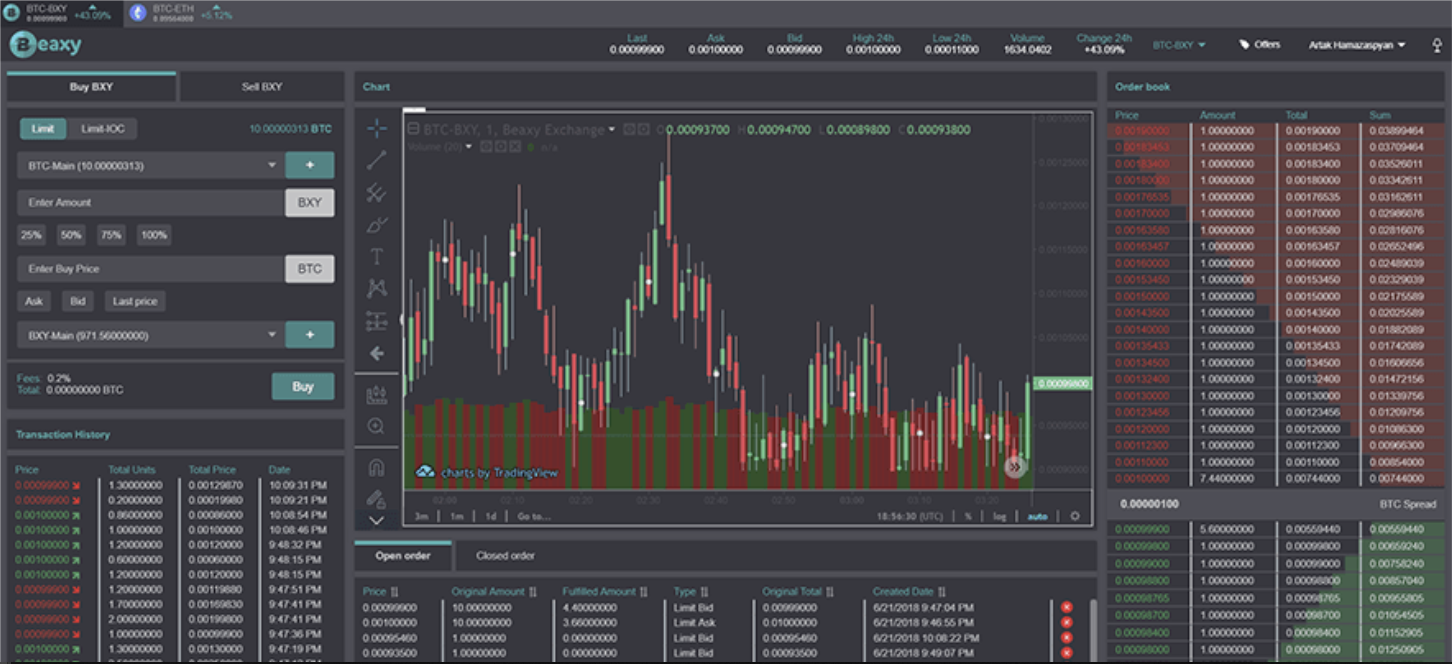

custom charts

With so many options to place orders, the customers need the best way to track their investments in terms of speed, customization and convenience. That’s why Beaxy worked in collaboration with TradingView® to develop the most intuitive and customizable interface the user can get, always ensuring the highest refresh rates and no lag.

institutional accounts

To aim towards a completely different and similarly neglected user base, Beaxy offers the option to create institutional accounts, with which companies like investment firms could generate high income.

This allows for the creation of sub-accounts that are all encompassed within the main institutional account, and have different and editable levels of permission, which grants a level of hierarchy that other platforms do not offer.

portfolio management tools

Detailed information and top-level analytics can give the user the necessary insight to correctly assess their investments and grant them the ability to develop safe, income-assuring plans. And customers also have the possibility to create and manage different wallets per currency, widening the opportunities to maintain a “safe deposit” in a wallet and another one for more volatile investments.

tax reports generation

Considering how tedious it can be to correctly write a tax report on stock investments, one could imagine how discouraging it can be for investors to set course in the cryptocurrency world if it implies having to write similar reports. Beaxy solves this by implementing a tool to automatically generate the tax reports, taking the weight off the investor.

Security as top priority

They understand that security is key when trading, especially when usual cryptocurrency investments represent high amounts of money. To ensure it, they have developed a system of military-grade security with two-factor authentication, security vetting by white-hat hackers, geo-distributed cold wallets, and many other features, all complying to PCI-DSS and ENISA standards.

But security goes beyond preventing external intervention to the platform, because many investors seem uninterested in the crypto market due to the lack of ‘surveillance’. This is why Beaxy uses the OneTick Surveillance solution (already being used by banks, top-tier brokers and firms) to integrate real-time examination of order flow, including end-to-end breach detection.

Fees and Token economy

Beaxy maintains its platform with their system of trading fees (0.2%, reduced to 0.1% if paid with BXY), ‘Over-the-counter’ fees for large volume orders, allowing coins to purchase an ‘sponsored’ spot in the home page, and (as usual) handling their own tokens: BXY and PLS (plus).

BXY tokens are the main in-site currency, and work for paying trading fees, accessing add-on tools, polls, surveys, purchasing Beaxy merchandise and other services, and its value is to be set by the open market. Meanwhile, the PLS token will only be awarded as part of the Loyalty Rewards Program and can only be exchanged to BXY tokens in a permanent 1:1 ratio.

Beaxy is looking to break new grounds into the cryptocurrency market by deploying the most advanced interface, data compilation, trading tools and security measures to date. By creating an atmosphere that is comparable to that of NASDAQ and other stock exchanges, they offer a smooth transition from traditional markets to digital ones for those capable of developing investment strategies that may create outstanding revenues.

The platform is set to fully release during Q1 2019, and you can pre-register or join the token presale at https://beaxy.com